U.S. Stock Futures Tick Higher as Bond Yields Slide

U.S. Stock Futures Tick Higher as Bond Yields Slide

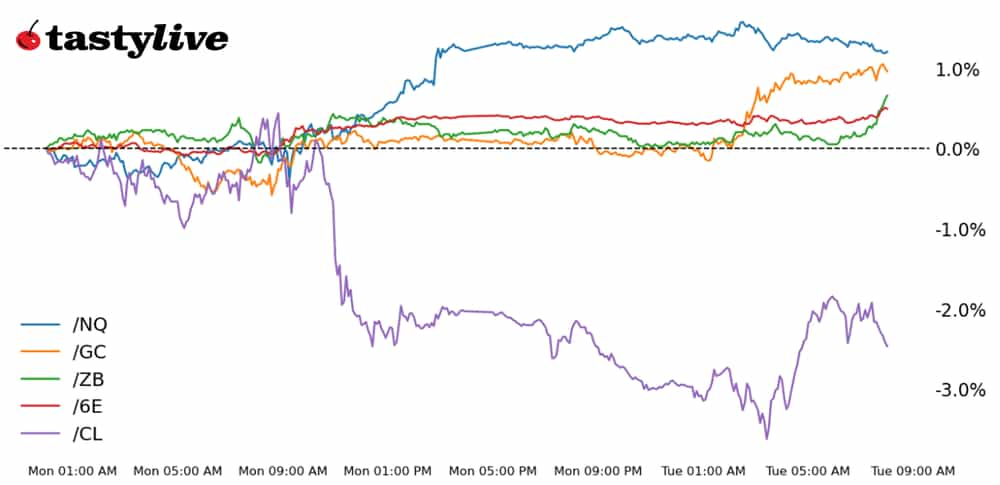

Also, 30-year T-bond, gold, crude oil and euro futures

Nasdaq 100 E-mini futures (/NQ): +0.23%

30-year T-bond futures (/ZB): +0.3%

Gold futures (/GC): +0.97%

Crude oil futures (/CL): +0.71%

Euro futures (/6E): +0.16%

An exceptional run of eight straight gains for both the S&P 500 and Nasdaq 100 is being tested as the calendar turns towards the middle of the week. Bond yields are lower across the curve following inflation data from the Eurozone and Canada. Precious metals continue to push higher, with gold hitting a fresh all-time high. Energy markets are reversing yesterday's moves across the board. Generally speaking, commodities may be enjoying a boost because of their USD-denomination: the greenback is the worst-performing major currency at the moment.

Symbol: Equities | Daily Change |

/ESU4 | +0.18% |

/NQU4 | +0.23% |

/RTYU4 | -0.35% |

/YMU4 | -0.08% |

Nasdaq futures (/NQU4) were slightly lower at the open this morning. If prices manage to rebound today it could mean the ninth straight day of gains. Lowes (LOW) fell in morning trading after the home improvement retailer reported mixed earnings figures this morning. Eli Lilly (LLY) rose over 2% after reporting that tirzepatide reduced the risk of obese adults from developing diabetes.

Strategy: (41DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 18250 p Short 18500 p Short 21000 c Long 21250 c | 66% | +1290 | -3710 |

Short Strangle | Short 18500 p Short 21000 c | 72% | +4540 | x |

Short Put Vertical | Long 18250 p Short 18500 p | 86% | +440 | -4560 |

Symbol: Bonds | Daily Change |

/ZTU4 | +0.08% |

/ZFU4 | +0.16% |

/ZNU4 | +0.21% |

/ZBU4 | +0.3% |

/UBU4 | +0.4% |

Bond yields are falling faster along the long-end of the curve this morning, with 30-year T-bond futures (/ZBU4) rising 0.28%. Meanwhile, we are approaching the end of August, a seasonally strong time for corporate bond issuances. Later this week, the Treasury will auction off 20-year bonds and 30-year Treasury inflation protected securities, or TIPS. That, along with the Federal Open Market Committee minutes, could influence the calculus of bond investors.

Strategy (66DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 117 p Short 118 p Short 131 c Long 132 c | 67% | +250 | -750 |

Short Strangle | Short 118 p Short 131 c | 73% | +1171.88 | x |

Short Put Vertical | Long 117 p Short 118 p | 88% | +109.38 | -890.63 |

Symbol: Metals | Daily Change |

/GCZ4 | +0.97% |

/SIU4 | +1.93% |

/HGU4 | +0.37% |

More weakness in the dollar is helping to clear the path higher for precious metals, with gold pushing into fresh record high territory this morning at 2,566.70, about a 1% gain on the day. Silver prices continue to outperform against gold, with /SIU4 up 2%, which is pushing the gold-silver ratio lower.

Strategy (36DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 2400 p Short 2425 p Short 2700 c Long 2725 c | 68% | +630 | -1870 |

Short Strangle | Short 2425 p Short 2700 c | 74% | +2390 | x |

Short Put Vertical | Long 2400 p Short 2425 p | 86% | +400 | -2100 |

Symbol: Energy | Daily Change |

/CLU4 | +0.71% |

/HOU4 | +0.77% |

/NGU4 | -1.7% |

/RBU4 | +0.65% |

Crude oil prices (/CLV4) trimmed earlier losses from overnight to trade positive this morning. Economic data from China overnight weighed on the commodity along with the signing of a ceasefire deal by Israel. Inventory data from the American Petroleum Institute (API) is due today. Analysts expect to see an inventory draw of 2.8 million barrels.

Strategy (28DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 72.5 p Short 73 p Short 75.5 c Long 76 c | 19% | +390 | -110 |

Short Strangle | Short 73 p Short 75.5 c | 51% | +3370 | x |

Short Put Vertical | Long 72.5 p Short 73 p | 59% | +190 | -310 |

Symbol: FX | Daily Change |

/6AU4 | +0.12% |

/6BU4 | +0.27% |

/6CU4 | +0.01% |

/6EU4 | +0.16% |

/6JU4 | +0.36% |

Euro futures (/6EU4) are slightly higher after inflation data for the Euro Area came in at expectations, rising 2.6% from a year ago in July. That was down slightly from June’s 2.5% increase from a year ago. Markets are currently pricing in about a 90% chance for a rate cut from the European Central Bank (ECB) in its September meeting, as disinflation concerns policymakers amid a turbulent economic backdrop.

Strategy (45DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 1.105 p Short 1.11 p Short 1.125 c Long 1.13 c | 31% | +412.50 | -212.50 |

Short Strangle | Short 1.11 p Short 1.125 c | 55% | +1600 | x |

Short Put Vertical | Long 1.105 p

| 71% | +225 | -400 |

Christopher Vecchio, CFA, tastylive’s head of futures and forex, has been trading for nearly 20 years. He has consulted with multinational firms on FX hedging and lectured at Duke Law School on FX derivatives. Vecchio searches for high-convexity opportunities at the crossroads of macroeconomics and global politics. He hosts Futures Power Hour Monday-Friday and Let Me Explain on Tuesdays, and co-hosts Overtime, Monday-Thursday. @cvecchiofx

Thomas Westwater, a tastylive financial writer and analyst, has eight years of markets and trading experience. @fxwestwater

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.