Euro in Trouble if the ECB Races Past the Fed on Rate Cuts

Euro in Trouble if the ECB Races Past the Fed on Rate Cuts

By:Ilya Spivak

The euro may fall against the U.S. dollar if ECB rate cuts outpace the Fed

Stock markets are embracing a 25bps Fed interest rate cut after receiving in-line U.S. CPI data.

The ECB rate decision is now in focus, which may mark a dovish turn.

The euro might fall as yield differentials shift to favor the U.S. dollar.

Wall Street has found a way to embrace a slower pace downward for U.S. interest rates after August’s consumer price index (CPI) data came across the wires broadly in line with expectations.

Headline price growth slowed to 2.5% year-on-year, which was a touch lower than the 2.6% median forecast. The core reading excluding volatile food and energy prices—the focal point for Federal Reserve officials—held at 3.2% for a second consecutive month, just as economists projected.

Stocks embrace slower Fed rate cuts after CPI data

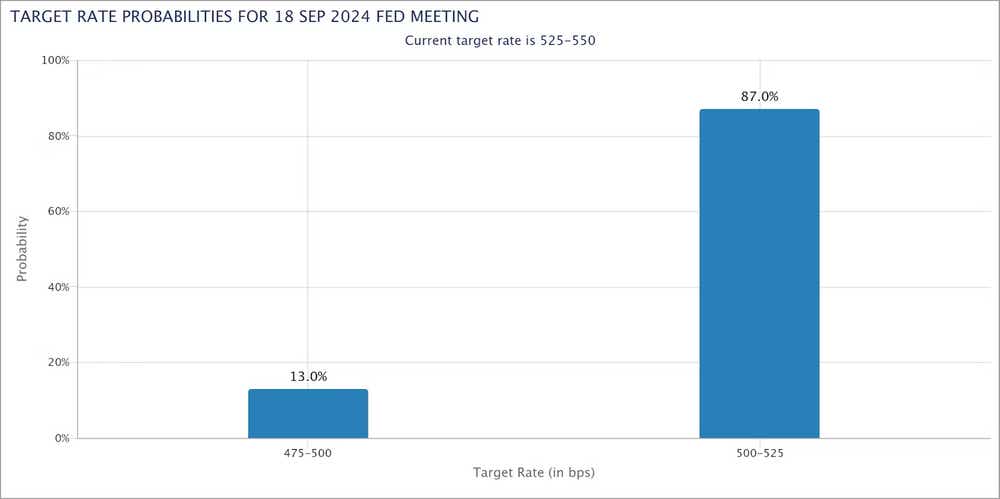

Stocks dropped at first, which may have reflected initial disappointment with an outcome that seemed to leave ambiguity about Fed rate cut intentions broadly in place. But they promptly steadied and priced in the probability of a 25-basis-point (bps) rate cut at next week’s Federal Open Market Committee (FOMC) policy meeting. That probability rose to 87%, from 66% yesterday and 56% a week ago.

A rate cut at this month’s gathering of the policy-steering FOMC is not controversial. The markets have assigned that outcome a 100% probability for weeks. The object of speculation has been the size of the move.

With that in mind, price action in the wake of the CPI report suggests the markets have decided to embrace the idea that a jumbo 50bps rate cut is unlikely. Last week showed them skittish amid concern that Fed action will be too slow to avoid an unwelcome economic slowdown. Now, those worries seem to have diminished.

Time will tell whether stocks find room for upside follow-through before next week’s Fed announcement. Currency markets might get their bearings sooner as a solidifying outlook for the U.S. rates path contrasts with next steps from the European Central Bank (ECB).

Euro in danger if the ECB dials up dovish signaling

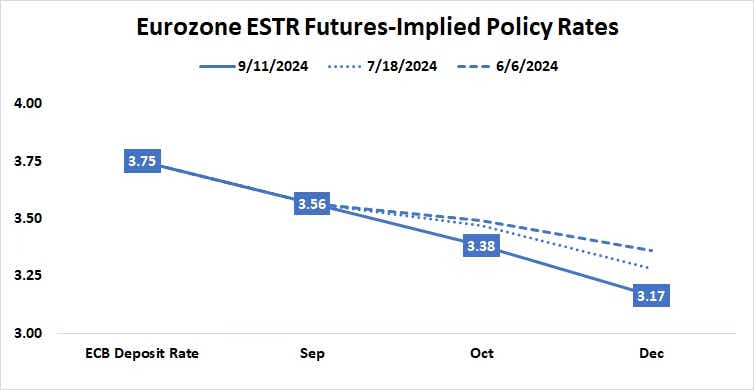

ECB President Christine Lagarde and company are broadly expected to issue another interest rate cut this week. The probability of a 25bps reduction is priced in at a confident 76%. Benchmark ESTR interest rate futures imply 58bps in easing through the end of the year, meaning at least two standard-sized reductions and 32% probability of a third.

Recent comments from ECB officials hinted a 50bps cut may be on the table, perhaps even this month. Current market pricing appears to make light of such an outturn, even if the ECB opts against big-splash action this month yet signals it’s likelier in October or December than currently expected.

The euro is likely to lose ground against the U.S. dollar if the central bank’s Governing Council signals as much, striking a contrast with the markets’ newly minted confidence in a gradualist Fed. An especially sharp adjustment lower may be in the cards if they choose to pull the trigger this go-around.

Ilya Spivak, tastylive head of global macro, has 15 years of experience in trading strategy, and he specializes in identifying thematic moves in currencies, commodities, interest rates and equities. He hosts Macro Money and co-hosts Overtime, Monday-Thursday. @Ilyaspivak

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.