Selling Premium in TLT

Selling Premium in TLT

By:Kai Zeng

Establishing positions when implied volatility is higher can boost overall performance

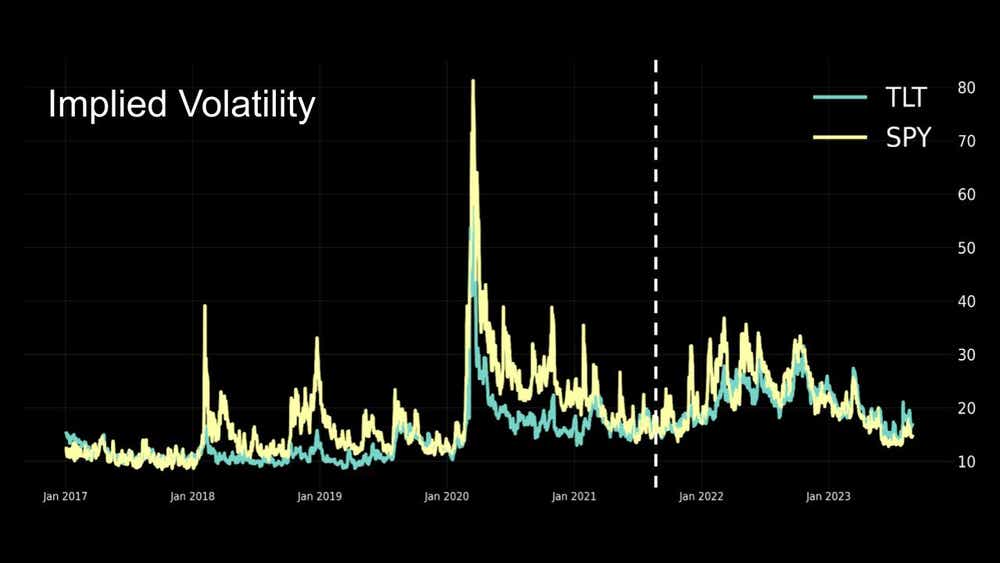

TLT, a 20+ year Treasury bond ETF, was traditionally less favored by option sellers due to its lower options premium, reflected in its implied volatility. Conversely, the most traded ETF, SPY, known as the fear index “VIX,” has a higher implied volatility, despite being relatively low compared to other equities and ETFs like Apple (AAPL) or Tesla (TSLA).

However, the upheaval of the pandemic and subsequent economic adjustments altered this trend. The Federal Reserve's swift decision to cap inflation by raising interest rates gave TLT’s implied volatility an unexpected surge.

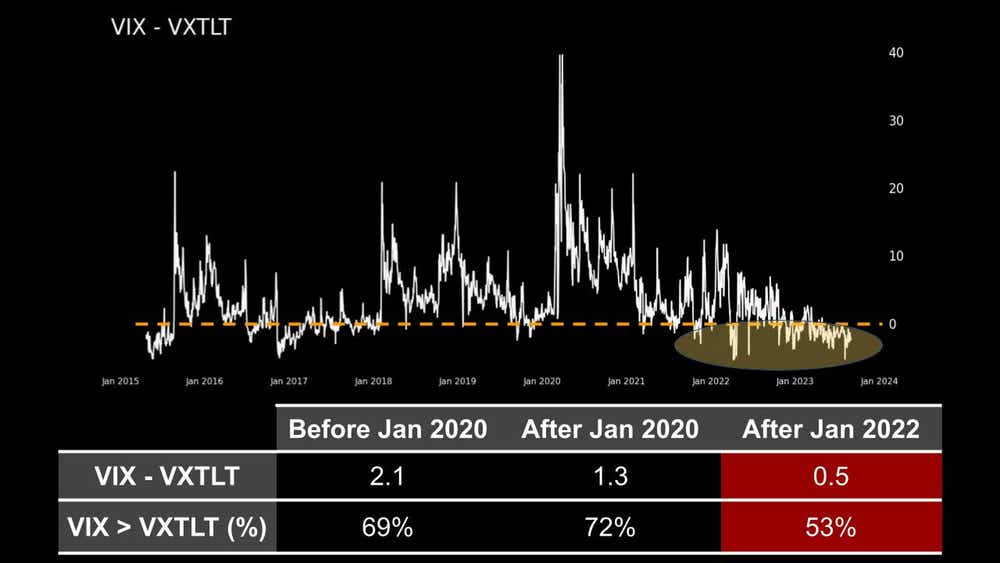

Before January 2020, the spread between VIX (SPY’s IV) and VXTLT (TLT’s IV) averaged at 2.1%. This discrepancy began to diminish with the onset of the pandemic. By 2022, when the Fed began increasing interest rates, it had narrowed to half a point. Furthermore, the percentage of days when VIX exceeded VXTLT approached 50%, indicating that nearly half of the time, VXTLT was higher than VIX.

Now, the question arises: Is selling premium in TLT profitable now when the IV is higher? Can we anticipate better performance than in a lower IV market? To investigate this, we conducted a study, analyzing 45 DTE 16 delta SPY and TLT Strangles. These positions were managed in three ways: held until expiration, managed at a 50%-win rate, and exited at 21 days to expiration (DTE).

Before 2020, the performances were unimpressive due to the lower premium. While the success rates were commendable, the low-IV markets did not yield substantial profits. However, post-2020 results improved with higher IV, with management at 21 DTE proving to be the most effective strategy.

Compared to other indices like SPY, the profit from the 16 delta TLT strangle was lower. To address this, we conducted another analysis, increasing the risk and the premium by opting for higher deltas like 40. As expected, the success rates were lower for higher delta positions, regardless of management strategy.

However, with effective management, specifically 21 DTE, the success rate was not much lower than that of 16 delta strangles. This is impressive considering the breakeven points are significantly tighter when using 40 delta options. The overall performance remained satisfactory with significantly better P/L, especially when selling the same strategy in a higher IV market post-2020.

In light of these findings, it's clear that traders should not overlook selling premium in TLT, despite its lower implied volatility. Entering positions when the IV is higher can boost overall performance. Regardless of the level of IV or the chosen strategy, managing at 21 DTE can help maintain the success rate and increase overall profits.

In conclusion, the trading landscape is dynamic and constantly evolving. Traders must adapt their strategies to these shifts. Despite its historical underperformance, TLT has shown potential for profitability. By adjusting strategies and managing risk effectively, traders can harness these changes to their advantage.

Kai Zeng, director of the research team and head of Chinese content at tastylive, has 20 years of experience in markets and derivatives trading. He cohosts several live shows, including From Theory to Practice and Building Blocks. @kai_zeng1

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.