U.S. CPI Preview: Stock Markets May Wobble If Inflation Falls Too Sharply

U.S. CPI Preview: Stock Markets May Wobble If Inflation Falls Too Sharply

By:Ilya Spivak

Stock markets may wobble if an unexpectedly sharp drop in U.S. inflation stokes recession fears.

Wall Street races higher as Fed Chair Powell gives encore performance in testimony.

U.S. CPI inflation data now in focus, core price growth seen holding a three-year low.

Unexpectedly soft figures may sound the alarm on recession risk, worrying stocks.

Wall Street was decidedly happier on the second day of high-profile Congressional testimony from Federal Reserve Chair Jerome Powell than the first. What central bank chief told a committee in the House reiterated the dovish tone shift on display before the Senate yesterday, implying that the start of interest rate cuts is closer on the horizon.

This time, Powell assured lawmakers that inflation does not need to fall below 2% before easing can commence, adding that the tradeoff between the Fed’s inflation and employment mandates has come into closer balance. Put simply, this means that the U.S. central bank is becoming concerned about a painful downturn in the economy.

Stocks gallop on as Fed’s Powell sticks to the script

The bellwether S&P 500 stock index shot upward, hitting a record high. It is trading on pace to close the session up over 0.7% on the day, for what could be the largest one-day rise in close to a month. As it stands, the markets are pricing in 132 basis points (bps) in rate cuts through year-end 2025. The probability of a cut in September is implied at 76.7%.

The Fed’s growing dovish confidence will now be promptly tested with the release the latest update on U.S. inflation.

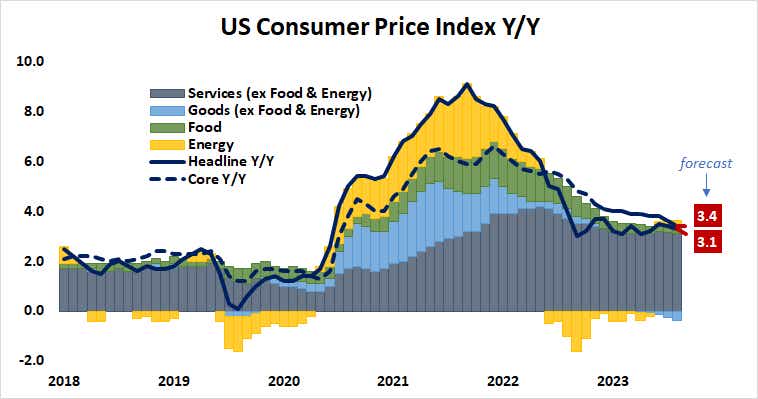

Consumer price index (CPI) data is expected to show headline price growth cooled to 3.1% in June, the slowest in five months. The core measure, which strips out volatile food and energy prices — a focal point for policy officials — is seen holding at 3.4%, unchanged from the three-year low established in May.

U.S. inflation: how low is too low?

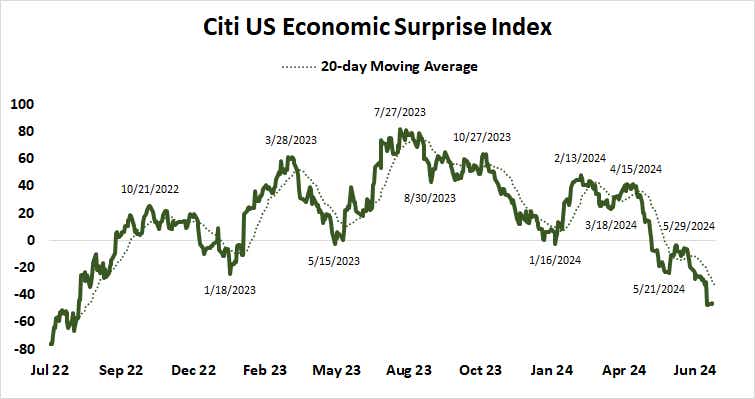

How markets might respond seems likely to depend on whether they underpin benign rate cut speculation or ring the alarm bells about economic growth. Analytics from Citigroup reveal that U.S. data outcomes have increasingly underperformed relative to forecasts for three months, warning of downside surprise risk.

Markets might cheer the prospect of incoming rate cuts, but they are usually less receptive when the easing arrives. That is because some sort of intolerable economic negativity is needed to push the central bank to act. A wide miss that that is potent enough to pull easing forward in time may leave stocks unsettled.

lya Spivak, tastylive head of global macro, has 15 years of experience in trading strategy, and he specializes in identifying thematic moves in currencies, commodities, interest rates and equities. He hosts Macro Money and co-hosts Overtime, Monday-Thursday. @Ilyaspivak

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.