U.S. Retail Sales Data May Lift Bond Yields and the Dollar, Threaten Stocks

U.S. Retail Sales Data May Lift Bond Yields and the Dollar, Threaten Stocks

By:Ilya Spivak

Can stock markets hold up as U.S. economic strength threatens global growth?

- U.S. retail sales data may add to upward pressure on yields and the dollar

- Chinese economic activity and U.K. GDP data might miss the mark again

- The growing disparity in U.S. versus global growth trends is a risk for stocks

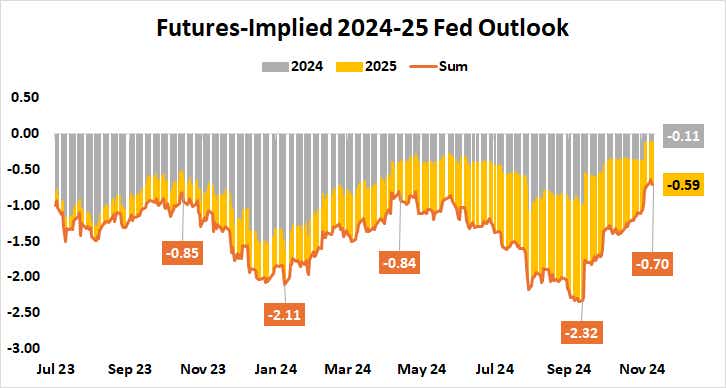

The markets have been single-minded in their assessment of U.S. economic trends and their implications since September. As the Federal Reserve prepared to begin cutting interest rates after a two-month stage-setting exercise since early July, traders sniffed out a pickup in U.S. economy and reckoned incoming stimulus would boost inflation.

Treasury bond yields tellingly bottomed just as the U.S. central bank issued a double-sized 50-basis-point (bps) rate cut and laid out dovish forecasts envisioning full 1% reductions in the target Fed Funds rate this year and next. Over the subsequent two months, the expected rate cut tally for 2025 has been slashed in half.

U.S. retail sales data may be fresh fuel for yields and the dollar

Inflation data published this week predictably showed that lingering price pressure is almost entirely concentrated in the service sector. This implies that domestic demand in this space is the engine powering the U.S. economy’s dramatic outperformance relative to soggy global trends and helps explain why it has not spilled over across borders.

.png?format=pjpg&auto=webp&quality=50&width=1000&disable=upscale)

October’s retail sales report may be a telling waypoint in the story. It is expected to show that receipts rose 0.3% last month, a mild cooling after the 0.4% increase in September. Meanwhile, analytics from Citigroup show U.S. economic data outcomes still tend toward upside surprises relative to baseline forecasts, and by a widening margin.

This may set the stage for hotter retail sales numbers than economists anticipate, which may amount to still more fodder for hawkish repricing of Fed rate cut bets. That could give bonds another downward nudge, pushing yields and the U.S. dollar higher in tandem.

Stock markets may struggle as global economic trends diverge

How all of this may register in stock markets probably depends on its implications for broader market-wide risk appetite. Wall Street has been resilient so far, echoing solid performance in the first quarter of the year when a similar upturn in U.S. economic news flow moved markets to mark down stimulus bets.

This time might be different. Whereas the global economy was broadly accelerating at the start of 2024, it has been slowing since mid-year despite U.S. strength as Europe and China – the other two major engines of demand – remain in an anemic state. This makes the rise in global rates following on from Fed policy speculation a potent risk.

China is due to report on retail sales and industrial production trends while the U.K. will unveil third-quarter gross domestic product (GDP) data. Both sets of figures run the risk of disappointment, which might amplify the sense of disparity between U.S. and global outcomes and sour sentiment. Stock markets may end up displeased.

Ilya Spivak, tastylive head of global macro, has 15 years of experience in trading strategy, and he specializes in identifying thematic moves in currencies, commodities, interest rates and equities. He hosts Macro Money and co-hosts Overtime, Monday-Thursday. @Ilyaspivak

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.