U.S. Consumers Will Tell Stock Markets if Recession Fears Are Real

U.S. Consumers Will Tell Stock Markets if Recession Fears Are Real

By:Ilya Spivak

Stocks May Struggle if U.S. Consumers Are Gloomy About the Economy

- Wall Street is signaling it’s content with a smaller Fed interest rate cut next week.

- The markets still think the U.S. central bank will move too slowly on growth risks.

- Stocks may struggle to extend higher if U.S. consumers are in a worried mood.

Stock markets have seemingly embraced a slower approach to Federal Reserve interest rate cuts. The priced-in probability that the U.S. central bank will lower borrowing costs by 25 instead of 50 basis points (bps) at next week’s policy meeting stands at 81%, up from 60% a week ago.

The shift followed the release of August’s of U.S. consumer price index (CPI) data. The numbers printed broadly in line with expectations, and core inflation even inched up a hair more than economists anticipated, adding 0.3% from the prior month compared t the 0.2% increase penciled in before the release.

Markets still think the Fed will be too slow on rate cuts

Traders appeared to interpret these results in terms of their implications for the business cycle, reasoning that the absence of an outsized drop in price growth spoke to decent demand dynamics and offered officials enough runway to ease gradually. Nevertheless, worries remain that the Fed will move too slowly to avoid an unwanted downturn.

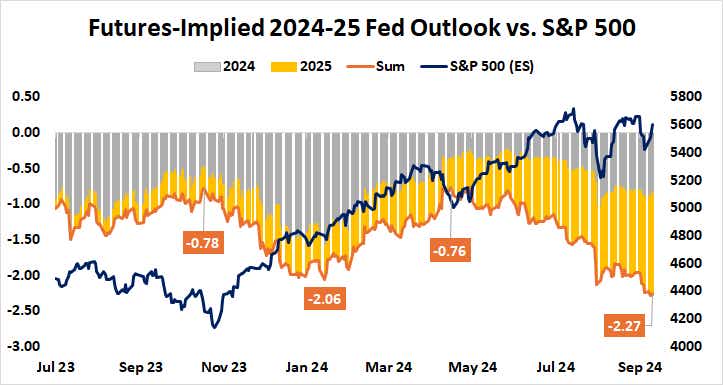

That much is evident in the policy path implied in benchmark Fed Funds interest rate futures. They priced in 104bps in cuts this year amid the market meltdown on Aug. 5, when recession worries hit fever pitch. That tally now stands at 86bps. Meanwhile, the total for 2025 has grown from 105bps to 141bps over the same period.

Put simply, the markets have reduced scope for rate cuts in 2024 by 18bps as last month’s panic ebbed but added twice that (36bps) to the expected stimulus offering for next year. This seems to mean markets anticipate the Fed will have to scramble to catch up having dragged its feet at the onset of the easing cycle.

Stock markets face gut check as U.S. consumers weigh in

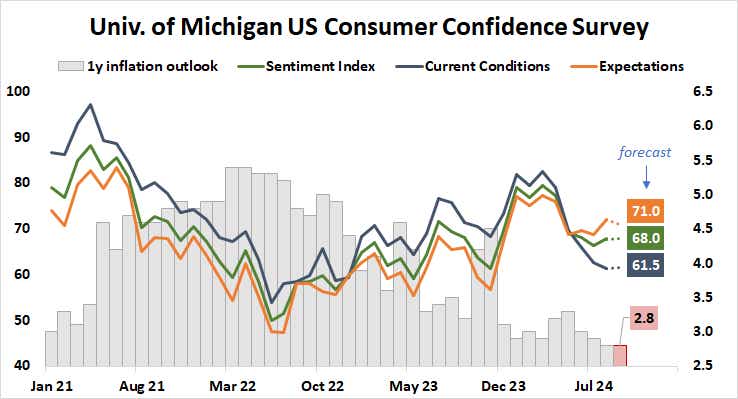

With that in mind, the spotlight now turns to U.S. consumer confidence data from the University of Michigan. The survey is expected to show that respondents’ mood was little changed in September after August marked a modest improvement from July’s eight-month low.

Sentiment was steadily improving as inflation expectations were declining since mid-2022 as the Fed rate hike cycle started in March of that year began to bear fruit. This trend held until June of this year, when lower price growth estimates lost their ability to uplift consumers’ mood.

This is a worrying sign because household consumption is by far the largest contributor to U.S. economic growth. More of the same might remind the markets why the Fed began to worry aloud about labor market weakness in July, bringing growth concerns back to the forefront and putting a lid on Wall Street’s upward progress.

Ilya Spivak, tastylive head of global macro, has 15 years of experience in trading strategy, and he specializes in identifying thematic moves in currencies, commodities, interest rates and equities. He hosts Macro Money and co-hosts Overtime, Monday-Thursday. @Ilyaspivak

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.