U.S. House Prices Face Oncoming Headwinds

U.S. House Prices Face Oncoming Headwinds

By:Ilya Spivak

Prices may fall on new construction, Fed policy turn

- U.S. housing market stuck as Fed rate hikes and de-stocking freeze turnover.

- New home sales hit a 17-month high but existing homes are where volume is.

- Signs of life in housing starts offer a glimpse of new supply, the Fed may help.

The U.S. housing market is in a holding pattern.

Home prices began to recover from the slump that triggered the 2008 financial crisis and subsequent recession in the first half of 2012. The rise picked up blistering momentum at the onset of the COVID-19 pandemic in early 2020 as lockdowns of public spaces pushed a wide swathe of the population to reshape their living arrangements.

Gains stalled by mid-2022 as the Federal Reserve raced to contain surging inflation after the pandemic, launching an intensive campaign of interest rate hikes that drove up mortgage rates. Prices have idled since. A shallow pullback through last year seesawed in the opposite direction at the start of 2023. An index from Standard and Poor’s tracking the national average of single-family home prices is now a mere 1% below the peak.

U.S. housing market stuck at standstill

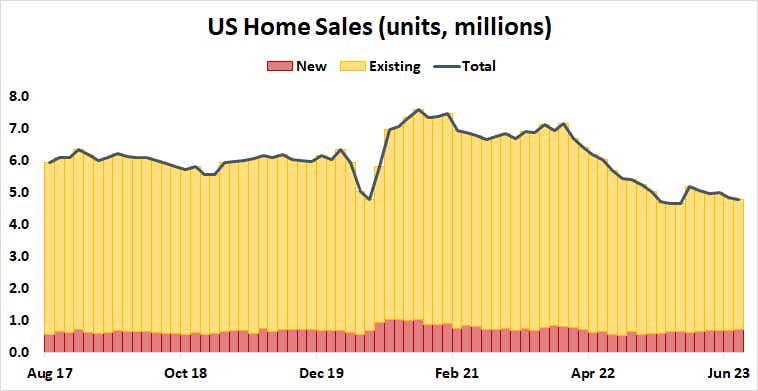

The standstill reflects a collapse in turnover. Total home sales are hovering near a 12-year low, just under five million units per month.

This speaks to a dearth of sellers at least as much as it does priced-out buyers, if not more so. In fact, sales of new homes have perked up a bit since mid-2022, hitting a 17-month high at 714,000 units in July. Sales of existing homes dwarf that part of the market by nearly six times however, and they’re pinned to decade lows.

That’s probably because most U.S. homeowners enjoy long-term fixed-rate mortgages. The Bureau of Economic Analysis (BEA) reports that the effective interest rate on outstanding mortgage debt is just 3.6%, while BankRate.com has the national average for 30-year fixed rate home loans at 7.15%.

No wonder there is no rush to sell: one must of course live somewhere, and financing a purchase is vastly more expensive now than what most owners have locked in.

An almost 20-year decline in inventories of existing homes has hardly helped. Supplies peaked in July 2007 as the building boom that would crash the U.S. housing market crested and a long-lasting digestion period ensued. The available stock stood at just 1.1 million units in July.

Homebuilding stirs as Fed policy turns a corner

A break in the deadlock may be on the horizon.

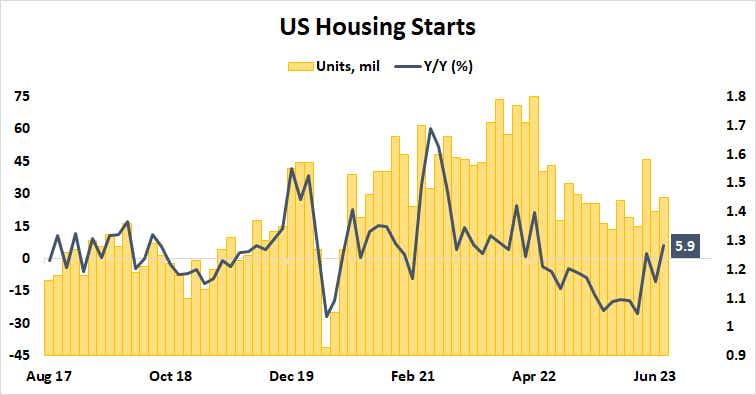

Housing starts are showing signs of life, rising 5.9% year-on-year last month. That marked the largest increase since February 2022, offering a glimpse of construction activity at a pace preceding the Fed’s rate-hike bonanza. Total numbers are still woefully low at just 1.45 million in July, but perhaps the ice caps are finally starting to melt.

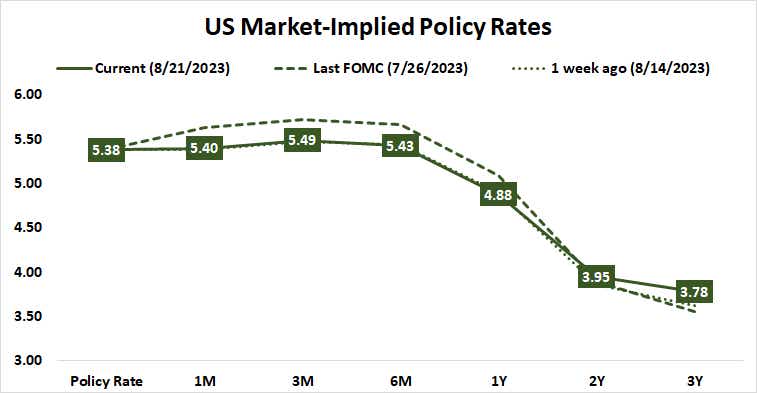

An end to the Fed’s tightening campaign may help. Interest rate futures price in the probability of another rate hike in 2023 at 41%, implying the bet that the U.S. central bank is now in wait-and-see mode. A spirited reversal is expected to begin in the second quarter of 2024, with rates reduced by 100 basis points (bps) or 1% by year-end. This might begin to nudge along some sellers.

Taken together, these forces may begin to feed a bit more supply to the market. If this can pressure prices lower, the process may start to be self-reinforcing. A downturn in home values may trigger holdout sellers to take the plunge, increasing inventories further.

A tailwind from new construction—where finishing a unit takes between seven and 12 months, according to the U.S. Census Bureau—might arrive just in time. Builders began scaling back production in January 2022, just over two months before Fed rate hikes started. If recent activity finds follow through, a healthy dose of newly built supply might hit the market in the second half of 2024.

A drop in house prices may be brewing.

Ilya Spivak, tastylive head of global macro, has 15 years of experience in trading strategy, and he specializes in identifying thematic moves in currencies, commodities, interest rates and equities. He hosts Macro Money and co-hosts Overtime, Monday-Thursday. @Ilyaspivak

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.