Probability of Significant Market Move

Probability of Significant Market Move

By:Kai Zeng

The potential for larger, clustered market moves of the SPX is very real and can offer both risks and opportunities.

- S&P 500 volatility trails the historical average.

- What's the probability of significant market moves in the long run?

- Despite low volatility, traders should remain vigilant.

Historically, the S&P 500 has seen an average daily movement of around ±0.5% in either direction. Yet, current trends have shown a slight dip in this volatility, with movements of 0.44% and 0.34% in the previous month, indicating a quieter phase compared to the long-term average.

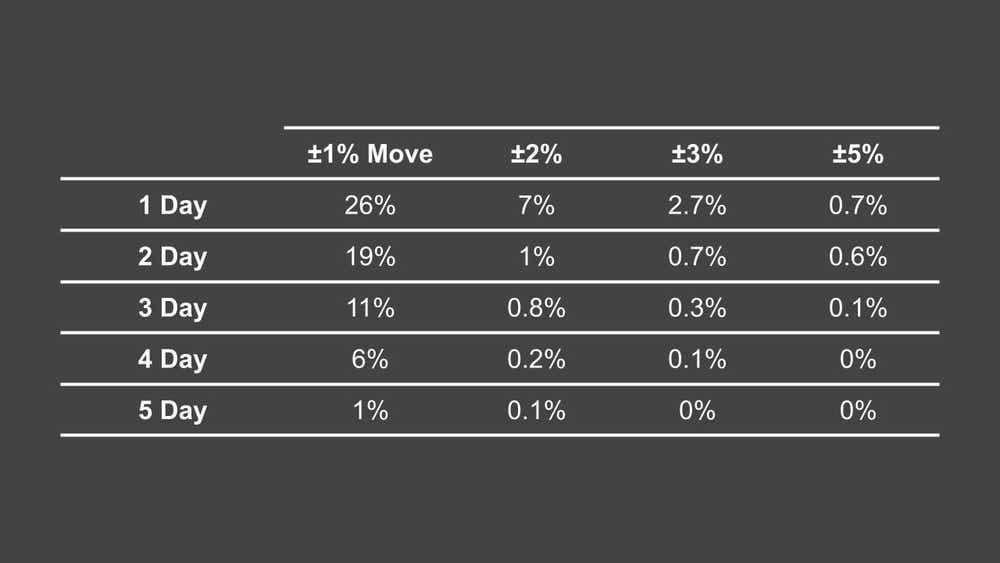

As the concerns about potential risks on the downside continue to grow, we are interested in understanding the probability of significant market moves in the long run. So, we analyzed the probability of SPX having 1%, 2%, 3%, and 5% daily changes within a 5-day trading period over the past two decades.

A 1% move is likely, larger moves are not

The analysis indicates that the likelihood of encountering a daily change of 1% within any given trading week is high. However, the probabilities drop for larger movements. For example, the chance of witnessing daily shifts of 3% to 5% within the same timeframe has been virtually nonexistent.

Don't be complacent

Despite this, traders must remain vigilant. Market behavior is not always straightforward, and extreme movements can persist longer than anticipated. It's essential to understand whether such fluctuations are isolated incidents or part of a broader trend.

