EUR/USD, GBP/USD, AUD/USD – US Dollar at Key Crossroads in 2023

EUR/USD, GBP/USD, AUD/USD – US Dollar at Key Crossroads in 2023

By:Ilya Spivak

The US Dollar enjoyed a banner year in 2022 but the currency now stands at a crossroads. Another year of strength would probably align with grave turmoil in most other markets.

Key Takeaways

- Fed rate hike speculation delivered impressive gains for the US Dollar last year

- If risk appetite holds up, the Euro and British Pound may play catch-up in 2023

- Worries about credit market instability may stoke liquidity-haven USD demand

The US Dollar enjoyed a banner year in 2022, adding a commanding 8.7 percent against an average of its major currency counterparts. An aggressive inflation-fighting effort at the Federal Reserve powered the rise. Policymakers delivered a blistering 425 basis points (bps) in rate hikes between March and December, amounting to the most aggressive pace of tightening since Paul Volcker famously led the Fed to vanquish runway inflation in the early 1980s.

This proved doubly supportive for the Greenback. First, the rapid rate rise burnished the currency’s interest-bearing appeal. Owning USD-denominated assets suddenly offered the highest yield net of inflation in close to 20 years. Second, markets that had enjoyed ultra-cheap borrowing now faced a historic rise in financing costs. That cooled risk appetite, pushing capital from stocks and crypto to bonds and fiat. The Dollar’s unrivaled liquidity was a familiar attraction in such an environment.

What kind of US Dollar will we get in 2023?

As the calendar turns to a new year, investors are questioning whether both influences can remain supportive.

The Fed is conspicuously signaling that the time of back-to-back 75bps rate hikes has passed, and a more measured fine-tuning is now underway. Its latest forecasts envision a peak (‘terminal’) rate of close to 5 percent being reached sometime this year, with a pause and then a moderation toward approximately 3 percent over the course of 2024 and 2025. Current market pricing is broadly in alignment, implying more limited scope for volatility-driving speculation than last year.

Meanwhile, some major central banks that lagged the Fed in joining the inflation fight have more room for catch-up. That means the yield advantage that USD now enjoys will be diminished somewhat in the months to come as rate spreads with other currencies are narrowed. Current expectations implied in market pricing put the European Central Bank (ECB) and the Bank of England (BOE) out in front with close to 150bps in upcoming rate hikes. By contrast, the Fed is seen adding just 25-50bps more. That projects out a relative swing of close to 100bps in the Euro and Sterling’s favor.

Such thinking only works if markets are in a reasonably steady mood, however. Investors prioritize returns in their decision-making when the global economy in aggregate is growing, and market conditions are generally hospitable. This offers a spectrum of diverse opportunities that may then be analyzed, and the most attractive chosen. Conversely, an all-encompassing recession or a systemic disruption in vital market plumbing put capital preservation at the forefront. These often go in-hand. For example, the 2008 global financial crisis (GFC) evolved from the latter into the former.

USD may rise if rapid rate hikes trigger credit market stress

The cost of US Dollar borrowing – a vital barometer of financial health considering the Greenback’s unrivaled role as medium of exchange in global commerce – was pinned near record lows for an exceedingly long time over the past 15 years. That created ample opportunities for making risky bets without significant capital constraints. With rates now sharply higher, such ventures are likely to be stressed. Hefty layoffs in the financing-sensitive tech sector and the collapse of crypto exchange FTX are a case in point.

