Election Fallout: DJT Fizzles as Other 'Trump Trade' Stocks Surge

Election Fallout: DJT Fizzles as Other 'Trump Trade' Stocks Surge

The election’s biggest trade has options traders scratching their heads

- Stock in Trump Media & Technology Group was expected to make a big post-election move but instead surprised investors by stalling despite Trump’s decisive victory.

- Options on the stock were priced for a 50% election-week swing, but a “volatility crush” left options buyers disappointed with the stock moving only 6% yesterday.

- The unexpected stability in its price action highlights the unpredictable nature of the Trump trade, with potential implications for the stock’s future direction.

The financial markets reacted with exuberance to President-elect Donald Trump’s decisive win over Vice President Kamala Harris. Yet, unexpectedly, Trump Media & Technology Group (DJT)—the crown jewel of the Trump trade—barely moved. That was particularly surprising for a stock widely viewed as a barometer of Trump’s political fortunes.

The muted reaction from DJT not only caught shareholders off guard but also rippled through the options market, where traders had been betting on extreme volatility. Leading up to the election, DJT’s Nov. 8 weekly options straddle traded at a steep $21.00, implying a 50% move—up or down—would be necessary for straddle buyers to see profits. But DJT closed only 6% higher yesterday, delivering a devastating “volatility crush” in DJT’s options.

This type of rapid decline in volatility—often seen after binary events like earnings reports or Food and Drug Administration decisions—left many option buyers blindsided and bewildered (highlighted below). With the election concluded, the market no longer saw DJT as a high-risk listing, causing options prices to deflate faster than a popped balloon. Mike Butler, tastylive director of market intelligence, described it as the “biggest vol crush I've ever seen across all expirations.”

DJT’s weak post-election move meant buyers banking on a major price swing saw heavy losses. On the other hand, options sellers who had positioned for this type of volatility crush, largely had a field day. Ahead of the election, $115-strike calls expiring on Nov. 15 traded as high as $5.00 per contract—implying DJT would have to surge to $120 by expiration for this contract to have intrinsic value. But DJT barely broke $46 yesterday before slipping all the way back to $35, leaving those $115-strike calls almost certainly worthless. They closed trading at $0.13 per contract.

To illustrate the loss, consider an investor who paid $50,000 for 100 of those $115 calls at $5.00 per contract, only to see the position’s value plummet to $1,300 in a matter of days—akin to driving a new car off the lot and immediately losing 97% of its value. The anticipated binary event simply didn’t materialize, turning DJT’s options market into a financial graveyard for troves of buyers.

Implied volatility in DJT’s December monthly options also cratered—dropping from nearly 275% to under 200%—confirming that the post-election “volatility crush” left many option buyers reeling. On the other hand, those who sold options ahead of the election, especially if they hedged delta-neutral, are likely celebrating their disciplined approach, capitalizing on an unusual opportunity as DJT’s volatility collapsed.

In hindsight, DJT’s post-election calm reminds investors of the risks of binary events. When a big anticipated move doesn’t materialize, options buyers can suffer severe losses, while disciplined sellers often thrive. For DJT, the 2024 election served as a powerful case study in the potential rewards—and risks—of betting on extreme levels of volatility.

Post-election uncertainty and January 2025 options

As the dust settles on Election Day, the big question becomes this: Where will shares of Trump Media & Technology Group (DJT) go from here? The answer may be anyone’s guess because the stock’s path will likely be determined by factors beyond typical market fundamentals.

