Stocks May Fall as the U.S. Dollar Gains If PCE Data Slows Fed Rate Cuts

Stocks May Fall as the U.S. Dollar Gains If PCE Data Slows Fed Rate Cuts

By:Ilya Spivak

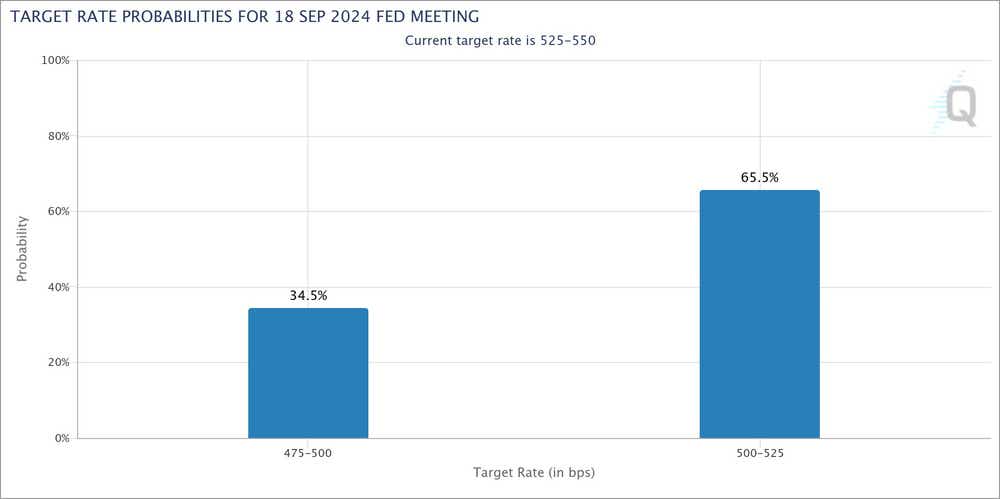

The markets still put the probability of a double-sized 50 basis-point interest rate cut at a formidable 34.5%

Fed interest rate cut speculation is back in focus as markets eye July’s PCE inflation data.

Uneven disinflation trends hint Fed officials are likely to move slowly on rate cuts.

Stocks may fall as the dollar gains if 50bps September rate cut chances fizzle.

Financial markets have been starving for fresh fodder to feed their favorite macro narrative—the outlook for Federal Reserve interest rate cuts—ever since central bank Chair Jerome Powell spoke last week at the Jackson Hole Symposium in Wyoming. Assorted lower-tier economic data and a handful of comments from Fed officials have not moved the needle.

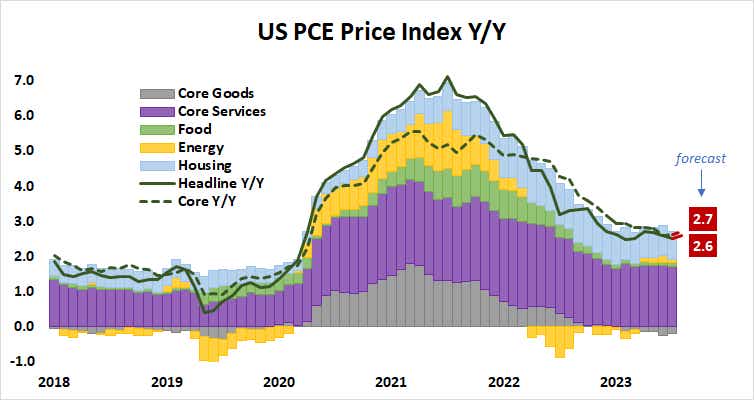

That may be about to change as the Bureau of Economic Analysis (BEA) publishes July’s U.S. personal consumption expenditure (PCE) inflation data, the Fed’s favored price growth gauge. The headline year-on-year growth rate is expected to edge up to 2.6% from 2.5% in June, marking the first increase since March.

All eyes on Fed favorite PCE U.S. inflation gauge

The core PCE reading, excluding volatile food and energy prices, is the focus for Fed officials because this is where monetary policy has direct agency to act. It has been ticking higher and is penciled in at 2.7% year-on-year, up from 2.6% previously. That would amount to the largest rise since September 2022 and only the second rise between then and now.

A closely watched “nowcast” model of PCE inflation from the Cleveland Fed branch mostly concurs with the markets’ baseline. It sees a rise to 2.56% on the headline measure and 2.64% on the core. Realized results have narrowly outpaced these estimates for six consecutive months, implying continued upside surprise risk.

In fact, the near-term inflation dynamics often cited by Fed officials have painted a less than totally convincing picture. While the three-month annualized core PCE rate has been trending lower since peaking in March, the six-month equivalent has increased every month so far in 2024.

Stocks at risk if jumbo Fed rate cut speculation cools

That higher-frequency metrics are trending in the central bank’s desired direction is encouraging, suggesting longer-term averages will roll over in the same direction with some lag. Nevertheless, mixed signals now may limit officials’ conviction in ongoing disinflation, making for slow policy changes from here.

That a rate cut is on the menu for September seems like a foregone conclusion. Fed Chair Powell has been signaling as much with increasingly clarity since early July, and the markets have listened. The probability of at least a standard 25-basis-point (bps) reduction implied in benchmark Fed Funds futures stands at 100%.

However, the markets still put the probability of a double-sized 50bps reduction at a considerable 34.5%. PCE data that makes such a move appear less likely might weigh on stock markets as traders fret that slower stimulus delivery this year will put the Fed behind the curve on containing recession risk. Meanwhile, the U.S. dollar may rise.

Ilya Spivak, tastylive head of global macro, has 15 years of experience in trading strategy, and he specializes in identifying thematic moves in currencies, commodities, interest rates and equities. He hosts Macro Money and co-hosts Overtime, Monday-Thursday. @Ilyaspivak

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.