U.S. GDP and PCE, Bank of Canada Meeting, PMI Data: Macro Week Ahead

U.S. GDP and PCE, Bank of Canada Meeting, PMI Data: Macro Week Ahead

By:Ilya Spivak

Stock markets may keep falling if signs of economic slowdown continue to feed fear of global recession

Recession worries may grow more acute if global PMI data undershoots expectations.

A dovish tone from the Bank of Canada may fuel fears about U.S. demand trajectory.

U.S. GDP and PCE data are eyed as the markets struggle despite firming Fed rate cut bets.

Wall Street is trading on pace for its worst week in three months. The bellwether S&P 500 is tracking down over 1% ahead of the weekly close. The high-flying Nasdaq 100—the tech-oriented index defining the blistering nine-month rally from the lows in late October 2023—is on pace to lose 2.7%.

Cracks in the markets’ confidence began to appear the previous week. Traders seemed to take signs of the imminent arrival of Federal Reserve interest rate cuts as signaling that economic trends have finally become troubling enough for the central bank to act, as expected.

Against this backdrop, here are the macro waypoints likely to shape what comes next.

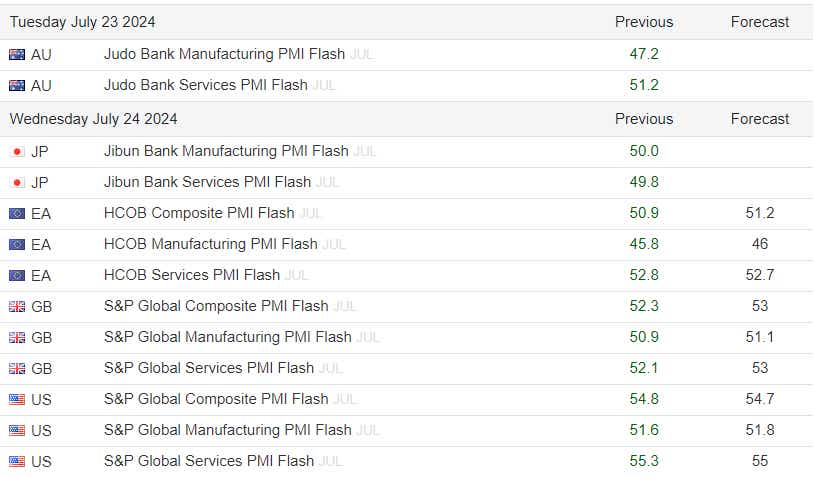

Global purchasing managers’ index (PMI) data

The first round of July purchasing managers’ index (PMI) data from S&P Global will offer a timely picture of economic activity trends in the world’s top economies. Early forecasts point to relatively benign results, with the pace of expansion in the U.S. holding broadly steady while conditions improve a bit in Europe.

However, analytics from Citigroup warn that global economic data outcomes have increasingly underperformed relative to baseline forecasts over the past three months. This warns that market-watchers’ models are tuned to a rosier setting than reality endorses, setting the stage for disappointment. Soft readings may stoke global slowdown fears.

Bank of Canada policy meeting

The Bank of Canada (B)C) is widely expected to cut its target overnight interest rate by 25 basis points (bps) to 4.50%. The priced-in probability of the move rose to 90% this week, according to Bloomberg. That came after Canadian inflation data fell short of economists’ forecasts, as expected.

The markets are pricing in a target rate of 4.12% by year-end, implying 63bps in further easing. That amounts to two more standard-sized 25bps cuts and a narrowly better-than-even 52% chance of a third one.

Dovish BOC guidance moving the outlook to a more dovish setting may hurt the Canadian dollar. It may also stoke U.S. growth concerns. Canada’s economy is intimately tied to the fortunes of its southern neighbor. Nearly 80% of Canadian exports are bound for U.S. markets.

