How to Trade a Yentervention

How to Trade a Yentervention

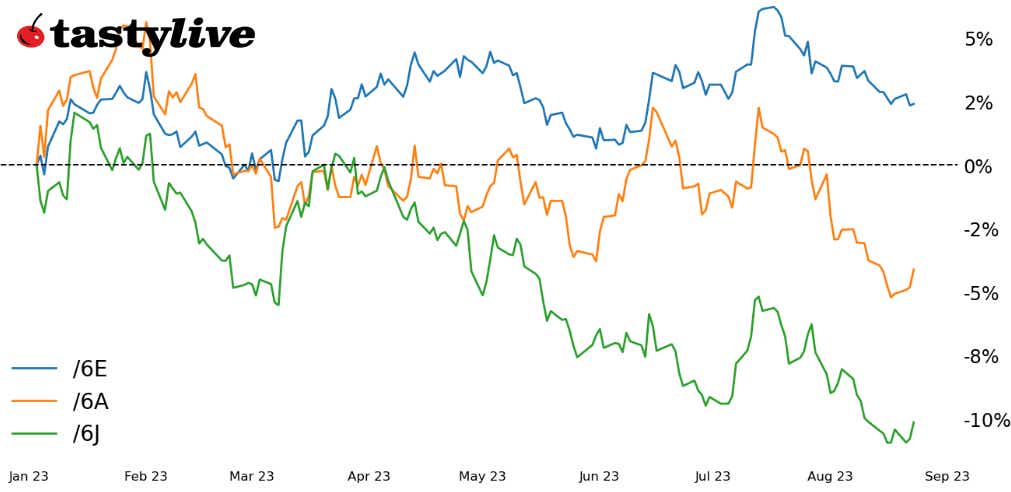

The Japanese yen (/6J) is down -2.14% month-to-date. Looking for a trade idea? Read on.

- The Japanese yen has weakened considerably in recent weeks, back to levels in November 2022 that prompted intervention by the Japanese Ministry of Finance.

- Getting long USD/JPY spot rates or short /6J may be akin to picking up pennies in front of a steamroller.

- Eroding confidence in global growth, particularly around China and the Eurozone, make short AUD/JPY (long /6J, short /6A) and short EUR/JPY (long /6J, short /6E) more appealing.

Shorting the Japanese yen has been a popular trade for many months now, dating back to early 2022.

Rising commodity prices undermine Japanese terms of trade, which in turn erodes purchasing power for Japanese businesses and consumers.

The Bank of Japan’s ultra-loose monetary policy, backstopped by quantitative and qualitative easing with yield curve control (or QQE with YCC, for short), has meant that the yen has been at a significant disadvantage to its peers in a world of rising interest rates in the United States, Europe, and elsewhere.

/6J Japanese yen technical analysis

The declines in the yen in 2023, particularly USD/JPY spot rates or /6J, have become so severe that we now find ourselves trading right around the November 2022 level that led to the Japanese Ministry of Finance intervening to halt the yen decline.

While yield differentials cater to continuing to short the Japanese yen, having arrived at the prior intervention levels, attempting to trade long USD/JPY spot rates or short /6J may be akin to picking up pennies in front of a steamroller.

There may be two ways, however, to take advantage of a yen intervention–a yetervention, if you will.

Growth concerns are escalating in Europe, as the latest batch of PMI figures show; a recession has arrived in the Eurozone and will continue to get worse over the next few months. This leaves the European Central Bank in a lurch, facing down stagflationary conditions at present time (even though disinflation, if not outright deflation is beginning to show up in the data). Weakness in EUR/USD spot rates and /6E is apparent, even though it hasn’t showed up in EUR/JPY spot rates or a long /6J, short /6E pair trade yet.

If Chinese property market debt issues are accelerating–and they are–then China-proxies will likely remain under pressure as well. The poster child for a China proxy in markets is the Australian dollar, and /6A has reflected the dour sentiment, no doubt. But thanks to yen weakness, AUD/JPY spot rates haven’t moved all that much since early June.

Christopher Vecchio, CFA, tastylive’s head of futures and forex, has been trading for nearly 20 years. He has consulted with multinational firms on FX hedging and lectured at Duke Law School on FX derivatives. Vecchio searches for high-convexity opportunities at the crossroads of macroeconomics and global politics. He hosts Futures Power Hour Monday-Friday and Let Me Explain on Tuesdays, and co-hosts Overtime, Monday-Thursday. @cvecchiofx

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.