Upbeat US Jobs Data May Lift the Dollar as Stocks and Gold Struggle

Upbeat US Jobs Data May Lift the Dollar as Stocks and Gold Struggle

By:Ilya Spivak

Upbeat US employment data that seems to guide the Federal Reserve away from interest rate cuts this year may lift the US Dollar while stocks and gold prices give back some of their recent gains.

- Markets spent May pricing down worries about the US debt ceiling debacle

- Bets on a global economic downturn to drive disinflation now back in focus

- Upbeat NFP data might lift rates and the Dollar as stocks and gold struggle

Markets Spent May Discounting US Debt Ceiling Risk Even as Politicians Squabbled

While US political leaders and the journalists that cover them spent the month of May worrying aloud about the possibility of default absent agreement to raise the federal debt ceiling, financial markets were busy setting up for a benign result. Treasury bond yields rose alongside stocks and the US Dollar while expectations for a swift Fed rate cut cycle in the second half of 2023 fell away.

As May began, Fed Funds futures anticipated nearly 100 basis points (bps) or 1 percent in interest rate cuts by the end of the year. As the calendar turned to June, a mere 25bps of easing remained priced in. Investors seemingly decided that the eventual resolution of the standoff would not amount to anything too disorderly or fiscally restrictive, relieving the Fed of having to rush out offsetting stimulus.

Market dynamics changed as news of a deal between President Joe Biden and House Speaker Kevin McCarthy crossed the wires. A kind of “buy the rumor, sell the fact” response appeared, with traders seemingly looking through the last bit of posturing in Washington, DC to check back in with the bigger picture.

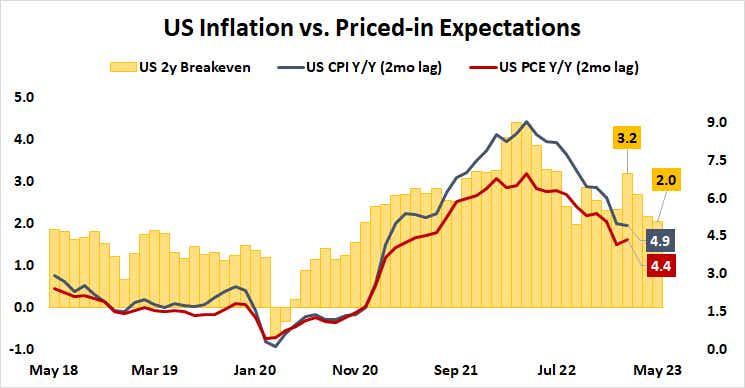

Data source: Bloomberg

They promptly rediscovered inflation hovering just under 5 percent while the two-year “breakeven” rate – the price growth expectation baked into the bond market – stood at 2 percent. Put simply, this setup called for disinflation to continue such that price growth would slow to the Fed’s target over the coming two years. This seemed to demand an economic downturn.

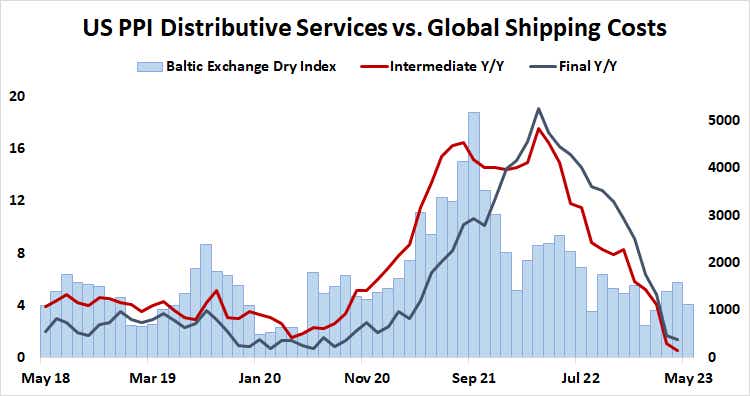

Inflationary pressure from the supply side appeared to have been squeezed out already. The Baltic Dry Index gauge of global shipping costs had long since fallen back to pre-Covid levels. Meanwhile, US PPI data revealed that distributive services costs grew at the slowest pace in at least three years in April. This left weakening demand as the way that price growth could continue to slow.

Data source: Bloomberg

The expected severity of the downturn promptly took over as the central object of speculation. Bond yields and the US Dollar backpedaled, stocks edged higher and gold prices found the strength to push from a two-month low. Heady expectations for a June or July rate hike built up through the first three weeks of May evaporated, leaving behind bets on stand-still until a single 25bps reduction in December.

All Eyes on US Jobs Data as Global Growth Trends Retake Center Stage

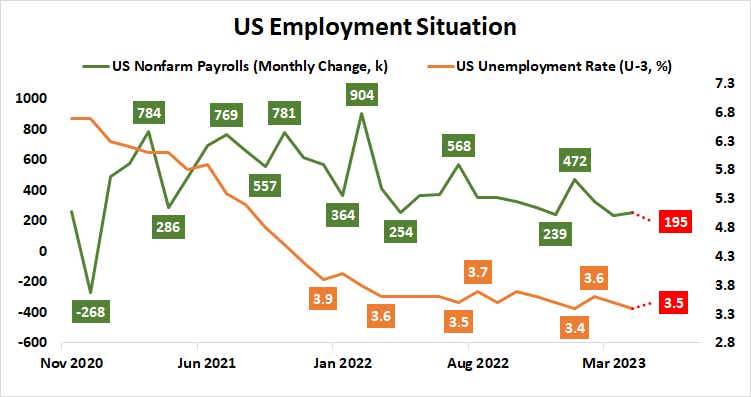

The spotlight has now squarely turned to May’s US employment data. It is expected to show a meager 195,000 rise in nonfarm payrolls, marking the smallest increase since December 2020. The jobless rate is seen edging up to 3.5 percent, putting it squarely in the middle of the narrow year-long range.

Soft data underwhelming these forecasts may add to downward pressure on bond yields and the US Dollar while gold and most G10 FX currencies continue to recover. However, upbeat labor-market cues from JOLTs job openings data and the ISM Manufacturing PMI survey released earlier in the week seem to make room for surprises on the upside. In that scenario, the Greenback will probably aim higher alongside rates while stocks wobble.

Data source: Bloomberg

Ilya Spivak is the Head of Global Macro at tastylive, where he hosts Macro Money every week, Monday-Thursday.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.