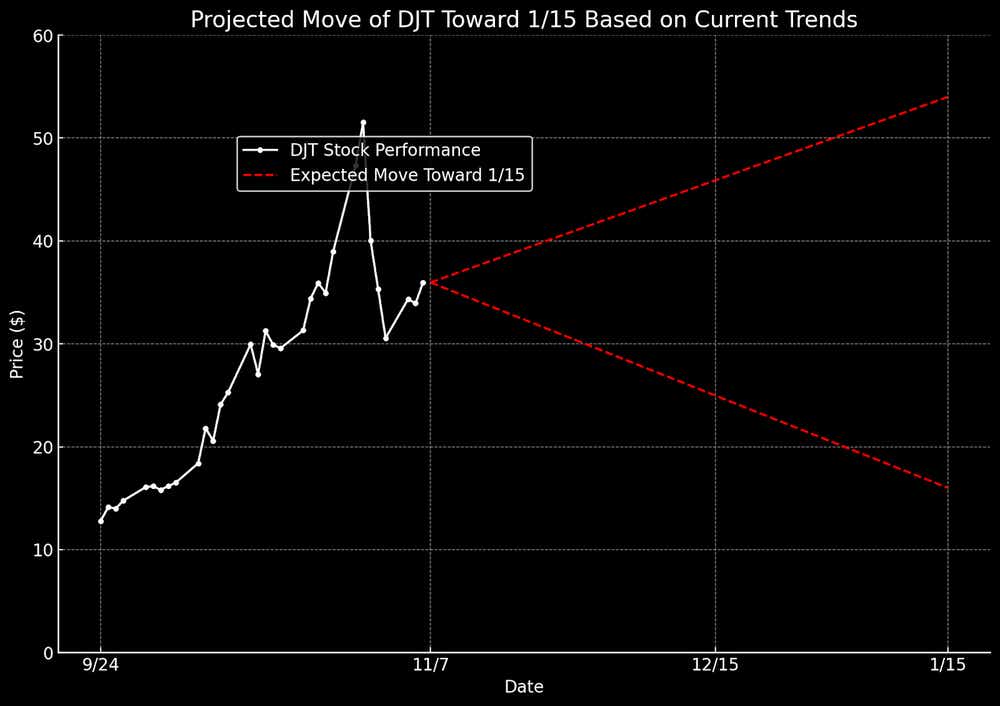

Currently, the monthly options straddle expiring Jan. 17, 2025—just three days before Trump’s inauguration—is trading around $19.50. Considering the two-month time frame and the fact that this straddle is priced only slightly lower than the one for election week, some investors might see it as a relative bargain for volatility. However, with so much time on the clock, predicting DJT's price in January becomes increasingly challenging.

A key factor influencing DJT's future will be whether Trump Media can finally monetize Trump’s election win. Will advertisers, who have previously avoided the platform, now see it as a viable space? And can Trump Media leverage his presidency to attract a broader user base? The answers to these questions may determine whether DJT's stock can hold its current levels or climb higher.

There's also the question of Trump’s involvement. Will he break with presidential tradition and maintain a prominent role in Trump Media, or will he step back from his business interests, as past presidents have done? Although Trump doesn’t manage the company on a daily basis, his majority ownership and influence have remained powerful, adding a layer of complexity to DJT’s future.

What’s clear is that DJT shares will likely remain volatile, but the stock may also start to move closer to its fundamentals. As Trump nears the start of his last term in office, Trump Media needs a clear path for growth and profitability. To become a sustainable business beyond 2028, the company must develop and follow a solid long-term strategy, ensuring it remains a viable entity for years to come, instead of relying on Trump’s political influence.

The upcoming January options expiration reflects this tension: priced high for volatility yet betting on a future that’s uncertain. For DJT, the stakes remain as high as ever, with both traders and long-term investors watching closely to see if Trump Media can capitalize on this new chapter.

Meanwhile, note that some other stocks highly leveraged to the election outcome did respond as anticipated. For example, First Solar (FSLR)—a leading American solar manufacturer and part of the “Harris trade”—dropped 10% in the wake of the election, as investors recalibrated expectations for renewable energy policies under a Trump administration.

Conversely, Tesla (TSLA) surged 15%, reflecting optimism over Trump’s protectionist policies and Musk's close ties with the incoming administration, which many believe could lead to favorable conditions for U.S.-based manufacturing and the broader automotive industry.

Beyond individual stocks like First Solar and Tesla, broader market sectors also reflected the impact of Trump’s victory. Big banks surged, with the Financial Select Sector SPDR Fund (XLF) rising more than 6% on hopes of regulatory easing and a boost from climbing Treasury yields—the latter of which could potentially widen banks’ profit margins on loans. The Russell 2000 index of small-cap stocks also jumped nearly 6%, spurred by expectations of corporate tax cuts and a friendlier environment for small businesses.

Andrew Prochnow has more than 15 years of experience trading the global financial markets, including 10 years as a professional options trader. Andrew is a frequent contributor of Luckbox Magazine.

For live daily programming, market news and commentary, visit ##tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.