TSLA Earnings Preview: Buckle Up

TSLA Earnings Preview: Buckle Up

By:Mike Butler

Higher revenues underpin beast mode expectations for a $44 trading range

- Tesla reports quarterly earnings on Wednesday, July 19, at 3:05 p.m. CST.

- Earnings per share (EPS) is expected to be $0.82, three cents lower than the previous quarter.

- Revenue is expected to be $24.69 billion, significantly higher than the previous report of $23.33 billion.

- We may get more information on the charging station deal between Tesla GM and Ford.

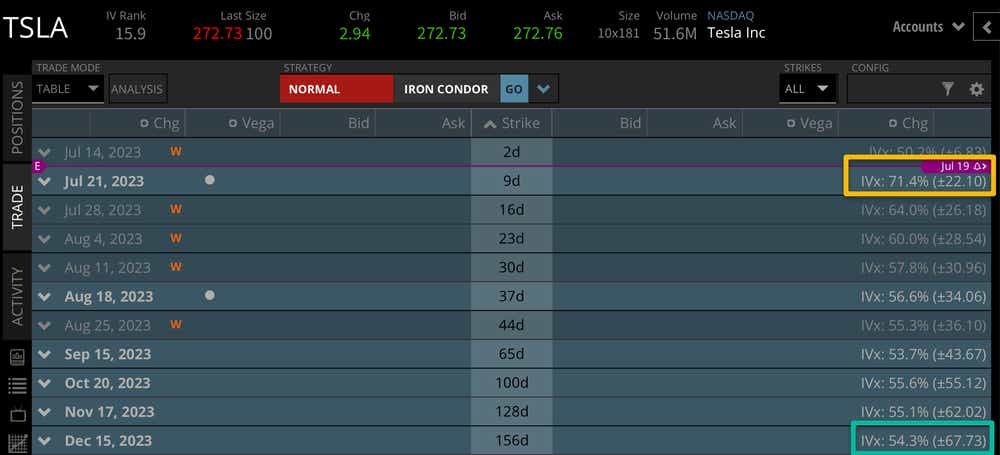

- The stock is expected to have a +/-$22.10 price range based on current implied volatility.

Tesla (TSLA) stock is trading at $273.27, just over $10 off the high point of the year realized on July 3 ($284.25).

The stock has been surging since early May, likely on the back of positive news that General Motors (GM) and Ford (F) would use the Tesla charging stations. That means more revenue for Tesla and more demand for current and future charging stations across the country.

Tesla reports earnings on July 19 at 3:05 p.m. CST and is expected to have an earnings per share (EPS ) of $0.82 on $24.69 billion in revenue.

Tesla implied volatility environment for earnings

With a big rally in the rear-view mirror and a lot of interesting business endeavors in the forecast, Tesla has quite a large, expected move relative to the stock price this earnings season. The expected stock price move through next week is just over +-$22, which is about 8% of the current stock price.

When we compare this weekly expected move to the implied volatility of the December 2023 cycle (+-$67.73) we can see that the market is expecting a lot of information to be processed this earnings season, as the weekly cycle accounts for about a third of the expected move through the rest of the year based on current implied volatility.

Tesla's bullish earnings argument

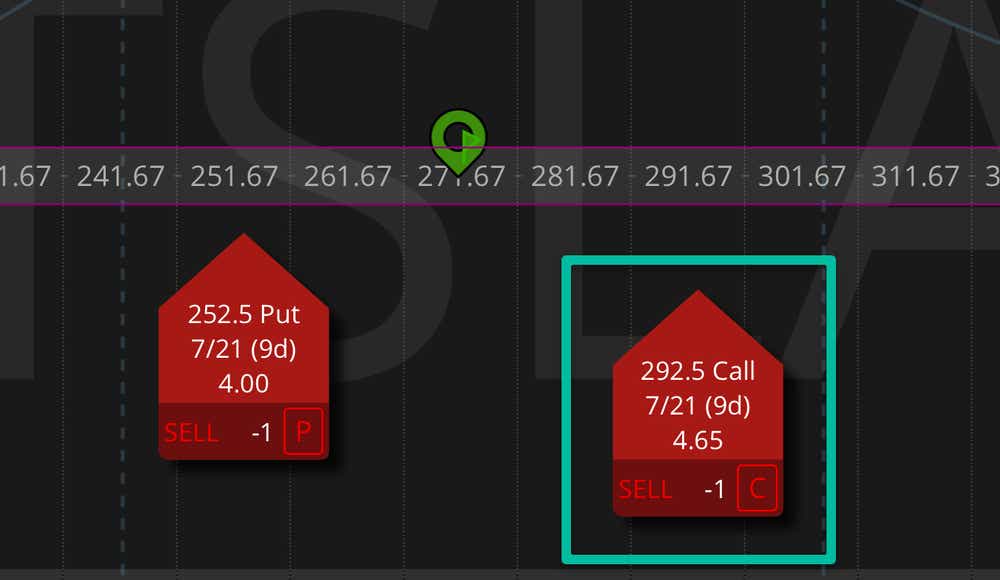

Tesla is one of those stocks that seems to have a cult-like following, and the stock has already realized a massive rally through 2023. When looking at the call skew environment we see in Tesla's weekly cycle, where the call option ($4.65) is trading for a higher extrinsic value premium than the equidistant put option ($4.00), the market is pricing in volatility risk to the upside.

This does not mean Tesla is going to rally after earnings. It does mean that the market perceives the risk of a high velocity move to be to the upside. This sort of price imbalance in short-term cycles is usually the result of strong bullish moves in a quick manner.

Tesla reported strong delivery numbers last quarter, it secured the charging deal with General Motors and Ford, and the EPS estimate is lower than last quarter. So, if the stock beats EPS and revenue estimates and has a strong outlook for the rest of the year, it could rally after earnings.

Tesla's bearish earnings argument

Given that Tesla has rallied to $273.27 from the 2023 low of $101.81, bears may lean on the notion that earnings reports must be strong through the rest of the year for the stock to continue this iron-clad rally.

The electric vehicle has substantial demand, so production hiccups could be magnified in an earnings report or projection through 2023.

The fact that earnings per share figures have dropped significantly from just a few quarters ago could be problematic if Tesla misses at all. That is because the stock is now almost three times more expensive than the low print realized earlier this year.

Overall, it feels like there is a lot of sensitivity around profit margins going forward, even though revenue is expected to increase a healthy amount from the previous quarter's earnings.

We shall see what the Tesla stock earnings digestion looks like on Wednesday, July 19, after the market closes.

Mike Butler, tastylive director of market intelligence, has been in the markets and trading for a decade. He appears on Options Trading Concepts Live, airing Monday-Friday. @tradermikeyb

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.