TSM Earnings Preview—Stock Price Move of More Than 5% Expected

TSM Earnings Preview—Stock Price Move of More Than 5% Expected

By:Mike Butler

Taiwan Semiconductor Manufacturing is in a race for market share in the AI chip-making business

Taiwan Semiconductor Manufacturing will report earnings on Thursday, before the market opens at 1:00 a.m. CDT.

TSM is expected to report an earnings-per-share of $0.28 on $20.09 billion in revenue.

Both figures are up from last quarter, after beating both estimates then.

3nm & 5nm technology performance will be in focus this earnings quarter

TSM earnings preview

In a race for market share in the artificial intelligence chip-making business, the market cap of Taiwan Semiconductor Manufacturing (TSM) is almost three times that of Advanced Micro Devices (AMD), with TSM stock around $833 billion.

Like most stocks involved in AI, TSM has realized a nice rally so far in 2024, opening the year at $102.25 and currently sitting at $186—up over 80% this year.

The chipmaker beat EPS and revenue estimates last quarter, but the stock price fell.

Wendell Huang, senior vice president and chief financial officer of TS, offered a statement in the last earnings call related to current and forecasted performance: “Our business in the first quarter was impacted by smartphone seasonality, partially offset by continued HPC-related demand ...”

Huang went on to say that “moving into second quarter 2024, we expect our business to be supported by strong demand for our industry-leading 3nm and 5nm technologies, partially offset by continued smartphone seasonality.”

Both of these chips boast powerful performance, and TSM claims on its website that the 3nm process is the industry's most advanced semiconductor technology.

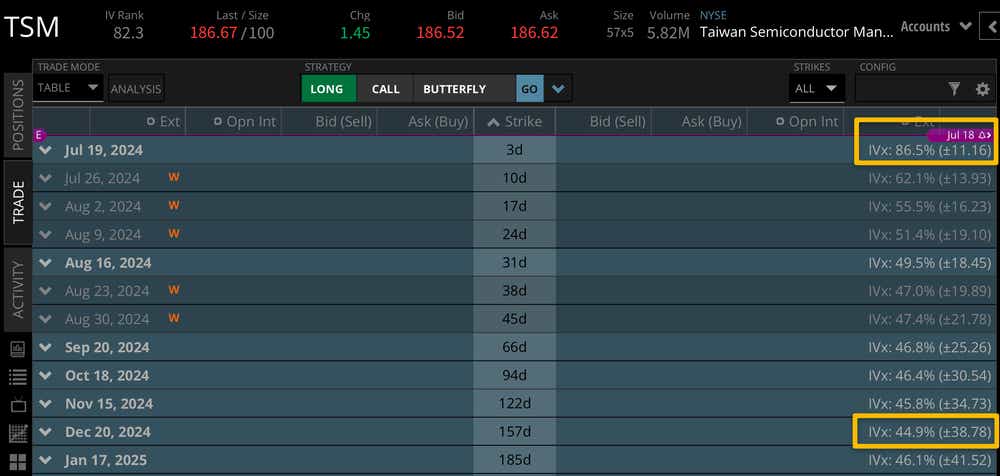

TSM implied volatility is elevated ahead of this week's earnings announcement, with an expected stock price move of +/-$11.16 against the $186 stock price. This puts the earnings expected move just over 5% of the stock price, which falls in the expected range of 5%-10% for most companies.

TSM is expected to report Thursday on an EPS of $0.28 on $20.09 billion in revenue.

Looking further to the December expiration cycle, which has an expected stock price move of +/-$38.78, we can see this earnings announcement accounts for about a third of the expected move through the rest of the year. It will be interesting to see if competitors AMD and Nvidia (NVDA) move if there is a big move in the TSM stock price.

Bullish on TSM stock for earnings

TSMC bulls will want to see robust performance for the quarter, with a strong outlook for the rest of the year as well. It feels abnormal for a stock near all-time highs to keep climbing, but we're just scratching the surface of AI technology and the potential demand for chips. Both EPS and revenue estimates are higher than last quarter, and if TSM can post a strong beat in both categories, we may see the stock continue to rise.

Bearish on TSM stock for earnings

TSM bears may believe the stock has reached the near-term high, with a more popular Nvidia reaching a more digestible price point after the stock split. If TSM misses on EPS or revenue estimates, or if there is weakened guidance for the rest of 2024, we may see some profit taking and a selloff after the announcement.

Tune in to Options Trading Concepts Live on Wednesday at 11 a.m. CDT for an in-depth options trading strategy session for TSM earnings ahead of the announcement!

Mike Butler, tastylive director of market intelligence, has been in the markets and trading for a decade. He appears on Options Trading Concepts Live, airing Monday-Friday. @tradermikeyb

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.