U.S. Jobs Data Preview: Stock Markets at Risk, Dollar Rally May Resume

U.S. Jobs Data Preview: Stock Markets at Risk, Dollar Rally May Resume

By:Ilya Spivak

Markets might be disappointed by August’s U.S. employment data if a still-low jobless rate keeps the Fed on offense

- Financial markets have cheered early signs of cooling in the U.S. labor market.

- Official employment data now in focus, with signs of a hiring slowdown expected.

- The market mood may sour if a still-low jobless rate hints the Fed will stay on the offense.

Financial markets have proven themselves sensitive to U.S. labor market data this week amid churning speculation about where the Federal Reserve will take monetary policy.

Job openings fell more than economists anticipated in July, slipping below 9 million for the first time since March 2021. An estimate of private sector employment growth from payroll processing giant ADP undershot as well. It pointed to an increase of 177,000 jobs, down from 371,000 in the previous month and lower than the 195,000 gain economists projected.

So far, these tentative signs of cooling have been greeted warmly by investors, who seemed cheered by the idea that these outcomes imply a lower probability of another rate hike from the Federal Reserve before year-end. Stocks rose while policy-sensitive two-year Treasury yields ticked down alongside the U.S. dollar.

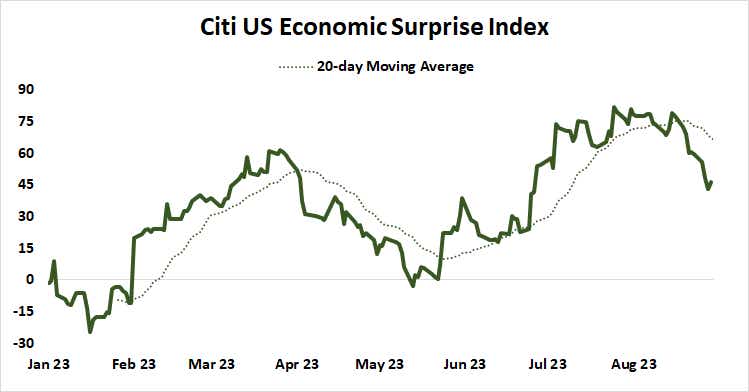

Signs of deterioration in comparative U.S. economic data flow have emerged more broadly. Figures from Citigroup show that, while outcomes still tend to outperform relative to baseline forecasts, momentum to the upside is waning.

This is not all bad news because an upshift in growth expectations is at least some part of this calculus. Bloomberg survey data shows analysts have upgraded 2023 and 2024 U.S. GDP growth expectations in August. Still, the stage seems set for generally soggier headline readings from here.

U.S. hiring expected to slow, but broad layoffs are still not on the menu

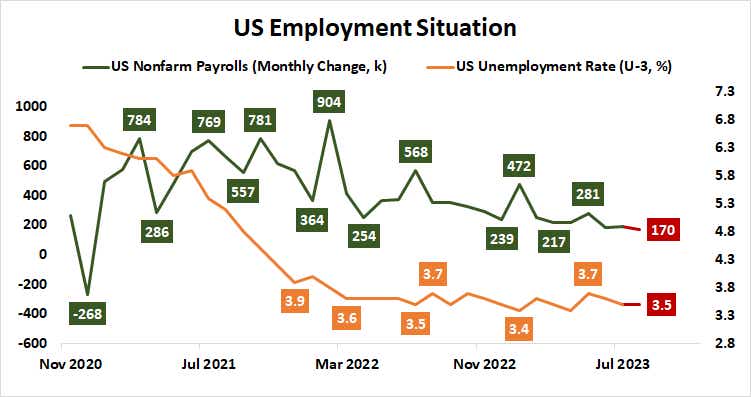

The spotlight now turns to August’s official employment report from the U.S. Bureau of Labor Statistics (BLS). It is expected to show an increase of 170,000 in nonfarm payrolls. At face value, which would be the lowest reading since December 2020. Factoring out COVID-related noise in the historical record, it would point to the slowest pace of job creation in four years.

Nevertheless, the unemployment rate is seen holding at 3.5%, a hair above the 55-year low at 3.4% recorded in January (and matched in April). Wage inflation is seen holding steady, with average hourly earnings rising 4.4% year-on-year.

A slowdown in hiring coupled with lingering tightness in the labor market signaled by the low jobless rate comports with the reports published earlier in the week to suggest that excess demand is being squeezed out without triggering mass layoffs. That is, the post-pandemic rush for staff is cooling, but thinning the ranks has not begun in earnest.

This points to a lingering problem for the Federal Reserve.

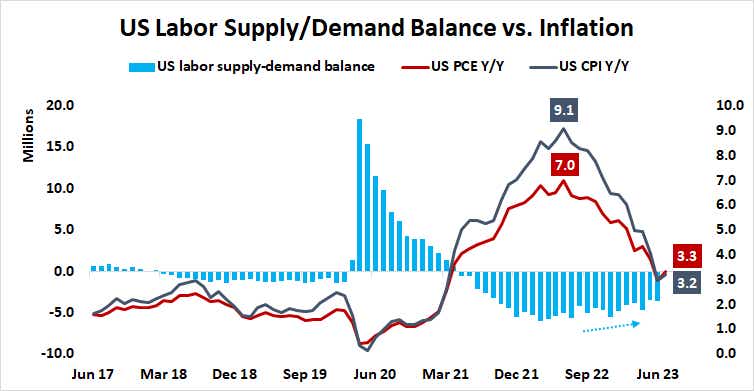

Sticky inflation is concentrated in the service sector. Prices related to housing are the largest piece of that puzzle, but the central bank has relatively little scope to affect outcomes there over the near term. This drives its focus on the labor market, where it hopes to bring down an imbalance in supply and demand that has been boosting wage growth.

The Fed needs a higher jobless rate to consider rate cuts

Fed officials have stressed that doing this will almost certainly demand a rise in the jobless rate because reducing labor cost burdens in earnest will demand resetting a swathe of wage agreements made in the after-COVID hiring boom.

To that end, a smaller rise in payrolls on its own will probably mean relatively little for the central bank. It may hold back another rate hike in 2023 – which is already the baseline scenario priced into markets – but it is unlikely to shake policymakers’ resolve to keep borrowing costs at restrictive levels.

Taken against the backdrop of rising global recession risk as the Eurozone slips into recession and economic conditions in China go from bad to worse, this seems broadly negative for risk appetite.

That portends weakness in stocks and cyclical commodities like copper and crude oil alongside sympathetic currencies, like the Australian dollar. Meanwhile, defensive capital flows might revive the uptrend in the US dollar and power a rebound in the anti-risk Japanese yen. Gold and Treasury bonds at the safety-minded long end of the yield curve may benefit as well.

Ilya Spivak, tastylive head of global macro, has 15 years of experience in trading strategy, and he specializes in identifying thematic moves in currencies, commodities, interest rates and equities. He hosts Macro Money and co-hosts Overtime, Monday-Thursday. @Ilyaspivak

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.