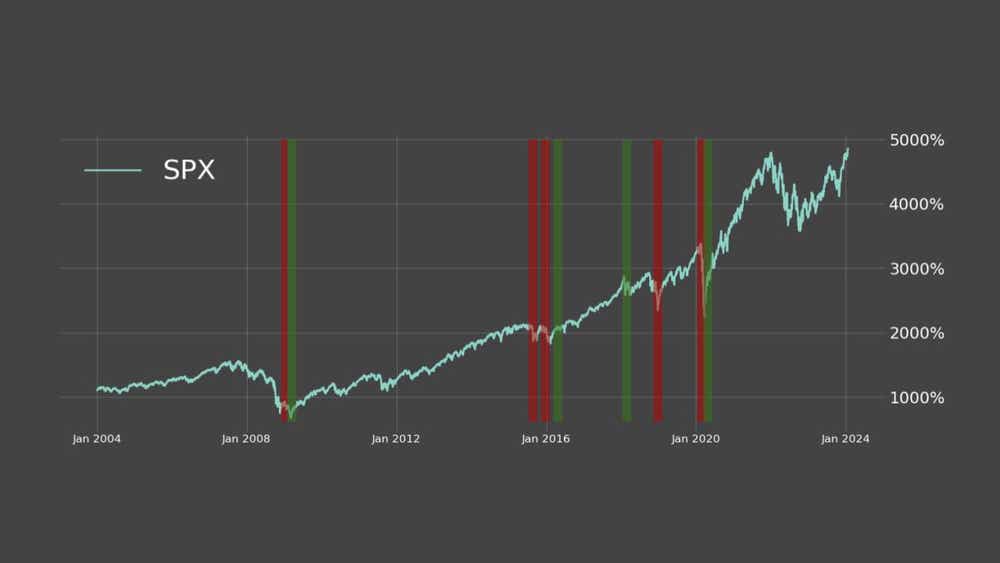

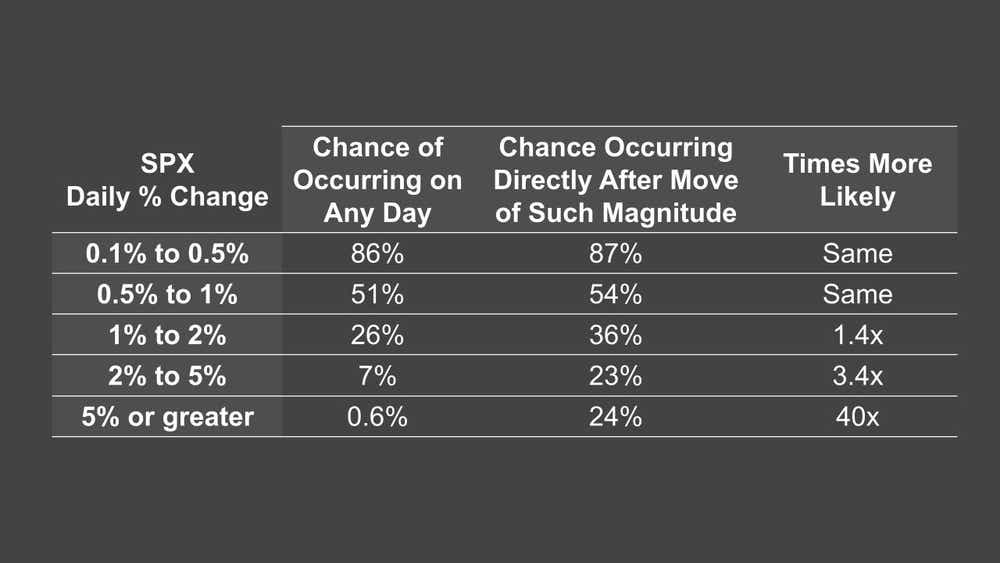

Research shows that daily moves of ±1% or smaller are mostly independent events. This contrasts with the pattern observed for shifts greater than 1%, which tend to cluster, suggesting a momentum effect during certain periods.

A notable insight for traders is the significantly elevated probability of consecutive large market moves. For instance, after a 5% move in the SPX, the chance of a similar move the following day is 40 times greater compared to if these events were purely random. This clustering of volatility can create opportunities for the astute trader who can recognize and act on these patterns.

Subdued activity might not last

For traders, the essential takeaways are: The chance of consecutive significant market moves over 3% is relatively low. Daily market movements under 1% are more likely to be independent events. After an initial move, the likelihood of larger movements over 2% increases in the following days.

In summary, despite the current phase of subdued volatility in the market, traders should remain vigilant. The potential for larger, clustered market moves is very real and can offer both risks and opportunities.

Kai Zeng, director of the research team and head of Chinese content at tastylive, has 20 years of experience in markets and derivatives trading. He cohosts several live shows, including From Theory to Practice and Building Blocks. @kai_zeng1

For live daily programming, market news and commentary, visit tastylive or the YouTube channels #tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.