How Are Crude Oil Prices Rising as U.S. Production Hits a Record High?

How Are Crude Oil Prices Rising as U.S. Production Hits a Record High?

By:Ilya Spivak

Crude oil prices are vulnerable to sudden bursts of selling if incoming news-flow eases geopolitical concerns.

- Crude oil prices have marched steadily higher since the start of 2024

- Record U.S. crude oil output seemingly at odds with price dynamics

- Headlines cooling geopolitical concerns may shock prices downward

Crude oil prices have mounted a slow-and-steady uptrend since the beginning of the year. The U.S.-based West Texas Intermediate (WTI) benchmark is up nearly 23% since bottoming below $68 per barrel (bbl) in mid-December 2023.

Its near-term consolidation range just below the $83/bbl mark puts it at the highest in almost five months.

A weekly update on inventory flows from the U.S. Energy Information Administration (EIA) is expected to show that stockpiles fell for a third week straight, shedding 1.28 million barrels.

Downstream, gasoline stocks are expected to see the eighth consecutive week of outflows, losing 1.65 million barrels.

Crude and gasoline inventory drawdowns have sharply outpaced expectations in recent weeks. If that trend continues, the incoming data might offer prices a bit of additional support in the near term.

Crude oil prices supported despite record U.S. output

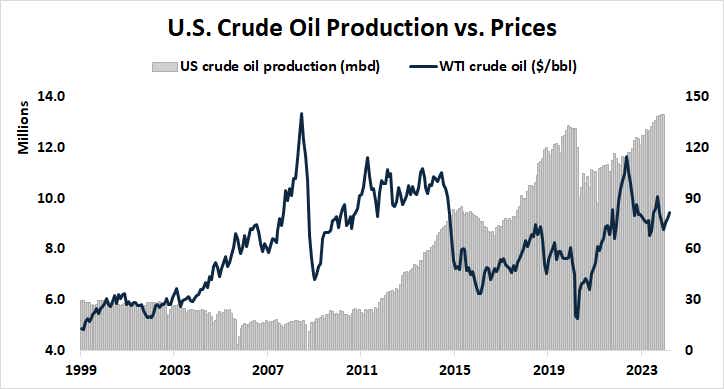

Nevertheless, a broader view suggests the U.S. is swimming in crude oil supply. EIA data shows that production bottomed out in March 2021 having plunged amid COVID-19 lockdowns, then started to rapidly rebuild. By December 2023, the U.S. was producing 13.3 million barrels per day (mbd), the most on record.

What’s more, production efficiency seems to have dramatically improved. Baker Hughes reports that the number of operational oil rigs in the United States has trended steadily lower since peaking just shy of 1,600 in September 2015. The tally fell to a pandemic low of 183 in August 2020, then rebuilt to settle at about 550 in 2023.

Energy consultancy Primary Vision reveals that the number of crews actively engaged in hydraulic fracturing of shale oil deposits – so-called “fracking”, the innovative extraction method at the heart of surging U.S. output over the past decade – has nearly halved from close to 500 in mid-2018 to about 260 in the past two years.

That crude oil prices are tracking upward while output continues to build seems somewhat counter-intuitive. One might have expected that growing production would pressure WTI lower. The lingering presence of a speculative geopolitical risk premium embedded in prices might explain the disconnect.

Energy markets: fearing fear itself?

Fighting between Russia and Ukraine continues, with both sides targeting each other’s energy infrastructure.

Meanwhile, Yemen’s Houthi rebels sympathizing with similarly Iran-backed Hamas – a terrorist group that launched a war against Israel in October – have taken to attacking tankers in the Red Sea on route to the Suez Canal.

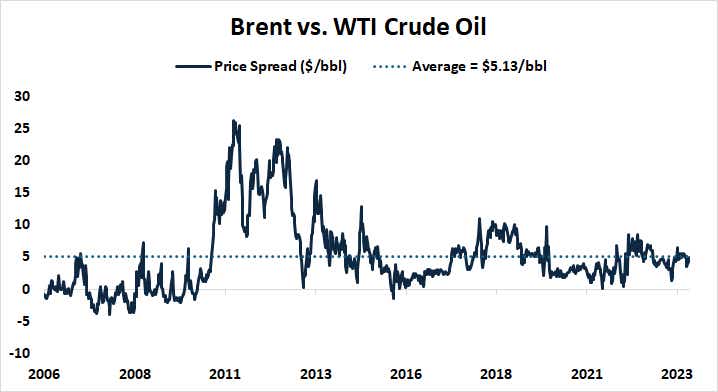

Interestingly, this has not shown up in the price spread between WTI and Brent, the European crude oil benchmark where the impact of supply disruption stemming from the crises in Ukraine and Israel ought to be outsized.

The premium on Brent over WTI has oscillated in a narrow range centered around $5/bbl for years, and that’s where it remains.

This suggests that if it is truly geopolitical risk that accounts for crude oil’s resilience, then it is concern about the increased probability of a supply shock that is at play, rather an actual disruption. This likely makes for outsized sensitivity to news-flow. A stray headline or two deflating risk perception may be enough to give prices a potent downward jolt.

Ilya Spivak, tastylive head of global macro, has 15 years of experience in trading strategy, and he specializes in identifying thematic moves in currencies, commodities, interest rates and equities. He hosts Macro Money and co-hosts Overtime, Monday-Thursday. @Ilyaspivak

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.