U.S. ISM Preview: Stocks Will Fall if Service Sector Data Keeps Fed Rate Cuts Off of the Menu

U.S. ISM Preview: Stocks Will Fall if Service Sector Data Keeps Fed Rate Cuts Off of the Menu

By:Ilya Spivak

Stock markets are under fire as uncertainty swells amid growing recession fears and a “higher-for-longer” Fed rates outlook.

- Stocks swooned as job openings topped forecasts, draining hopes for a Fed rate reprieve.

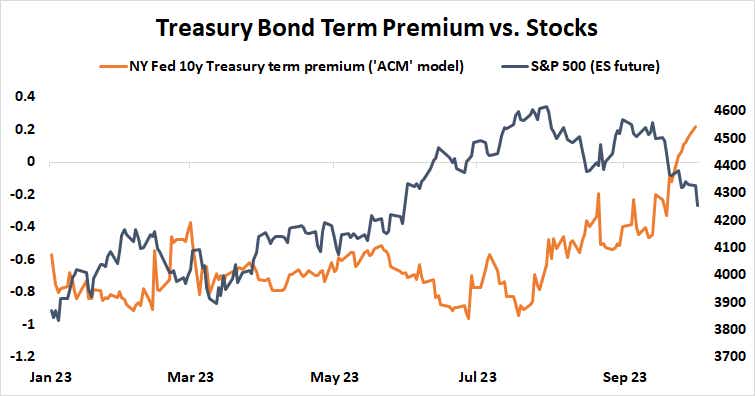

- Rising term premium in the Treasury bond market speaks to investors’ uncertainty.

- ISM service sector PMI data may underpin “higher-for-longer” rates and could hurt markets.

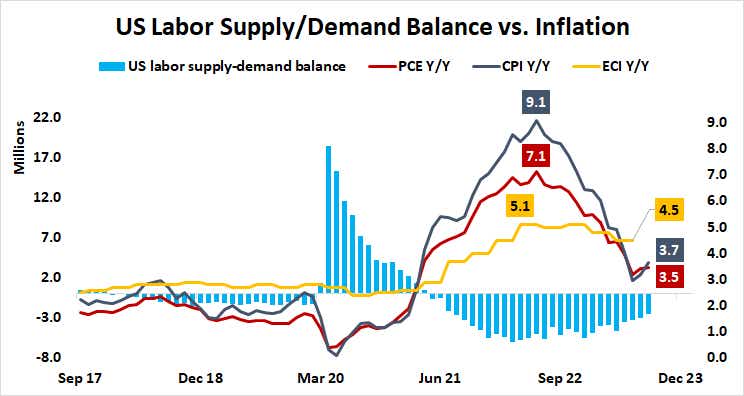

Stock markets swooned after the job openings and labor turnover survey (JOLTs) showed vacancies rose to 9.61 million in August, topping forecasts penciling in 8.82 million. July’s reading was also revised higher, from 8.83 to 8.92 million.

The markets responded as expected. The bellwether S&P 500 equity index dropped while the yield curve continued to steepen, with longer-term borrowing costs rising as short-term rates lagged. This seems to indicate swelling term premium in the bond market, a reflection of rising uncertainty among investors.

Investor uncertainty grows

Data from the Federal Reserve Bank of New York measuring the 10-year Treasury bond term premium—the excess return demanded by investors to compensate for the additional risk of loaning money over longer vs. shorter time periods—has turned positive for the first time in more than two years. At 15 basis points (bps), it’s at the highest since May 2021.

That doesn’t seem surprising. Front-end borrowing costs are pinned in place as the Federal Reserve makes clear its intent to hold interest rates “higher-for-longer” after a blistering cycle of hike.s This means that markets hoping for a lifeline are out of luck even as global recession worries gather. A deep downturn in the Eurozone and a struggle to regain pre-COVID momentum in China has left the U.S. as the last bit of relative resilience among the major engines of global growth.

Stocks still in danger as service-sector ISM data looms

The spotlight now turns to September’s service sector purchasing managers' index (PMI) data from the Institute of Supply Management (ISM). It is expected to show that growth slowed in the largest sector of the economy after jumping to a six-month high in August. The report’s insights into pricing and employment trends will be closely watched.

Analog PMI data compiled by S&P Global offers ominous foreshadowing of what the ISM survey may contain. It pointed to “broad stagnation,” with cautious stabilization in manufacturing tarnished by the weakest service-sector activity in eight months. Nevertheless, hiring picked up and input costs continued to rise, in part because of wage hikes.

More of the same in the ISM release bodes ill for stocks if it translates into expectations of continued stasis at the Fed. Slowing growth means further rate hikes are likely off the table for now, as the markets already price in. However, if sticky labor markets continue to bedevil the Fed’s inflation-fighting efforts, a turn to rate cuts seems distant.

Ilya Spivak, tastylive head of global macro, has 15 years of experience in trading strategy, and he specializes in identifying thematic moves in currencies, commodities, interest rates and equities. He hosts Macro Money and co-hosts Overtime, Monday-Thursday. @Ilyaspivak

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.