DJT: Poised for 50% Binary Move During Election Week

DJT: Poised for 50% Binary Move During Election Week

As election odds shift, Trump Media & Technology Group (DJT) stock captures every twist and turn

- This election cycle, some believe fluctuations in the price of stock in Trump Media and Technology Group (DJT) may provide a real-time indication of Trump’s election prospects.

- With the options market pricing in a 50% move for DJT shares during election week, the stock is set for extreme volatility, offering both risk and opportunity tied to investing in the election outcome.

- The conventional thinking is a Trump victory could propel DJT higher, while a loss could drive shares down to fundamental levels.

Is Donald Trump’s Truth Social somehow worth more money than Elon Musk’s X? That’s what Wall Street seemed to think as recently as the day before yesterday.

Shares in Trump Media & Technology Group (DJT) were selling Tuesday for as much as $54.68, which placed the company’s capitalization at nearly $11 billion. That’s far greater than the $9.4 billion valuation analysts have assigned to Musk’s privately held X Corp., the social network formerly called Twitter.

The price of stock in DJT had climbed nearly 15% Tuesday after soaring nearly 22% on Monday, when trading was halted several times to keep the situation under control. Since late September, the stock had more than quadrupled in value from $12.

But the Bible says all things must pass. DJT stock fell 22% yesterday to close at $40.03. When we checked this morning, it was trading just above that level, around $41/share.

DJT: Strongly tied to Trump's political fortunes

The stock’s red-hot volatility becomes especially interesting when you consider that some believe the price of DJT stock serves as a barometer of the former president’s chances of winning the election.

This year, the stakes extend beyond policy and party lines. Perhaps for the first time, a presidential candidate's personal business interests are actively traded on the stock market, creating a window into how Wall Street perceives the political landscape.

Trump holds a majority stake in the company that bears his name. No modern candidate has maintained such direct control over a publicly traded company, which makes it tempting to view its stock price as a real-time gauge of Trump’s election odds. While past candidates—including Mitt Romney, Michael Bloomberg and Ross Perot—had extensive business backgrounds, they typically moved their financial interests out of direct view, placing assets in blind trusts to avoid conflicts.

