Stocks and Bonds Quake on Jump in U.S. Inflation Rates

Stocks and Bonds Quake on Jump in U.S. Inflation Rates

S&P 500 up/down +/-2.2% month-to-date

- The August US consumer price index came in hotter than anticipated, at +3.7% y/y on the headline and at +4.3% y/y on the core.

- The Fed’s preferred “supercore” measure – core ex shelter – held steady at +4.1% y/y.

- Equity futures initially fell, as did bonds, following the August US inflation data.

.png?format=pjpg&auto=webp&quality=50&width=1000&disable=upscale)

Asked and answered: Is the fight to tame inflation done? For the Fed, "not yet."

The August U.S. consumer price index (CPI) showed gains of 0.6% month over month and +3.7% year over year on the headline and +0.3% month over month and +4.3% year over year on the core. The headline reading was a touch hotter than anticipated (+3.6% year over year expected), as was the core (+0.2% month over month expected).

How have markets reacted?

The reaction to the data was initially negative, whereby stocks and bonds across the curve initially traded lower. The negativity has been limited, with stocks off their lows and now trading higher (/ES fell from 4465 to as low as 4446.75 but was last seen at 4475.50) and Treasury yields have reversed their gains (/10Y rose from 4.316% to as high as 4.352%, before dropping to 4.292% at the time of writing).

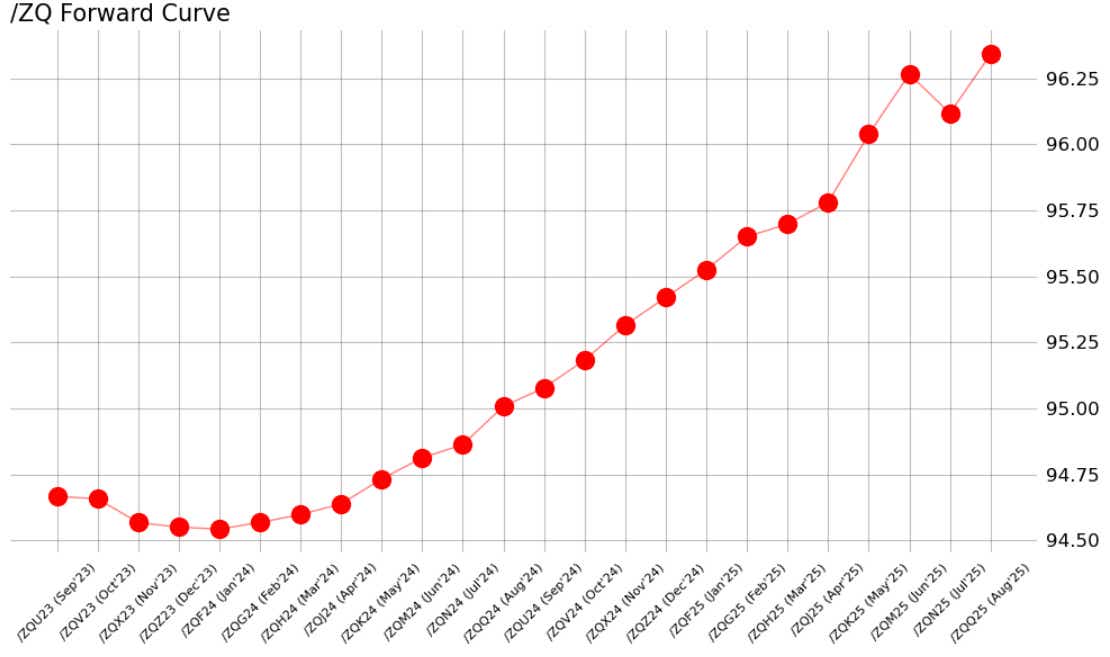

Thus far, the mixed reaction to the report has not done much to shift Fed rate hike expectations in the near-term: yesterday, markets were pricing in an 8% chance of a 25-basis-point rate hike next week. Today, there is a 3% chance, according to Fed funds futures. As for November, the odds of a hike have dropped from 44% to 42%.

/ZQ Fed Funds Futures Forward Curve (September 2023 to December 2025)

What does the Fed do next?

The +3.7% year over year headline inflation is still above the Fed’s medium-term target of +2%—and getting further away from it. Despite uneven U.S. labor data in recent months (nonfarm payrolls have had the tendency to be revised lower in subsequent updates), Fed policymakers remain of the mindset (as Phillips Curve economic theorists) that keep monetary policy in restrictive territory is necessary in the near term.

It remains the case, however, that this may not necessarily mean more rate hikes. It could mean that interest rates stay elevated for a prolonged period. Rising rate cut odds in the first half of 2024 are unlikely to arrive barring a financial crisis or global economic meltdown.

As we’ve noted before, Fed Chair Jerome Powell has said interest rates could remain elevated for “years” – the August US inflation report does not necessarily change that calculus.

Christopher Vecchio, CFA, tastylive’s head of futures and forex, has been trading for nearly 20 years. He has consulted with multinational firms on FX hedging and lectured at Duke Law School on FX derivatives. Vecchio searches for high-convexity opportunities at the crossroads of macroeconomics and global politics. He hosts Futures Power Hour Monday-Friday and Let Me Explain on Tuesdays, and co-hosts Overtime, Monday-Thursday. @cvecchiofx

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.