.png?format=pjpg&auto=webp&quality=50&width=1000&disable=upscale)

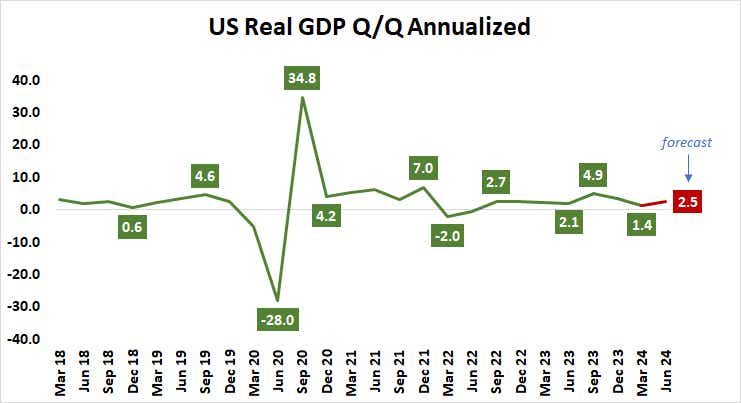

U.S. gross domestic product data

The pace of expansion in the world’s largest economy is expected to have quickened in the second quarter. Analysts see the annualized growth rate rising to 2.5% from 1.4% in the first three months of the year. A closely watched “nowcast” estimate from the Atlanta branch of the Federal Reserve puts the reading at a slightly higher 2.7%.

That may shade market expectations to benchmark an upside bias. Nevertheless, Citigroup data implies that the trend in U.S. data outcomes relative to forecasts is the most negative in two years. Taken together, this means a modestly upbeat result may have little market impact, while even a narrow miss triggers a strong response.

Meanwhile, the latest PMI survey of U.S. economic activity from the Institute of Supply Management (ISM) warned that last month, the manufacturing and services sectors contracted in tandem for the first time since December 2022. This warns that any signs of resilience in the GDP report may be stale relative to timelier business cycle trends.

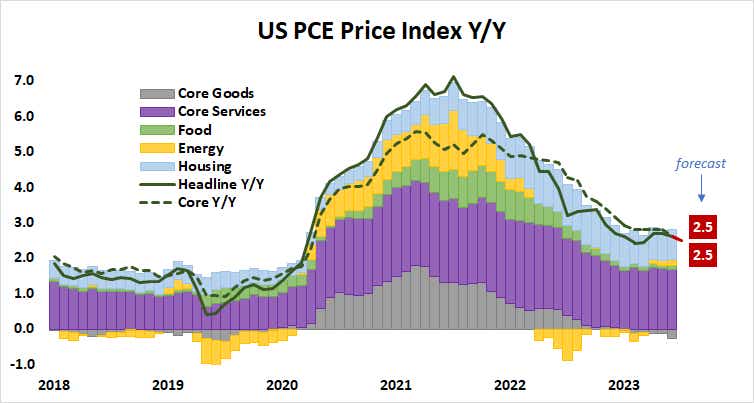

U.S. personal consumption expenditure (PCE) data

The Fed’s favored inflation measure is expected to show that core price growth—a gauge of the central trend that excludes volatile food and energy prices—fell to 2.5% year-on-year in June. That would amount to a new three-year low.

The markets are typically good at forecasting PCE data once consumer and producer price indexes (CPI and PPI respectively) are published for the same reference period. That means that scope for a meaningful surprise one way or another is usually limited.

All the same, the skew toward disappointment in recent U.S. data outcomes and strikingly soft results on CPI for the same period – an outcome loudly jeered by stock markets – warn that, what modest surprise risk there is, seems pointed to the downside. Such a result might compound pressure on risk appetite.

Ilya Spivak, tastylive head of global macro, has 15 years of experience in trading strategy, and he specializes in identifying thematic moves in currencies, commodities, interest rates and equities. He hosts Macro Money and co-hosts Overtime, Monday-Thursday. @Ilyaspivak

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.