Trading the Nasdaq Rebalance

Trading the Nasdaq Rebalance

Here are the new weightings for Nvidia, Microsoft, Tesla, Alphabet, Apple and more

- This is a "special" rebalancing.

- No additions or removals from the index.

- The rebalance puts the top five stocks down to a weighting of 36.6%.

The Nasdaq released the pro forma filing for the Nasdaq rebalance set to go into effect as of Monday, July 24.

Normal rebalancing happens on a quarterly basis—at the end of March, June, September and December. Nasdaq is doing this “special” rebalancing to address over-concentration of the index and redistribute weighting across the index. The rebalancing will not include any additions or removals from the index, it will just adjust the overall weighting of some of the components.

How will the Nasdaq change?

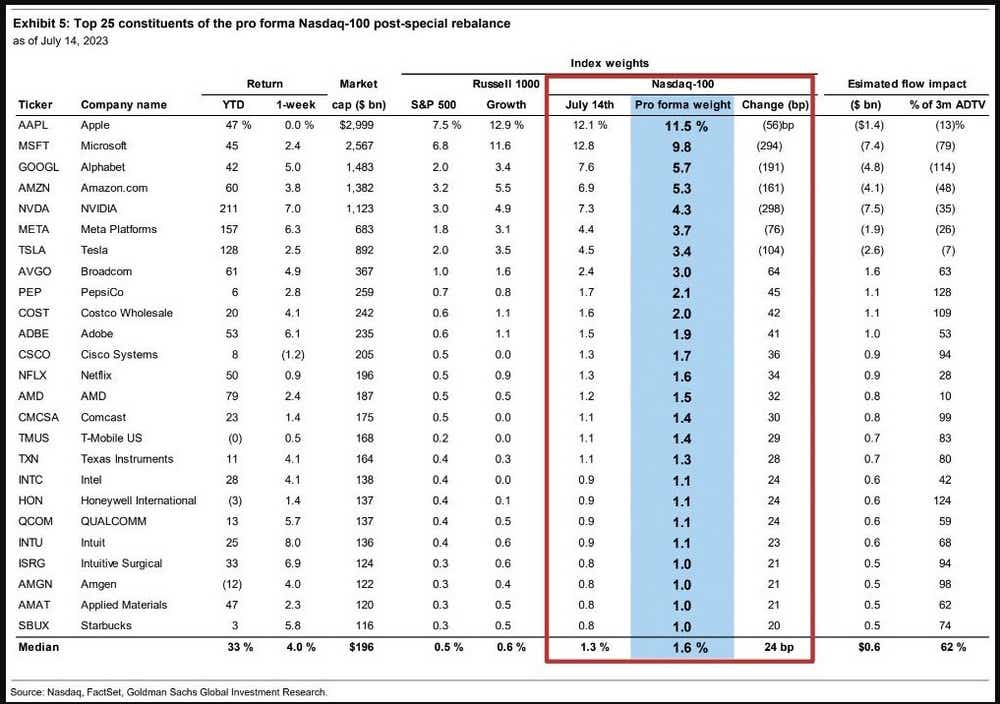

Here are the rebalancing numbers:

It was well known that the largest members of the index would see a reduction in weighted, which would be spread across some of the less weighted names. The biggest reductions will come from Nvidia (NVDA, -2.98%), Microsoft (MSFT, -2.94%), Alphabet (GOOGL, -1.91%), Amazon (AMZN, -1.61%), and Tesla (TSLA, -1.04%). Apple, (AAPL) on the other hand had the smallest drop in weighting of the “Magnificent 7” of just -0.54%.

The rebalance puts the top five stocks (AAPL, MSFT, GOOGL, AMZN, NVDA) down to a weighting of 36.6%, back within the 38.5% total weighted requirement.

Meta (META, -0.76%) and Tesla saw their weightings reduced due to the requirement for any component outside the top five to be under 4.40% weighting.

The reduction from the top names will be spread across the index, with the largest increase going to Broadcom (AVGO, 0.64%) among many others.

How will this affect the index/stocks going forward?

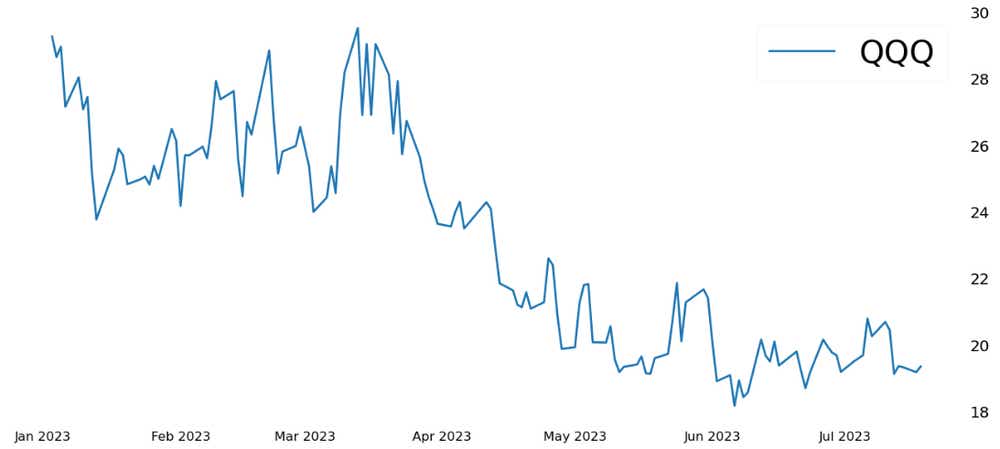

The Nasdaq is a relatively small index compared to SP500 or the Dow, so the rebalance will likely not materially impact the index. However, news and sentiment can certainly affect price—in the short term, we could see price moves outside expectations.

That said, the general change in the index is largely exaggerated. For example, based on AAPL previous weighting of 12.06%, a 10% move in AAPL would account for roughly +/- 1.21% move in the Nasdaq. With the new weighting of 11.50%, that same 10% move in AAPL would move the index roughly +/- 1.15%. If the each of the magnificent 7 moved 10%, the total change in the nasdaq at the new rebalance weight would be 4.37% vs 5.55% pre rebalance.

Many mutual funds will also have to rebalance accordingly, as many track the Nasdaq. “growth” funds, and broad-based index funds that track the Nasdaq will also have to participate in a similar rebalance, adding to the potential volatility into the event–although that has yet to be seen!

Nick Battista, tastylive director of market intelligence, has a decade of trading experience. He appears Monday-Friday on Options Trading Concepts Live. On Wednesdays, he co-hosts Johnny Trades. @tradernickybat

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.