Trading the ECB Rate Decision: Eurozone Stocks and the Euro at Risk

Trading the ECB Rate Decision: Eurozone Stocks and the Euro at Risk

By:Ilya Spivak

The European economic recovery seems to be slowing

- A post-recession recovery in Eurozone economic growth seems to be stalling.

- Cyclical weakness is likely to put inflation firmly on the path to the 2% objective.

- The dovish ECB tone is boosting rate cut bets that may punish the euro and Eurozone stocks.

The European Central Bank (ECB) is expected to keep its target deposit rate unchanged at 3.75% this week. Nevertheless, the tone the bank’s president, Christine Lagarde, may display at the press conference following the sit-down is likely to remain dovish, underpinned by a recent downturn in economic data. That might weigh on the euro and local stocks alike.

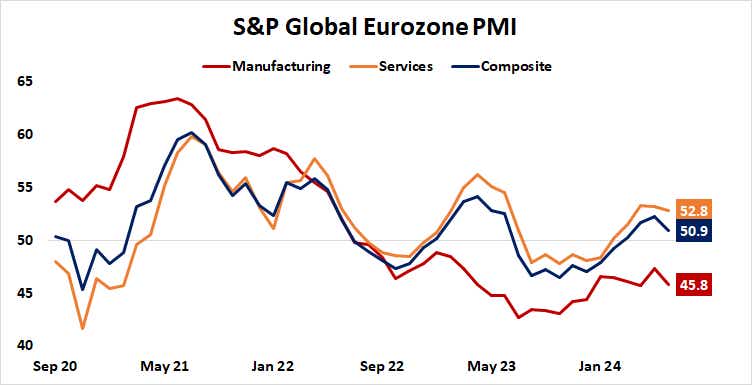

Analytics from Citigroup reveal that Eurozone economic data has increasingly underperformed relative to baseline forecasts since the central bank began its easing cycle at the start of June. Last month’s woeful purchasing managers’ index (PMI) data is a potent case in point.

Eurozone economic recovery: Hitting a wall

The surveys from S&P Global unexpectedly revealed that manufacturing- and service sector economic activity growth dropped to its lowest in three months. The numbers seemed to suggest the rebound in growth in the first half of the year following a shallow recession in late 2023 is running out of steam.

This seems likely to make for grater confidence in ongoing disinflation among central bank officials. June’s consumer price index (CPI) data showed that the hospitality sector—restaurants and hotels—contributed a hefty 0.58 percentage points to the headline 2.5% inflation rate. If the economy is slowing, such discretionary spending seems likely to cool.

The markets appear to agree. Germany’s two-year breakeven rate—a measure of near-term inflation expectations priced into the bond market of the Eurozone’s largest economy—has dropped to just 1.29%. That is the lowest since early January, and hints that the ECB is well on its way to achieving the 2% inflation target on schedule.

Dovish ECB threatens the euro, Eurozone stocks

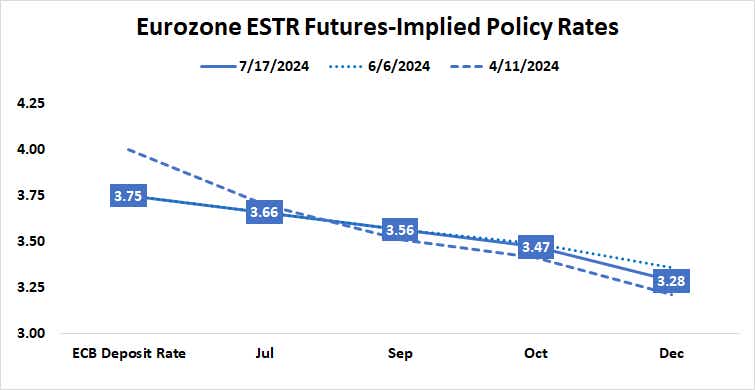

On balance, this looks likely to set the stage for a dovish tone from Lagarde, setting the stage for ongoing rate cuts in the months to come. As it stands, the ECB is expected to deliver a further 47 basis points (bps) in rate cuts this year. The likelihood of a cut in September is currency priced in at 76%.

The euro may come under pressure if the ECB President’s remarks shift up the scope for easing on the menu or move up the timeline for its arrival. Regional stocks (ETF: EZU) may likewise suffer. They marked a top as the central bank began to cut rates last month. Signs of greater urgency may compound pressure as worries about economic weakness swell.

Ilya Spivak, tastylive head of global macro, has 15 years of experience in trading strategy, and he specializes in identifying thematic moves in currencies, commodities, interest rates and equities. He hosts Macro Money and co-hosts Overtime, Monday-Thursday. @Ilyaspivak

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.