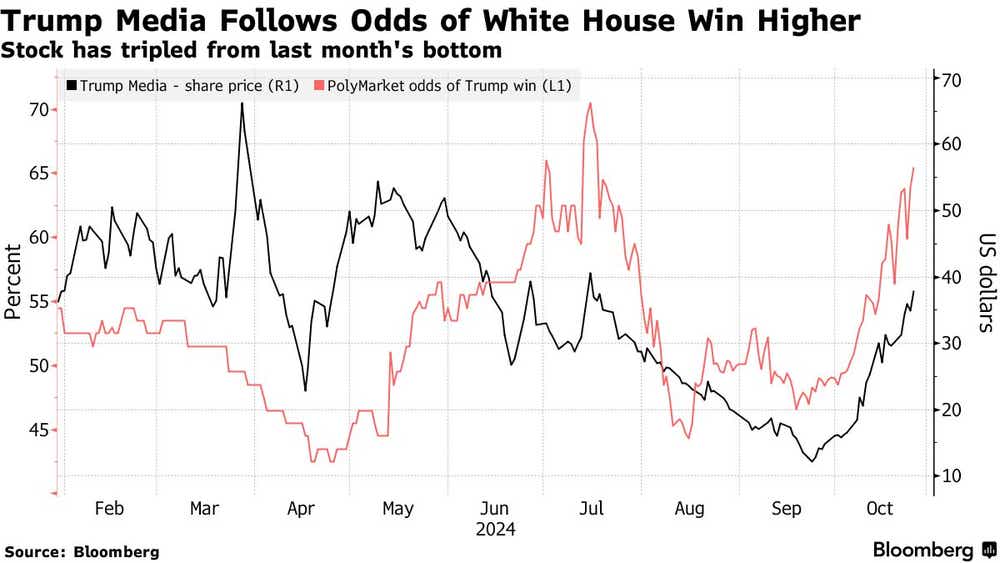

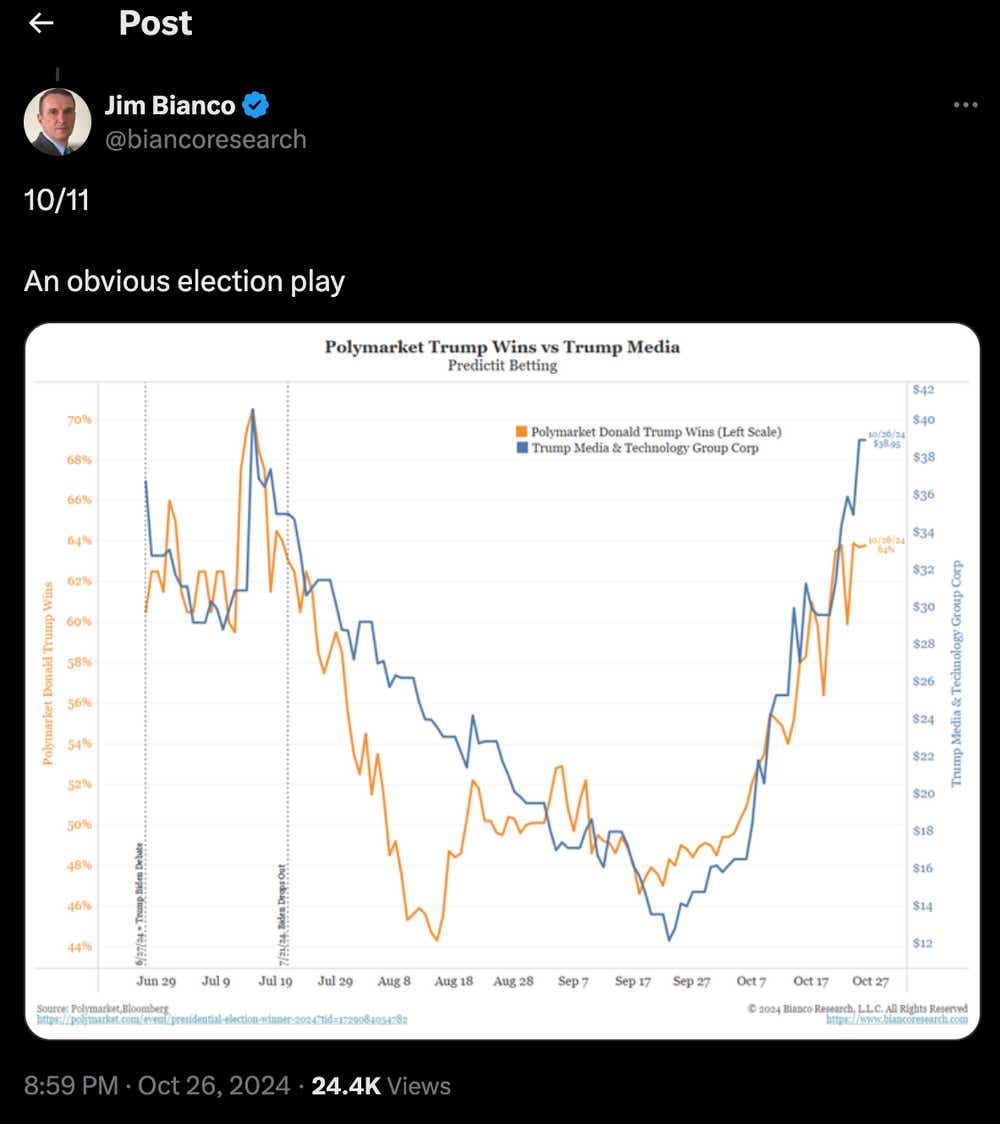

In Trump’s case, however, DJT’s market performance shifts in near lockstep with his political prospects—or at least it did until this week. Until now, it seemed that as DJT’s stock price rose and fell with the ups and downs of Trump's popularity, reflecting public sentiment on his chances to win the election.

