U.S. Dollar Grinds Sideways Ahead of FOMC Meeting

U.S. Dollar Grinds Sideways Ahead of FOMC Meeting

Technicals suggest dollar weakness ahead

- U.S. Treasury yields are continuing to rise but not in the part of the yield curve that tends to influence foreign exchange (FX) rates.

- Markets don’t anticipate another Fed interest rate hike this cycle; the November FOMC meeting is Wednesday.

- Technical trends are beginning to break in favor of short-term U.S. dollar weakness.

Market Update: The dollar is down 0.05% month-to-date

When the Federal Reserve meets this week for its November policy meeting, it’s unlikely the Federal Open Market Committee (FOMC) will raise interest rates (<5% chance per Fed funds futures (/ZQ) and SR3 futures spreads (/SR3)). That comports with the price action seen at the short-end of the U.S. Treasury yield curve—the important part of the yield curve when it comes to FX markets—where two-year yields have been range-bound for several weeks around 5%.

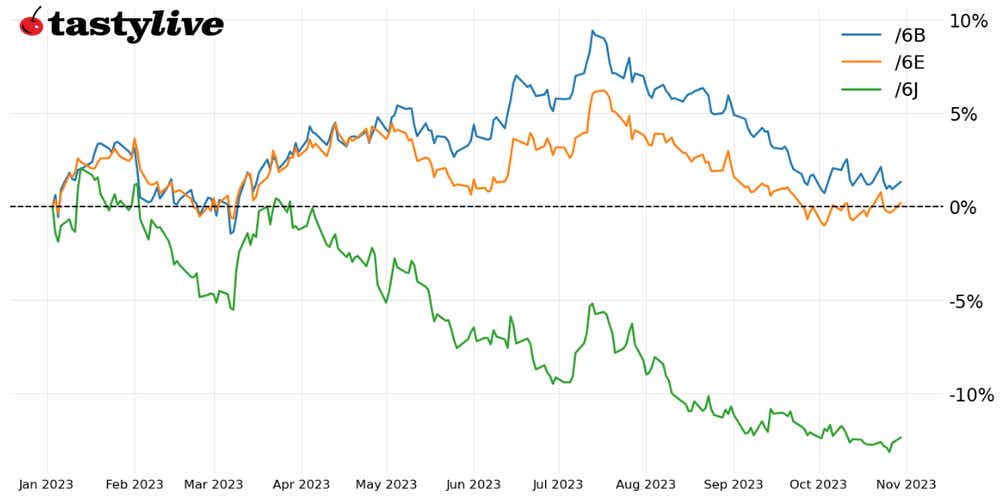

The relative stability in the short-end of the U.S. yield curve has deprived the U.S. dollar of what’s been its most potent catalyst this year, in turn giving room for other major currencies to claw back some of the losses accumulated since mid-summer.

With Bank of England and Bank of Japan (BOJ) rate decisions later this week, as well, there are meaningful catalysts on the horizon that could help shake FX markets out of their recent stupor. (Because let’s face it, FX futures have been extremely staid relative to what’s happening in equities, bonds, metals and energy).

/6B British Pound Technical Analysis: Daily Chart (September 2022 to October 2023)

The British pound (/6B) has been consolidating for the past several weeks, carving out a descending triangle in the process. That’s typically a bearish continuation pattern, so it’s wise to treat it neutrally until a directional break occurs. Momentum is accordingly neutral. /6BZ3 is above its daily 5-EMA (exponential moving average), back to its daily 13-EMA, but still below its daily 21-EMA. MACD (moving average convergence/divergence) is trending higher, but remains below its signal line. Slow stochastics are rebounding from oversold territory, yet they’re still below their signal line. A break of the downtrend from the July and October swing highs would open up possibilities for bulls; a drop below the October low would increase the likelihood of a return to the yearly low established in March.

/6E Euro Technical Analysis: Daily Chart (September 2022 to October 2023)

Like /6B, the euro (/6E) had been consolidating into a descending triangle, but unlike /6B, /6E has traded through descending triangle resistance from the July and August swing highs. The retest of resistance turned support held, setting up a potential bullish reversal. A series of higher lows has defined price action in recent weeks (which may ultimately be a bear flag; it’s too soon to tell). The moving average envelope is mixed, with /6E above its daily 5-, 13- and 21-EMAs, but the daily 5- and 13-EMAs remain below the daily 21-EMA. MACD is trending higher, but has yet to cross above its signal line. Meanwhile, slow stochastics are inching up, yet have not moved above their median line.

/6J Japanese Yen Technical Analysis: Daily Chart (October 2022 to October 2023)

The Japanese yen remains the most interesting currency among the three major components of the dollar index (DXY), insofar as speculation around the BOJ adjusting its ultra loose policy efforts remains a focal point. /6J is lingering right near the October 2023 yentervention level (USD/JPY spot rates just below 150). A policy adjustment later this week, or even the hint of a forthcoming shift in policy, could prove to be a potent catalyst for a return to the descending trendline from the March and July highs just under 0.0069.

Christopher Vecchio, CFA, tastylive’s head of futures and forex, has been trading for nearly 20 years. He has consulted with multinational firms on FX hedging and lectured at Duke Law School on FX derivatives. Vecchio searches for high-convexity opportunities at the crossroads of macroeconomics and global politics. He hosts Futures Power Hour Monday-Friday and Let Me Explain on Tuesdays, and co-hosts Overtime, Monday-Thursday. @cvecchiofx

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.