U.S. CPI Preview: Stock Market at Risk Even as Core Inflation Cools

U.S. CPI Preview: Stock Market at Risk Even as Core Inflation Cools

By:Ilya Spivak

Stock markets may not like August U.S. inflation data even as it endorses a pause in Fed interest rate hikes

- Overall U.S. inflation is expected to quicken in August, with oil prices likely to be at fault.

- The Fed may see welcome progress and hold back rate hikes if core CPI ticks lower.

- Stock markets may wobble as service-sector disinflation warns of recession risk.

U.S. inflation data is expected to show mixed signals for a second consecutive month.

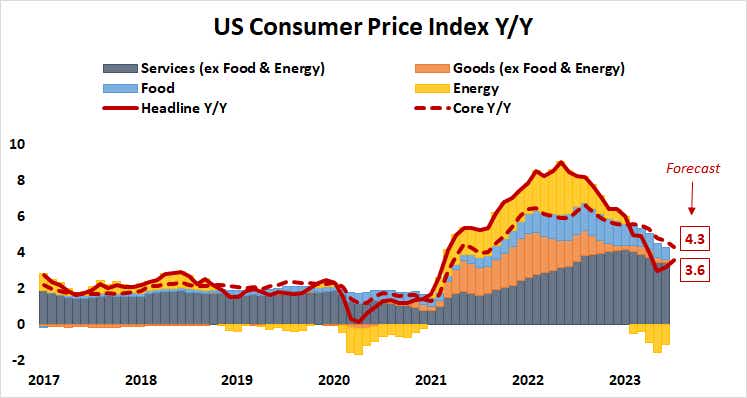

The headline consumer price index (CPI) is expected to quicken to 3.6% year over year in August, up from 3.2% in July after setting a 27-month low of 3.0% in June. By contrast, the core reading excluding often volatile food and energy prices is seen falling for a fifth straight month to print at 4.3%, the lowest since September 2021.

Oil prices probably drove up U.S. inflation in August

Food prices are an unlikely culprit here. Agricultural commodity prices fell last month, and in any case, they’ve been stable in a broad range since July 2022. Energy was likely to blame for the boost in headline CPI. Prices there rose by a hefty 24% in the past three months, with crude oil as the driver. Natural gas has been idle since April.

This raises a key question: if headline inflation prints higher, does that mean the Federal Reserve is more likely to issue another interest rate hike? The answer is probably “no."

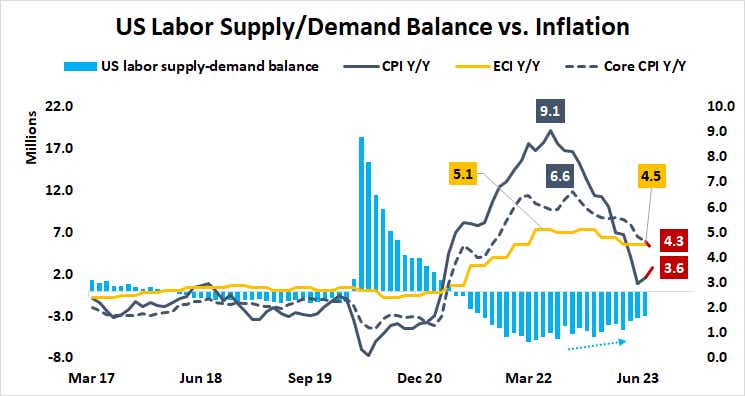

Jerome Powell, chair of the Federal Reserve and other Fed officials have loudly stressed they are focused on so-called “core services” inflation. That's the portion of service-sector price growth excluding housing. This makes sense. While housing is the largest contributor to service-sector inflation, the Fed has relatively little agency to do anything about it in the near term.

That leaves the supply/demand mismatch in the labor market as the main disinflation lever. Cooling growth to trigger a reset of wage agreements—i.e., layoffs—seems to be the plan here. This explains why central bank officials frequently warn about a rise in the jobless rate as the expected cost of getting prices back to the target 2% growth rate.

Stocks may wobble even as the Fed welcomes core disinflation

So, if the core CPI reading ticks down as expected in the August data set, the Fed will be shown continued progress on the metric it most cares about. This probably means policymakers will feel little pressure to hike rates again, for now. However, it would also signal that the screws are tightening on U.S. consumers.

Household consumption is close to 70% of U.S. economic growth, and the North American behemoth is the largest piece of the worldwide total at about 24%. Puncturing labor market strength underpinning resilience here would amount to a potent headwind for global growth at a time when it can ill afford another one. China is in dire straits having failed to find momentum after reopening from COVID lockdowns in December, and the Eurozone is on the doorstep of recession.

To that end, a welcome sign of progress for the Fed may double as evidence of a looming global contraction for investors.

That would bode ill for corporate earnings, and thereby stock markets. Meanwhile, the U.S. dollar may continue to be buoyed as the go-to form of cash amid liquidation. The Japanese yen and gold prices may also rise as haven demand for longer-term Treasury bonds flattens the yield curve, solidifying bets on an easing cycle sometime next year.

Ilya Spivak, tastylive head of global macro, has 15 years of experience in trading strategy, and he specializes in identifying thematic moves in currencies, commodities, interest rates and equities. He hosts Macro Money and co-hosts Overtime, Monday-Thursday. @Ilyaspivak

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.