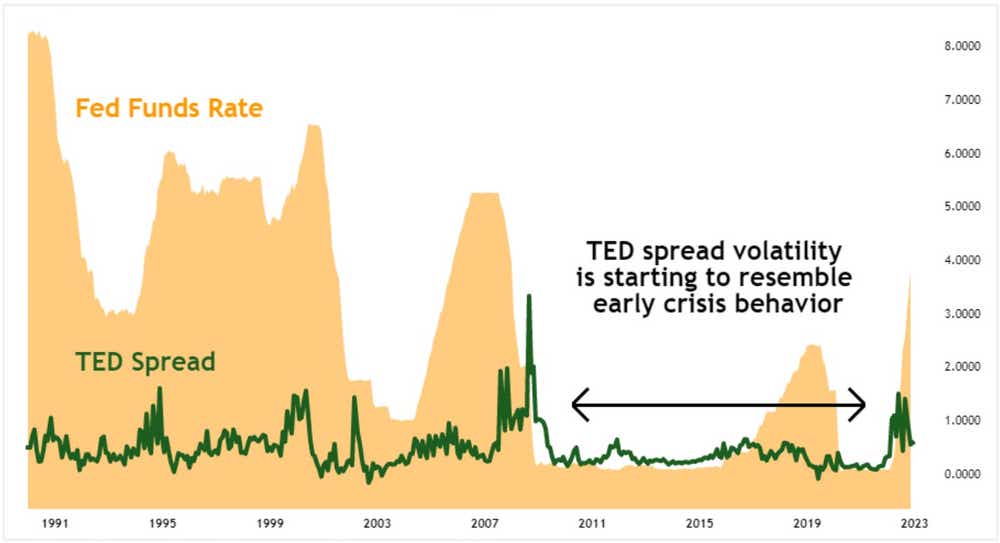

Indeed, the TED spread – the extra cost of borrowing USD outside (‘offshore’) versus within the United States – is hitting peaks and displaying volatility unseen since the early rumblings of the GFC in 2007. That points to lenders turning leery of parting with cash, lest they need it to weather another bout of market-wide liquidation. Traders seem plainly worried that the sharp rise in rates will find another critical weakness in the credit structure akin to housing-related obligations in the last go-round, triggering a panic.

The US Dollar tends to thrive against such a backdrop. Close to 80 percent of global monetary transactions are settled in the currency, making it a uniquely liquid instrument. This translates into an abundance of buyers and sellers at just about any price level, which works to dull volatility. That makes the Greenback a go-to destination when traders “cash out” en masse.

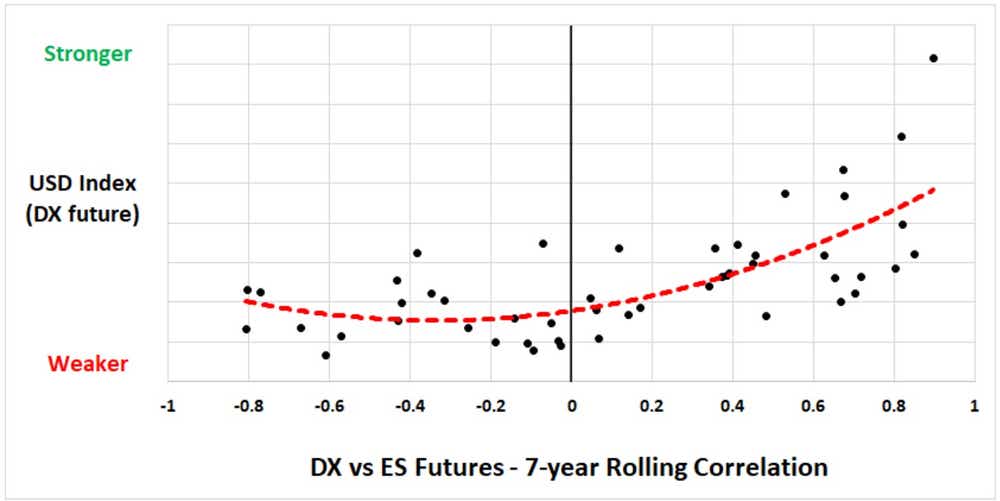

Tellingly, the relationship between the US Dollar Index – a benchmark for the currency’s average value – and its correlation with the bellwether S&P 500 stock index takes on a “smile”-like shape (this is an extrapolation of the well-worn Dollar Smile Theory, which relates USD to the spread between US and other G7 countries’ growth rates). This highlights that the currency does best when its correlation to underlying risk trends is strongly positive or negative.

The right side of the chart tells most of the story of 2022. If the markets’ worries about the consequences of the Fed’s actions grow more acute, the left side may be what 2023 is all about. Gains may be most pronounced against sentiment-sensitive alternatives, with commodity currencies like the Australian Dollar high up on the list.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.