Lean Into Market Momentum (When the Macro Calendar is Quiet)

Lean Into Market Momentum (When the Macro Calendar is Quiet)

Moving averages, stochastics and other technical takes on the current market

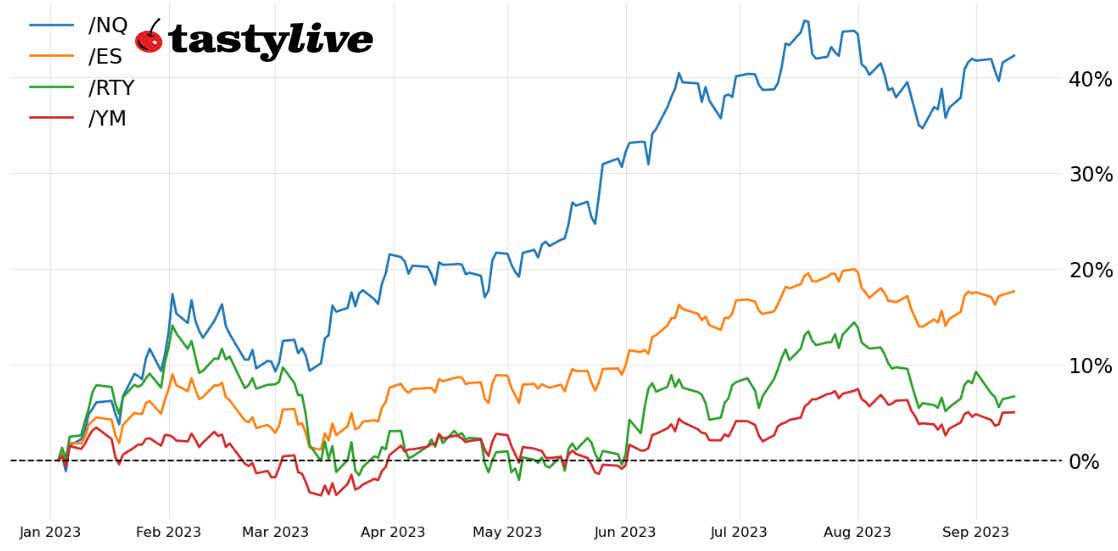

- Choppy price action continues to define trading across the four major U.S. equity index futures.

- /ESZ3 may have the most bullish directional setup, while /NQZ3 remains in a range that began in June.

- /RTYZ3 is on the least stable ground, unable to gain significant traction off the 1820/50 area that has been pivotal since March.

A quiet start to the week–no major U.S. earnings releases or macro data–has stocks riding higher, ever so slightly. Each of the four major U.S. equity index futures are trading in the green on Monday, led higher by the Nasdaq 100 (/NQZ3) midway through the North American trading session. It may be a ‘calm before the storm’ of sorts, given the upcoming August U.S. inflation rate report on Wednesday (it should be noted that implied volatility is discounting less than a +/-1% move through the end of this week).

/ES S&P 500 price technical analysis: daily chart (December 2022 to September 2023)

/ESZ3 may have the best bullish setup among the major U.S. equity index futures at the start of the week, though that’s more of an observation based on relativity than outright bullishness. The uptrend from the September 2022, March 2023, and August 2023 swing lows is intact, and /ESZ3 has broken the downtrend from the July and August swing highs.

Momentum, however, is lacking. /ESZ3’s daily 5-, 13-, and 21-EMA envelope is in neither bearish nor bullish sequential order. The Moving Average Convergence Divergence (MACD) is rising, but has struggled to cross above its signal line, and slow stochastics have dipped out of overbought territory. Choppy, rangebound conditions may prevail for the near future, putting into focus strategies like iron condors or short strangles (despite low IV not offering much premium for traders to collect).

/NQ Nasdaq 100 price technical analysis: daily chart (December 2022 to September 2023)

/NQZ3 is more rangebound than its counterparts, but like /ESZ3, momentum appears neutral at present time. The trend higher in MACD has been curbed, while slow stochastics have slouched out of overbought territory. /NQZ3 is back above its daily EMA envelope, but the EMA envelope is not in bullish sequential order yet. Like for /ESZ3, directionally neutral, risk-defined strategies may prove most suitable in the near-term.

/RTY Russell 2000 price technical analysis: daily chart (April 2023 to September 2023)

If there is a case for a bearish play in any of the four major U.S. equity index futures, /RTYZ3 may be the best bet. /RTYZ3 has fallen to regain the uptrend from the intramonth May swing lows and has struggled to trade back above its daily 5-EMA (one-week moving average) over the past several sessions; the daily EMA envelope is in bearish sequential order. MACD is trending lower while below its signal line, and slow stochastics are moving towards oversold territory. For bears to truly gain control henceforth, a break below the 1820/50 area—which has been critical support and resistance dating back to the onset of the regional banking crisis in March—is necessary.

Christopher Vecchio, CFA, tastylive’s head of futures and forex, has been trading for nearly 20 years. He has consulted with multinational firms on FX hedging and lectured at Duke Law School on FX derivatives. Vecchio searches for high-convexity opportunities at the crossroads of macroeconomics and global politics. He hosts Futures Power Hour Monday-Friday and Let Me Explain on Tuesdays, and co-hosts Overtime, Monday-Thursday. @cvecchiofx

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.