Unlocking Trading Opportunities in the Russell 2000

Unlocking Trading Opportunities in the Russell 2000

By:Kai Zeng

The small-cap index remains a great trading vehicle despite muted performance and high volatility

The four most-recognized U.S. equity benchmarks are the S&P 500, Nasdaq, Russell 2000 and Dow Jones Industrial Average. While the Dow Jones is globally renowned, the S&P 500 is favored by traders for its focus on 500 large-cap companies like Costco (COST) and JPMorgan (JPM), offering stability and reliability.

Meanwhile, the Nasdaq 100 is known for its technology-heavy weighting, featuring growth-oriented stocks, such as Tesla (TSLA) and Nvidia (NVDA), attracting traders with its potential for substantial returns.

Now, let's focus on the Russell 2000 Index, a crucial benchmark for U.S. small-cap stocks. This index serves as a comprehensive barometer of the smaller capitalization sector, offering insight into the economic contributions of emerging enterprises often in the early stages of growth.

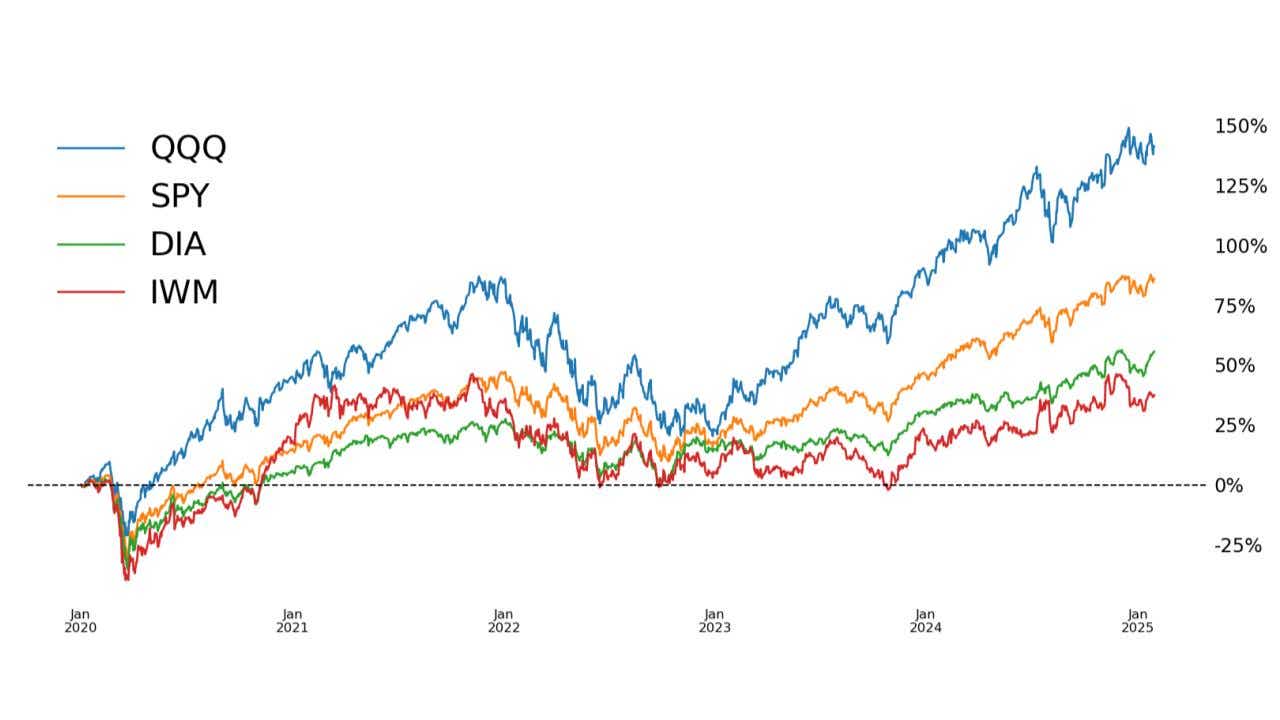

Despite its importance, the Russell 2000 has seen less discussion in recent years as other indices have outperformed it since the COVID-19 pandemic.

This raises the question: Are small companies losing momentum, or is there still an advantage to investing or trading in the Russell?

To explore this, let's consider the characteristics of this small-cap index. The market cap of stocks in the Russell 2000 is significantly smaller than those in other indices. To be included, a stock must have a closing price at or above $1.00 and a total market capitalization of at least $30 million. Currently, stocks in the Russell have market caps ranging from $3.9 billion to $92 billion, with the majority much smaller.

