U.S. Retail Sales, U.K. Inflation and Australian Jobs

U.S. Retail Sales, U.K. Inflation and Australian Jobs

By:Ilya Spivak

Macro events that may move the markets this week

- U.S. CPI miss cools Fed rates outlook but consumer confidence data stalls repricing.

- Focus on U.S. retail sales data to shape monetary policy bets before FOMC next week.

- U.K. inflation data may nudge British pound lower. Aussie dollar eyeing jobs report.

June’s U.S. consumer price index (CPI) data triggered dramatic volatility across financial markets.

The headline year-on-year inflation rate slipped from 4% to 3%, undershooting forecasts calling for 3.1%. The core reading excluding food and energy—a focal point for Federal Reserve policy considering officials’ acute focus on the service sector–was similarly soft, coming in at 4.8% against projections of 5%.

The response from traders was unmistakable. Bond yields fell alongside the U.S. dollar while gold and the Japanese yen jumped upward. The policy path implied in Fed Funds futures flattened, with most of the adjustment happening beyond 2023. Markets seemed to conclude that—while Fed officials’ hawkish rhetoric in recent weeks probably makes a July rate hike inevitable—the likelihood of another one is slim, and the start of easing can begin as soon as March of next year.

This narrative defined price action until Friday’s explosively upbeat U.S. consumer confidence figures from the University of Michigan (UofM) crossed the wires. Not only did the headline sentiment gauge unexpectedly jump to the highest since September 2021—crushing forecasts by a wide margin—but the inflation expectations components of the data set registered higher than expected. Consumers see price growth at 3.4% in a year, against a Fed target of 2%.

Now, the Fed has entered its communications blackout period—when officials don’t comment publicly in the week preceding a policy announcement—and the data docket has thinned out, leaving markets with relatively little to go on until the Federal Open Market Committee (FOMC) gathering next week. That might imbue what little event risk there is with greater potency, as well as leave more room for investors to fine-tune positioning without disruption from the economic calendar.

These are the releases that markets are likely to prioritize as they search for direction:

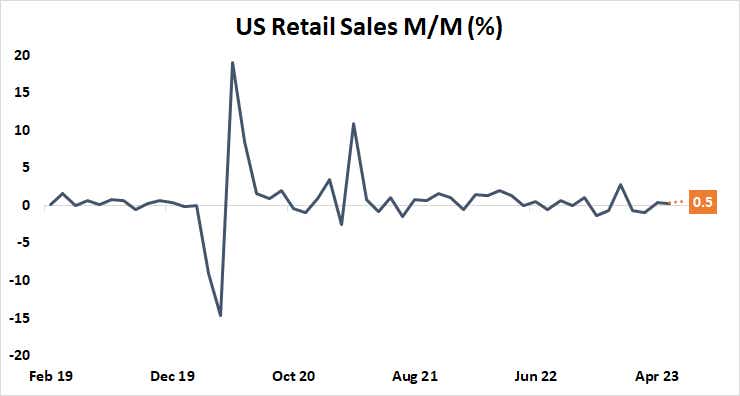

U.S. retail sales report

Receipts are seen rising 0.5% in June, marking a pickup from the 0.3% recorded in the prior month. U.S. economic data is skewed toward outperforming relative to baseline forecasts by the biggest margin since March 2021, according to data Citigroup. This along with the dramatic pop in the UofM consumer confidence gauge seems to open the door for an upside surprise, which may extend Friday’s retracement of post-CPI moves. That is, it may encourage yields and dollar higher while gold and the yen backpedal.

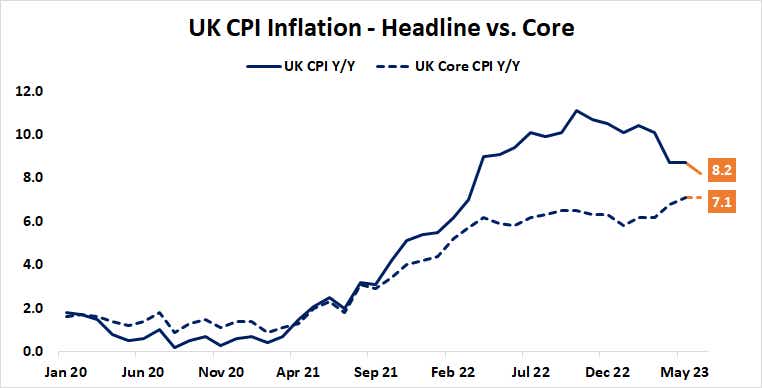

U.K. consumer price index (CPI)

Headline inflation in the U.K. is expected to pull back from 8.7% to 8.2% in June, the lowest since March 2022. Price growth data outcomes have been cooling relative to forecasts recently, which may set the stage for a miss. That might cool Bank of England (BOE) rate hike expectations somewhat, weighing on the British pound. As it stands, markets are pricing in a full percentage point in further tightening by year-end, bringing the target interest rate from 5% to 6%.

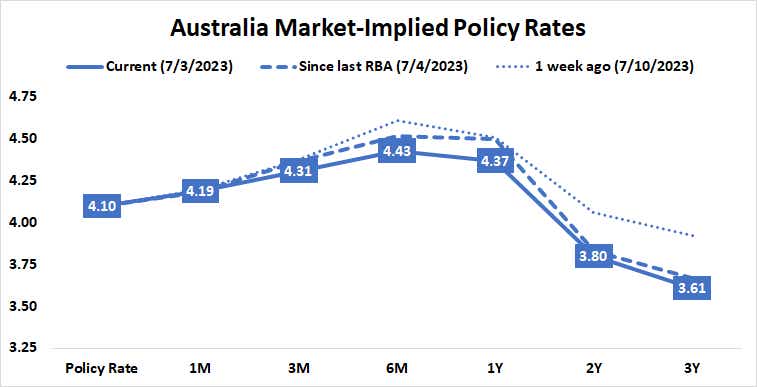

Australian employment

June’s labor-market figures are expected to show a slowdown in hiring, with the economy adding a net 15,000 jobs, down from the 75,900 increase in the prior month. The unemployment rate is seen holding steady at 3.6%, a hair above the record low at 3.4% established last year in November. A stronger-than-anticipated outcome echoing recently upbeat data flow might pull forward bets on another Reserve Bank of Australia (RBA) rate hike, lifting the Aussie dollar. Markets are currently pricing in one 25 basis points increase at either the November or December policy meeting, with standstill until then.

Ilya Spivak, tastylive head of global macro, has 15 years of experience in trading strategy, and he specializes in identifying thematic moves in currencies, commodities, interest rates and equities. He hosts Macro Money and co-hosts Overtime, Monday-Thursday. @Ilyaspivak

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.