Taiwan Semiconductor Manufacturing — Can AI Power a Rebound?

Taiwan Semiconductor Manufacturing — Can AI Power a Rebound?

By:Mike Butler

Shares in the tech company are near the low end of the trading range for 2025 because of fear of tariffs

- Taiwan Semiconductor Manufacturing will report quarterly earnings before the market opens on Thursday.

- The company blew earnings-per-share (EPS) estimates out of the water last quarter with a 500%+ surprise.

- Analysts expect it to report EPS of $0.42 on $25.72 billion in revenue.

- For the first three months of 2025, its net revenue MoM is up 41.8% on average.

- Demand for AI continues to climb, and the stock price is near 2025 lows.

Taiwan Semiconductor Manufacturing (TSM) is set to report quarterly earnings this week, and all eyes will be on one of the first AI stocks to report. We're in the beginning of earnings season, and tariff implications are buzzing through every company. For the first three months of 2025, the company has reported month-over-month (MoM) increases in net revenue of 35.9%, 43.1% and 46.5% for an average increase of 41.8% year-over-year (YoY). With all that said, TSM stock is near the low end of the trading range for 2025, with many tech companies affected by fear of tariffs.

TSM will make its earnings announcement before the market opens Thursday, the last trading day of the week because markets will be closed for Good Friday. It’s expected to report an earnings-per-share (EPS) of $0.42 on $25.72 billion in revenue.

TSM’s stock opened 2025 trading at $204 per share and has fallen to $156 per share. It rebounded from the recent low of $134.25 on April 7, which coincides with the broad market sell-off low print for the year.

Based on the Quarterly Management Report released earlier this year, the company relies heavily upon North American customers: “In 2024, revenue from customers based in North America accounted for 70% of total net revenue, while revenue from China, Asia Pacific, Japan and EMEA accounted for 11%, 10%, 5% and 4% of total net revenue respectively."

With such a push for AI technology advances and demand for semiconductors in the United States, we could see TSM continue to perform well in the next few earnings reports even with the threat of tariffs looming.

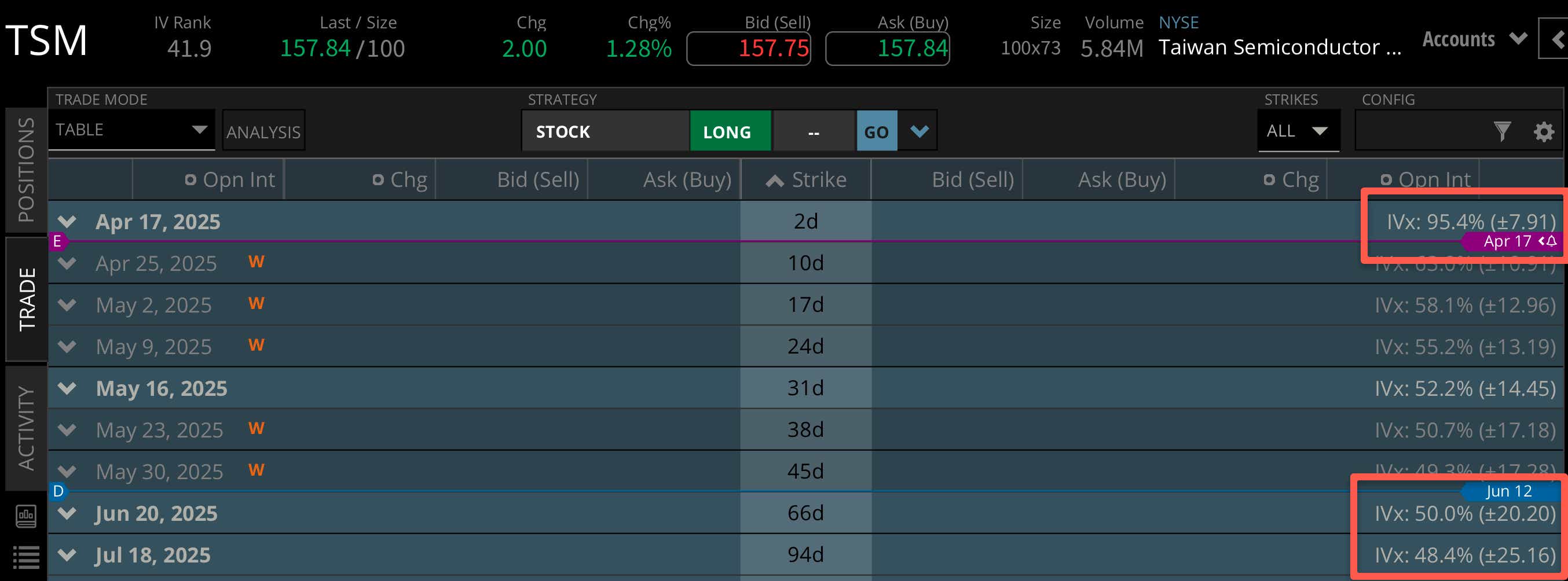

Looking at the implied volatility of the options market can help us put context around the expected stock price move for the TSM earnings announcement, but we can also compare the weekly cycle to further-dated cycles to see just how much weight the market is placing on the earnings report.

For this week, TSM stock has an expected price range of +/- $7.91. This is pretty low for any stock's earnings announcement, as most fall between 5%-10% of the notional value of the stock price. This clocks in at 5%, but having one less trading day this week plays a role in the IV reduction.

Looking further to June and July of this year, we can see a +/- $20.20 and +/- $25.16 expected move respectively. This tells us we should expect plenty of volatility for the next few months because this week's earnings call accounts for only a fraction of the expected move for the next few months.

Bullish on TSM stock for earnings

If you're bullish on TSM Stock for earnings, you loved to see the big EPS beat last quarter, and you're looking for more. The fact that the semiconductor company is continuously exceeding MoM net revenue from last year paints a pretty picture for the company this year. If we see a strong outlook for 2025 and a nice earnings beat on Thursday, we could see the stock rise from lows.

Bearish on TSM stock for earnings

If you're bearish on TSM stock for earnings, you're looking for an EPS or revenue miss and weak guidance through the rest of the year—likely because of potential tariffs. If weak guidance is the story for the earnings conference call, we could see the stock retreat to this year’s lows or worse.

Tune in to Options Trading Concepts Live at 11 a.m. CDT tomorrow for a deeper look at strategies ahead of the early-morning earnings release..

Mike Butler, tastylive director of market intelligence, has been in the markets and trading for a decade. He appears on Options Trading Concepts Live, airing Monday-Friday. @tradermikeyb

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.