Stock Markets May Keep Falling if Soft U.S. Jobs Data Fuels Recession Fears

Stock Markets May Keep Falling if Soft U.S. Jobs Data Fuels Recession Fears

By:Ilya Spivak

The probability of a 25bps rate cut in September is 100%, and the possibility of a 50bps cut is 28.5%

Stocks suffered punishing losses after disappointing ISM and jobless claims data.

Another round of soft results may be ahead with July’s labor market report.

Wall Street may suffer deeper losses if weak numbers stoke recession fears.

Stocks swooned after bitterly disappointing U.S. economic data stoked recession fears, sapping risk appetite from financial markets. The bellwether S&P 500 is on pace to finish the session down nearly 2%, while the high-flying Nasdaq 100 suffers a drawdown of nearly 3%.

Previous signs of capital rotation from these tech-powered outperformers to blue chips and small-cap names are pointedly absent, with all four major indexes tracking Wall Street performance tumbling. The Dow Jones Industrial Average and the Russell 2000 indices are approaching the daily market close with losses of 1.7% and 3.8%, respectively.

U.S. labor market data in focus after weak ISM, jobless claims results

The meltdown came after a sobering report tracking U.S. manufacturing from the Institute of Supply Management (ISM). It showed economic activity in the sector unexpectedly shrank at the fastest pace in eight months. New orders fell for a fourth month while employers shed workers at the fastest pace since June 2020.

Weekly jobless claims data was not helpful, either. It showed initial applications for unemployment benefits jumped to a one-year high at the end of July. More troubling still, continuing claims surged to the highest level since November 2021, meaning that workers who lost their jobs are having an increasingly hard time finding something new.

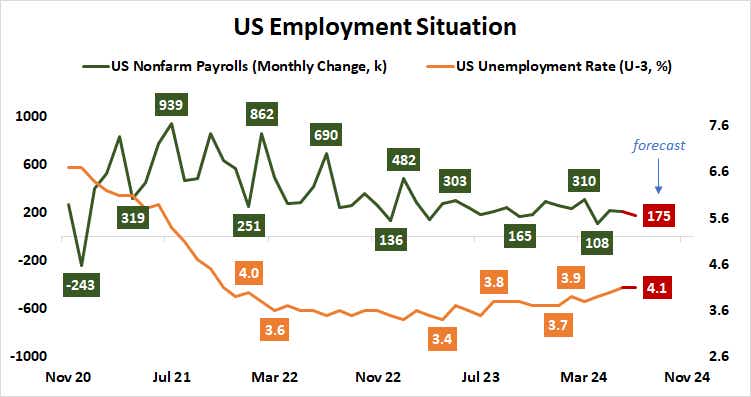

From here, the spotlight turns to July’s monthly labor market figures from the Bureau of Labor Statistics (BLS). They are expected to show the economy added 175,000 jobs last month, the smallest increase since April. The unemployment rate is expected to hold at 4.1%, matching the two-year high set in June.

Stocks may suffer deeper losses if U.S. jobs data disappoints

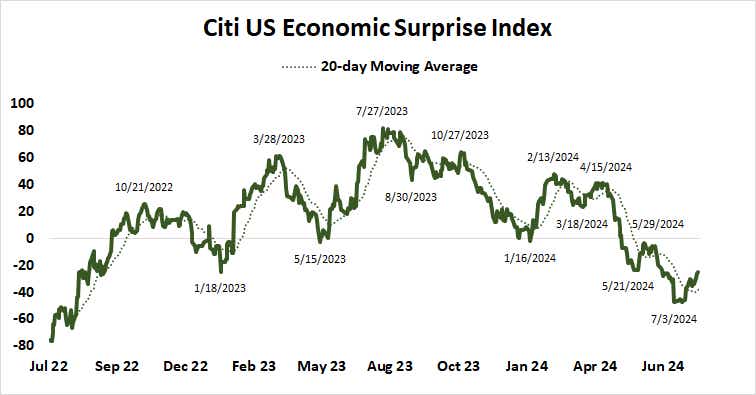

Analytics from Citigroup reveal that U.S. economic data outcomes have increasingly underperformed relative to market-watchers’ baseline forecasts since mid-April. This points to elevated disappointment risk as the jobs report crosses the wires. That may set the stage for another round of bloodletting to close out the week.

Most of the stocks rally from November 2023 has been marked by “bad data is good for risk appetite” dynamic as traders cheered amid building Federal Reserve interest rate cut speculation. Now, the markets have seemingly transitioned to a “bad data is bad for risk appetite” regime because the timing of the Fed rate hike cycle seems to have solidified.

The probability of at least a single, standard-sized 25-basis-point (bps) rate cut in September is implied at 100% in Fed Funds interest rate futures. The possibility of a jumbo 50bps cut has increased to 28.5%. Such a scenario was entirely off the table a month ago. 177bps in cuts are now priced in through year-end 2025, the most since February.

Ilya Spivak, tastylive head of global macro, has 15 years of experience in trading strategy, and he specializes in identifying thematic moves in currencies, commodities, interest rates and equities. He hosts Macro Money and co-hosts Overtime, Monday-Thursday. @Ilyaspivak

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.