Bonds Are Chipping Away at Key Support

Bonds Are Chipping Away at Key Support

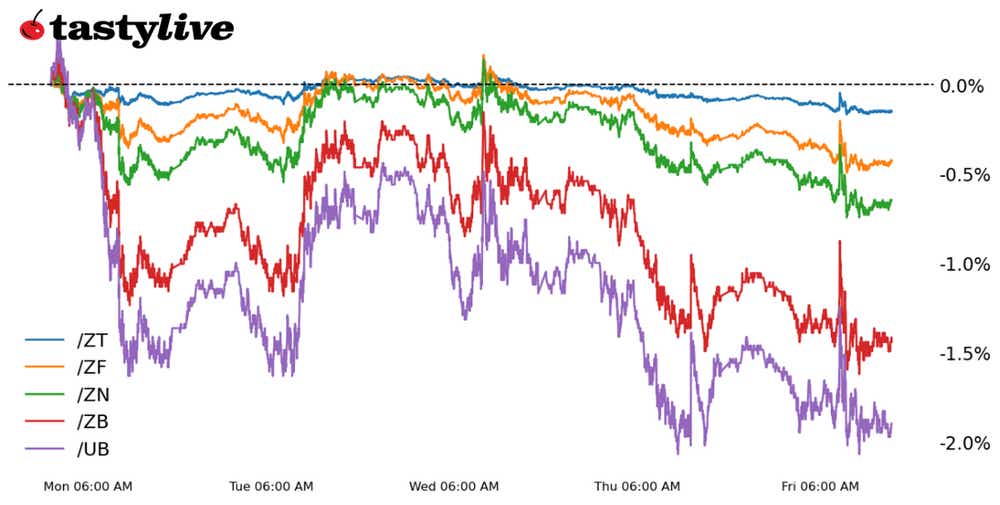

U.S. Treasury notes and bonds are back to or near their lowest levels of 2024 as stocks outperform

- U.S. Treasury notes and bonds are back to or near their lowest levels of 2024.

- Rate cut odds for 2024 have plummeted, with the odds of a 25 basis point rate cut in March down to 17.5% today. Four cuts are fully discounted, with an 80% chance of a fifth cut by the end of the year.

- Bond volatility remains absent despite big swings over the past week.

Market update: U.S. 10-year yield up to 4.177%

Receding concerns around regional banks (sparked by New York Community Bank (NYCB)) and renewed optimism over the trajectory of the U.S. economy have led to a whipsaw start to February for bond markets. The damage is palpable: 2s (/ZTH4), 5s (/ZNH4) and 10s (/ZNH4) are at fresh yearly lows today, having erased all or nearly all of their progress since the start of December.

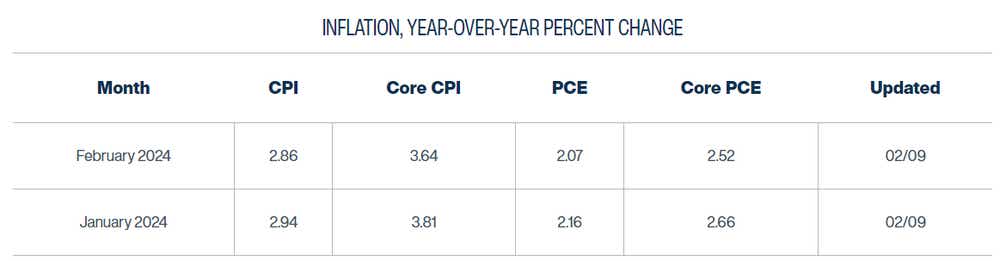

The January U.S. inflation report next week may mark a seminal turning point for bond markets, however. Headline U.S. inflation is expected to fall below 3% year over year(y/y) for the first time since March 2021. Inflation trackers maintained by the various Federal Reserve regional branches suggest the PCE (personal consumption expenditures) Index, the Fed’s preferred gauge of inflation, could fall to 2.1% y/y for February.

The point is, the fight against inflation is nearly wrapped up —the Federal Reserve is just afraid of its own shadow because of its perceived mishandling of the economy during the pandemic. The Federal Open Market Committee (FOMC) does not want to lose the hard-earned credibility it gained over past two years. Rate cuts are coming, but bonds are acting like the first cut will not arrive in March.

There’s another contributing factor to bonds’ underperformance: the outperformance by stocks. Market participants are moving out on the risk spectrum, jettisoning safe havens like bonds, precious metals and low-yielding currencies in favor of equities. This is a perfectly healthy capital rotation that happens in equity bull markets, and it may be one reason bonds have struggled in the face of falling Fed cut odds even while stocks have surged higher.

In a lackluster volatility environment, potential downside breaks in 10s (/ZNH4) and 30s (/ZBH4) can’t be ignored, nor should they necessarily be faded right away. Support may be nearby, but some more choppiness in bond markets may be necessary before bottoming occurs.

/ZN US 10-year Note Price Technical Analysis: Daily Chart (September 2023 to February 2024)

The U.S. 10-year Treasury note (/ZNH4) established a fresh yearly low today, on both an absolute and a closing basis. Support from January has been broken, and momentum remains weak with /ZNH4 below its daily 5-, 13- and 21-EMA (exponential moving average) envelope (which is in bearish sequential order), Slow stochastics trending lower in oversold territory and MACD (moving average convergence/divergence) still trending lower through its signal line.

A break of the current support zone opens the door for a deeper setback toward the late-November swing low/mid-November swing high near 109’20. The continued lack of volatility (IV Index: 6.5%; IV Rank: 8.6) further underscores why bulls need to remain patient and let the charts unfold; there is little rhyme or reason to begin trying to collect premium right now via put spreads or even taking a directionally bullish bet via call spreads.

/ZB US 30-year Bond Price Technical Analysis: Daily Chart (September 2023 to February 2024)

The long end of the curve has been more resilient than the short end or the belly. U.S. Treasury 30-year bonds (/ZBH4) have lost the uptrend from the October 2023, November 2023 and January 2024 swing lows. Momentum has flipped, with /ZBH4 now below its daily 5-, 13- and 21-EMA envelope, which is in bearish sequential order. Note that following the breakdown on Monday, /ZBH4 has been treating the EMA envelope as resistance ever since.

/ZBH4 is now gearing up for another retest of support in the area around 118’09/28, which proved pivotal at the end of November 2023, beginning of December 2023 and end of January 2024. Nevertheless, the lack of volatility in /ZBH4 (IV Index: 12.4%; IV Rank: 13.3) means bond bulls need to exercise patience until price action offers a compelling reason to look long.

Christopher Vecchio, CFA, tastylive’s head of futures and forex, has been trading for nearly 20 years. He has consulted with multinational firms on FX hedging and lectured at Duke Law School on FX derivatives. Vecchio searches for high-convexity opportunities at the crossroads of macroeconomics and global politics. He hosts Futures Power Hour Monday-Friday and Let Me Explain on Tuesdays, and co-hosts Overtime, Monday-Thursday. @cvecchiofx

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.