U.S. Inflation Data, ECB Rate Decision, China TradeReport: Macro Week Ahead

U.S. Inflation Data, ECB Rate Decision, China TradeReport: Macro Week Ahead

By:Ilya Spivak

Markets are still in trouble after last week’s heavy selling as spotlight turns to inflation data

Stock markets took a beating amid uncertainty about the Fed rate cut size.

U.S. CPI data is in focus as markets brace for the Sept. 17 FOMC meeting, dovish ECB report, and data from Chinese may rekindle growth fears.

Export and import growth are expected to cool in August.

Stock markets swooned last week. The bellwether S&P 500 stock index suffered a blistering loss of 4.3% while the tech-tilted Nasdaq 100 fell 5.9%. The bloodletting followed economic data that sustained ambiguity about the size of this month’s broadly anticipated interest rate cut from the Federal Reserve, as expected.

Treasury bonds rose and yields tumbled, helping to power a rise in the Japanese yen. Gold and the U.S. dollar were relatively little changed on the week, though the greenback picked up momentum in the second half of the week.

Crude oil prices fell despite lingering geopolitical fears and supportive OPEC comments, hinting at global growth fears.

Here are the macro waypoints that are likely to shape what comes next.

China trade data

Another round of soggy macro data from China threatens to remind the markets why they are so eager to see big-splash monetary stimulus from the world’s top central banks, and especially the Federal Reserve. Export and import growth are expected to cool in August.

Analytics from Citigroup show Chinese economic news flow has increasingly disappointed relative to baseline forecasts since mid-April. That sets the stage for a downside surprise. Such a result might underscore the risk of a global growth slump if the Fed were to miss the “soft landing” window in the U.S. at a time without a potent offset.

U.S. consumer price index (CPI) data

All eyes are on August’s U.S. inflation data this week as the size of the Federal Reserve interest rate cut almost certainly on tap later this month continues to be the central object of speculation for the markets.

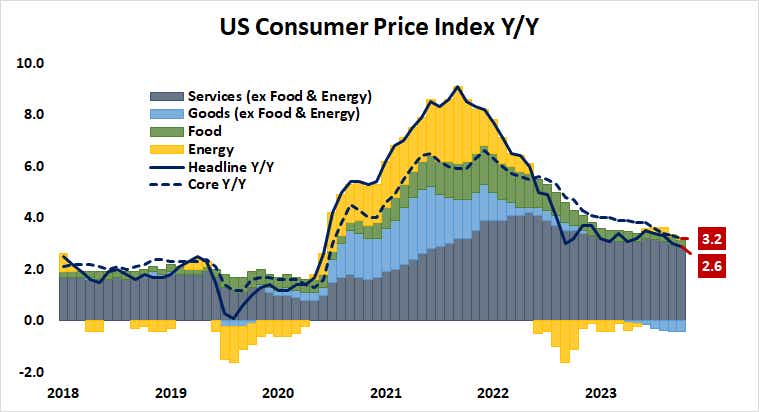

Headline consumer prices are seen growing 2.6% year-on-year, the slowest increase since March 2021. The core reading excluding volatile food and energy prices—a focal point for central bank officials—is expected to remain at 3.2%, matching the three-year low recorded in July.

As with last week’s Institute for Supply Management (ISM) and employment data, outcomes closely in line with expectations seem most troubling for traders. Only a very sharp (and inherently unlikely) upside surprise would make traders seriously consider the possibility that the Fed will delay stimulus yet again. A miss may well cheer up traders with hopes for a 50-basis-point (bps) reduction.

Meanwhile, numbers closely aligned with what is already priced in would lead the markets into next week’s Fed policy decision with an unwelcome degree of ambiguity. The likelihood of a 50bps cut implied in Fed Funds futures is still meaningful at nearly 30%. Locking that in might trigger de-risking, hurting stocks and lifting the U.S. dollar.

European Central Bank policy decision

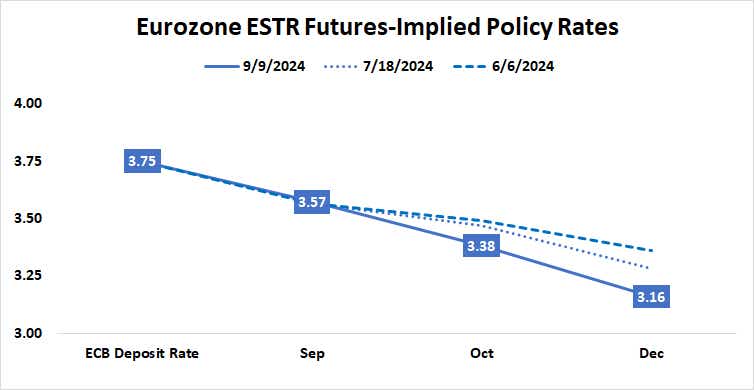

The European Central Bank(ECB) is broadly expected to issue another interest rate cut this month. The probability of a 25bps reduction is priced in at a confident 72%. Benchmark ESTR interest rate futures imply 59bps in easing through the end of the year, meaning at least two standard-sized reductions and 26% probability of a third one.

Recent comments from central bank officials have flagged the possibility a double-sized 50bps reduction may be on the table, perhaps even this month. Current market pricing appears to make light of such an outturn, even if the ECB opts against big-splash action this month yet signals that it’s likelier in October or December than expected.

The euro is likely to face selling pressure if ECB President Christine Lagarde and company signal as much after the Governing Council convenes this week. A sharp adjustment lower is in the cards if they opt to pull the trigger this go-around.

Ilya Spivak, tastylive head of global macro, has 15 years of experience in trading strategy, and he specializes in identifying thematic moves in currencies, commodities, interest rates and equities. He hosts Macro Money and co-hosts Overtime, Monday-Thursday. @Ilyaspivak

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.