Should Trump clinch victory on Nov. 5, it’s widely expected Trump Media could surge, potentially driving new users to Truth Social, boosting ad revenue and further intertwining his public persona with his media ventures.

But a loss could cast Trump Media adrift in a sea of uncertainty. Interest in his online and media presence might wane, growth in the number of customers on Truth Social could slow and Trump Media’s financial performance might face increasing pressure.

That creates a scenario in which DJT shares, as an extension of Trump’s personal brand, act as a barometer for the election itself—reflecting the market’s interpretation of his political fortunes in real-time and offering investors a fascinating view of the election from Wall Street’s perspective.

DJT: Poised for a 50% move during election week

Based on recent volatility in the stock, DJT shares may or may not continue to mirror trends in the betting markets. Earlier in the cycle, when President Joe Biden was still in the race, DJT surged to nearly $80 per share, buoyed by the anticipation of a Trump vs. Biden rematch. But following Biden’s withdrawal, DJT began a steady decline, reaching a low of around $12/share in September.

Since then, DJT has rebounded, now trading around $40 per share—a jaw-dropping 233% increase from its 52-week low, though the stock is still about 50% below its peak of $79. These levels, viewed as potential support and resistance ($12 and $79), have taken on new significance as Trump’s favorability in election-focused gambling markets has increased, with many bettors now seeing him as the favored candidate (illustrated below).

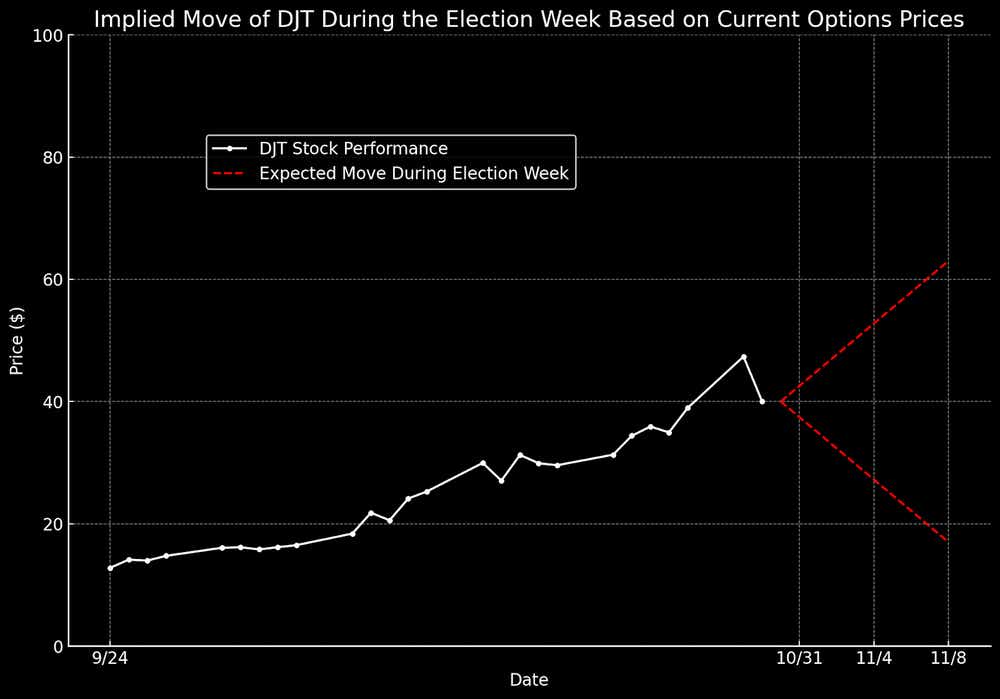

However, the underlying stock isn’t the only gauge of investor sentiment regarding Trump Media. The options market, often used by investors to express more nuanced market outlooks, reveals just how high the stakes have become. Weekly options expiring on Nov. 8—capturing the entirety of election week—suggest DJT will stage an incredible move.

