U.S. Jobs Data Preview: This News Can Sink or Save the Stock Market

U.S. Jobs Data Preview: This News Can Sink or Save the Stock Market

By:Ilya Spivak

Investors pondering Fed interest rate cuts want anything but the status quo

- Financial markets are fixated on the size of September’s Fed interest rate cut

- Worries about stimulus lag amid growth fears are fueling bets on a 50-basis-point reduction

- With U.S. jobs data in focus, stocks will likely cheer anything but the status quo.

Wall Street faces a critical test as traders turn their focus to the release of August’s U.S. labor market data. The release is usually a must-watch indicator for markets, in large part because it speaks directly to one half of the dual mandate pursued by the Federal Reserve. The central bank is tasked with maximizing employment while sustaining price stability.

This means that the monthly jobs growth update from the Bureau of Labor Statistics (BLS) is a key input into investors’ expectations for interest rates. Understandably enough, the cost of money is a vital input for market participants as they decide how much capital to deploy and in what parts of the asset universe.

Markets are fixated on the size of September’s Fed rate cut

This time around, the figures take on still more significance amid the countdown to the almost certain start of the Fed rate cut cycle when the policy-steering Federal Open Market Committee (FOMC) announces its next move on Sept. 18. The probability of a reduction is implied at 100% in benchmark Fed Funds interest rate futures.

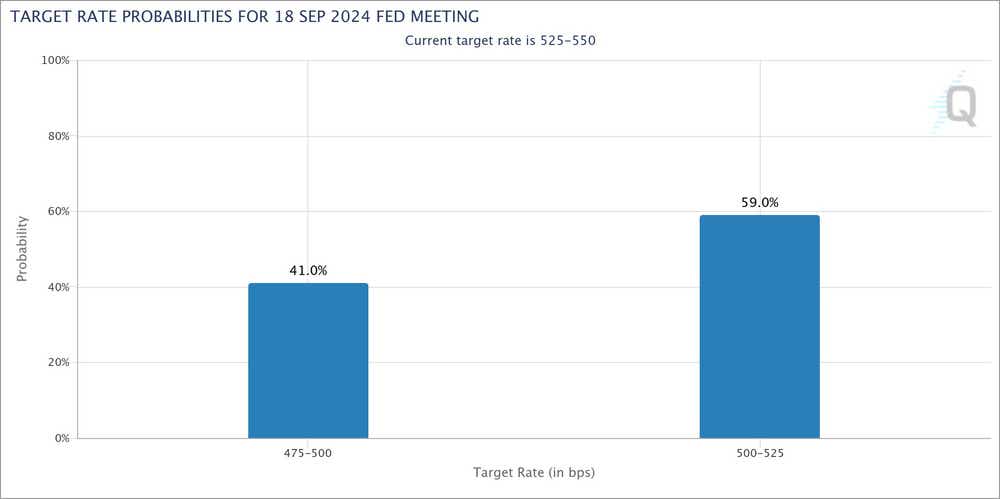

This makes the main object of speculation the size of the cut instead of its likelihood. As it stands, the probability of a standard-issue 25-basis-point (bps) move is priced in at 59%, while that of a double-sized 50bps change stands at 41%. Traders’ flirtation with an outsized cut speaks to worries about the Fed having waited too long to start easing.

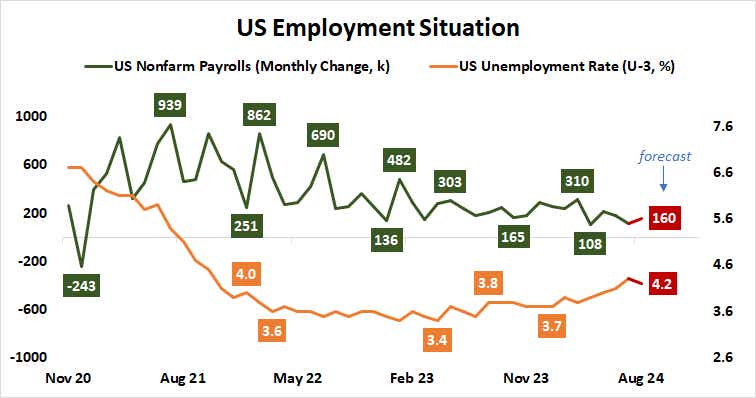

The BLS data are expected to show the economy added 160,000 jobs last month, marking a pickup from the soggy 114,000 in July. That dour reading triggered rapid selling across global stock markets. The unemployment rate is penciled in at 4.2%, a slight downtick from 4.3% previously.

Stocks want anything but the status quo from U.S. jobs data

Citigroup data hints that U.S. news-flow has tended to underperform relative to forecasts recently, which may set the stage for disappointment once again. Markets might welcome such a result, figuring it would nudge the Fed toward a 5bps cut. They may likewise endorse a beat, hoping the economy is strong enough that a 25bps cut will suffice.

A set of figures that registers broadly in line with expectations—de facto the likeliest outcome—may be the most negative scenario for stock markets. That would endorse the status quo, where traders are already dispirited by cyclical dynamics and worried about the Fed’s lagging response to recession risk.

The release of service sector purchasing managers’ index (PMI) data from the Institute of Supply Management (ISM) a day ahead of the jobs report previewed such dynamics (as expected). The headline index printed at 51.5, only a hair above the 51.1 reading expected. The S&P 500 briefly popped but fell to the lows of the day within just two hours.

Ilya Spivak, tastylive head of global macro, has 15 years of experience in trading strategy, and he specializes in identifying thematic moves in currencies, commodities, interest rates and equities. He hosts Macro Money and co-hosts Overtime, Monday-Thursday. @Ilyaspivak

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.