In comparison, the total market cap of the S&P 500 is around $50 trillion, while the Russell 2000 is less than one-tenth of that. For perspective, Microsoft (MSFT) alone has a market value of $3.5 trillion, surpassing the entire Russell 2000 index.

Despite the smaller size of its component companies, the Russell 2000 itself is not insignificant. The IWM, the ETF of the Russell 2000, is the seventh most actively traded equity based on options trading notional value, not far behind the QQQ, the exchange-traded fund (ETF) of the Nasdaq 100. This indicates superior liquidity for traders.

.jpg?format=pjpg&auto=webp&quality=50&width=1280&disable=upscale)

While small caps may have underperformed other indices recently, they have shown better performance over the long run. Over the past 25 years, the IWM has outperformed the SPY 14 times (56%), the QQQ 11 times (44%), and both 10 times (40%). The median annual return for the IWM is 12.5%, surpassing the SPY's 11.2%.

.jpg?format=pjpg&auto=webp&quality=50&width=1280&disable=upscale)

This strong performance suggests investing in the small-cap index can deliver great returns, albeit at different times, making the idea of diversifying portfolios by allocating funds to small-cap companies more appealing.

The Russell index's balanced and diversified nature adds a missing piece to our overall portfolio. For traders, the Russell 2000 presents several compelling opportunities:

- Growth Potential: Small-cap stocks often have significant growth potential, offering substantial upside and diversification benefits.

- Pricing Inefficiencies: Less coverage from analysts and media can lead to pricing inefficiencies, creating opportunities to find undervalued stocks.

- Economic Sensitivity: Small-cap stocks are more sensitive to domestic economic conditions, allowing traders to capitalize on U.S. economic trends.

Some argue small-cap stocks or ETFs have greater volatility, which is true. The long-term median volatility of the Russell index is 7% higher than that of the S&P. However, the Nasdaq is also known for its volatility.

.jpg?format=pjpg&auto=webp&quality=50&width=1280&disable=upscale)

Volatility is a double-edged sword; it represents risks associated with the underlying but also indicates potential opportunities, especially for options traders. Looking at the long term, the IWM has outperformed the SPY in terms of total return.

.jpg?format=pjpg&auto=webp&quality=50&width=1000&disable=upscale)

For options traders, another important indicator is implied volatility. Implied volatility, a leading indicator provided only by the options market, is highly correlated with the volatility familiar to most equity and futures traders, with slight differences. It represents the price level of the underlying's options premium. The higher the implied volatility, the richer the premium—a great opportunity for premium sellers looking for rich and overpriced options to sell.

We can see that the implied volatility of the IWM has consistently traded at a premium compared to other index ETFs.

.jpg?format=pjpg&auto=webp&quality=50&width=1280&disable=upscale)

For example, a strangle with the same probability of profit expiring in 30 days from MicroStrategy (MSTR) (No. 1 in the Russell 2000) can generate $1,520 in premium, which is 20% more expensive than a similar strangle from TSLA (No. 8 in the S&P).

Theoretically, the more expensive stock, TSLA in this case, should have more expensive options prices, all else being equal. However, because of the higher implied volatility in MSTR, selling a similar option strategy can yield more lucrative premiums. Options traders are well aware of this, as TSLA's options premium is already considered high among most large high-tech companies.

So, what about trading IWM options over the long term? How does its long-term performance compare to a buy-and-hold strategy?

Testing a 45-day at-the-money (ATM) put strategy in IWM, each option position was exited at the midpoint of the cycle (roughly 21 days before expiration), and a new position was reentered after closing the old one. Over the past decade, selling puts has outperformed buying and holding the IWM.

.jpg?format=pjpg&auto=webp&quality=50&width=1280&disable=upscale)

Despite the relatively muted performance of the U.S. small-cap index and its high volatility in the past five years, the Russell 2000 remains a great vehicle for both short-term and long-term traders. Short-term traders can benefit from its constant swings within a wider range, while long-term traders, especially options traders, can achieve great returns by collecting rich premiums. Trading the Russell 2000 thus provides exposure to a dynamic market segment, making it an appealing choice for investors seeking growth, diversification and opportunities to capitalize on market inefficiencies.

Kai Zeng, director of the research team and head of Chinese content at tastylive, has 20 years of experience in markets and derivatives trading. He cohosts several live shows, including From Theory to Practice and Building Blocks. @kai_zeng1

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.