Currently, the at-the-money $40-strike call and put for the Nov. 8 weekly expiration are trading at approximately $10.40 and $10.60, respectively, totaling $21.00. This total represents the cost of the at-the-money DJT straddle for the week of Nov. 4 through Nov. 8, indicating the market expects DJT to move by +/- $21 per share, or roughly 52%, from now through the end of the election week (percentage calculated by dividing $21 by the current stock price of $40).

Note that if the options had a long time until expiration, one might instead calculate the expected move using this equation: (Stock Price) x (Implied Volatility/100) x [square root (DTE/365)] = Expected Move. But with the election less than a week away, it’s more appropriate to estimate the breakeven points and expected move using the full cash value of the straddle.

DJT: The election represents a binary event

The term “binary event” is often used to describe situations like this in the options market, where a single, pivotal outcome—such as an election—can have outsized influence on a stock. These events are common in the biotech and pharma sectors, where they’re typically tied to high-stakes Food and Drug Administration approvals, but they’re rare for media companies and rarer still in politics.

In terms of profit and loss, the mechanics seem straightforward. For a trader purchasing the DJT straddle at $21.00, the stock would have to move more than $21.00 in either direction for a profit to materialize. On the other hand, an investor selling the straddle at the sam vely straightforward: Roughly $19.00/share on the downside ($40 - $21 = $19) and $61.00/share on the upside ($40 + $21 = $61), as illustrated below.

There’s no guarantee DJT will perform exactly as the options market projects. The stock could swing well beyond what’s implied by the straddle—or move far less than expected. In an extreme scenario, for example, key support and resistance levels could be tested, potentially pushing DJT below $12/share, or above $80/share.

Illustrating the potential for an extreme scenario, the $115-strike options that expire Nov. 15 are trading for about $1.40 per contract. At that price, shares of DJT would have to trade above $116.40/share before expiration for the $115-strike calls to turn a profit—at least in terms of intrinsic value.

Takeaways

The 2024 election offers an unprecedented view of how political outcomes can drive market sentiment. Throughout the year, DJT shares have often mirrored Trump’s polling, reflecting investor optimism or caution as his odds fluctuate. This alignment has created unusual opportunities for investors betting on volatility, with the options market now pricing in a 50%+ swing for DJT shares during election week.

As a binary event, the election places DJT in territory more commonly associated with biotech stocks awaiting FDA decisions, where outcomes can trigger significant gains or losses. A clear Trump victory could propel DJT shares beyond $60 and possibly toward $100 as post-election enthusiasm fuels demand. Conversely, a loss could see DJT dip below $12, with investors reevaluating Trump Media’s longer-term viability. For those tracking the intersection of politics and the market, DJT serves as a vivid, high-stakes barometer of Wall Street’s view of the election.

Beyond DJT itself, a Trump victory could also boost the energy sector, benefiting fossil fuel companies likely to thrive under favorable policies. Meanwhile, First Solar (FSLR) presents a contrasting angle, providing a potential vehicle for traders aligned with Kamala Harris’s prospects. First Solar surged to $255 per share after her strong debate performance but has since fallen to around $200/share, demonstrating the fickle nature of policy-sensitive stocks.

In sum, the 2024 election represents a unique blend of political sentiment and market strategy, with DJT offering the idea of a real-time gauge of Trump’s electoral fortunes. Beyond DJT, the election’s broader implications also resonate across sectors sensitive to policy shifts, highlighting how political dynamics can influence investment opportunities. For those looking to engage at this intersection of politics and market potential, stocks like DJT and First Solar stand out as feasible candidates.

Editor’s Note: Options trading entails substantial risk, particularly during periods of extreme volatility. Sudden price swings in short options positions can lead to outsized losses. Investors should understand and accept these risks before engaging in high-volatility trades because sudden market movements can amplify potential gains and losses. Options trading may not be suitable for all investors.

Andrew Prochnow has more than 15 years of experience trading the global financial markets, including 10 years as a professional options trader. Andrew is a frequent contributor of Luckbox Magazine.

For live daily programming, market news and commentary, visit #tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.