Trading FX Volatility Around the U.K. and French Elections

Trading FX Volatility Around the U.K. and French Elections

The end is in sight for uncertainty caused by the European balloting, but the yen remains a wild card

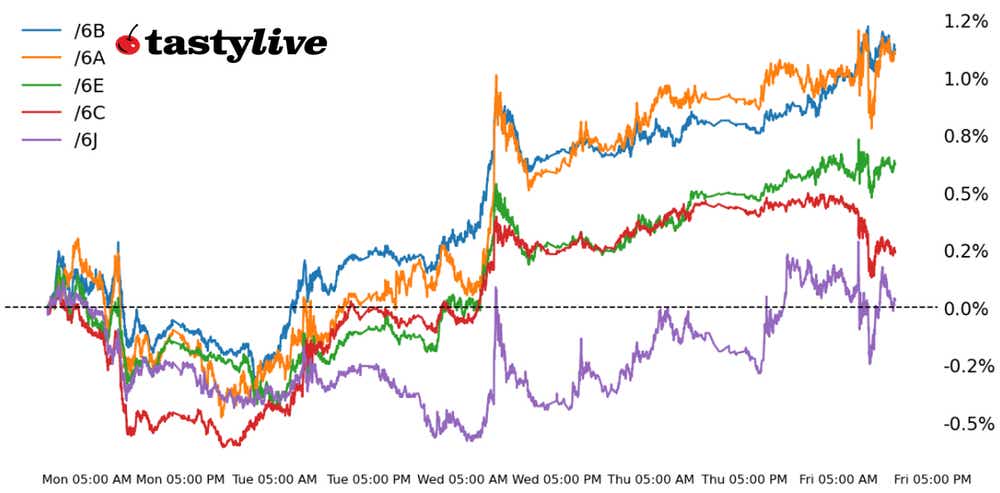

- FX futures’ volatility began to creep higher in April, when concern about the weakness of the Japanese yen began to stoke speculation over intervention.

- While the yen’s volatility subsided in May and June, volatility in the euro and British pound continued as elections came into focus.

- Once elections come to pass, volatility may downshift to a lower plateau as focus shifts back to the weak Yen.

Market Update: dollar index (DXY) down 0.72% month-to-date

Bets on Federal Reserve interest rate cuts are up, and U.S. Treasury yields are lower in the wake of the June U.S. jobs report. But that may not be the biggest driver of the weakness of the U.S. dollar weakness in recent days—or in the days to come.

Political risk has infested foreign exchange (FX) markets for the past several weeks. It began in April when the risk of a weak Japanese yen (/6JU4) and its impact on the Japanese government’s popularity stoked concern about speculation. British political risk arrived on the scene in May, when former U.K. Prime Minister Rishi Sunak called for snap elections, jolting the British pound (/6BU4). The euro (/6EU4) added its own volatility to the mix when French President Emmanuel Macron dissolved parliament.

Two-thirds of those risks are going away, or are at least are on the way to being severely diminished. The one that is now gone: U.K. political risk. The Labour Party’s victory is its largest since 1997, and it represents the smallest Tory representation in parliament ever. The next U.K. elections don’t need to be held for five years, meaning a period of turbulence in U.K. politics is drawing closed.

The other third of political risk that has been dissipating and may be diminished further, is the French elections. Round two is this Sunday. Neither the far-left nor the far-right parties appear likely to gain an outright majority in parliament, meaning gridlock is on the way. An upheaval of the French fiscal situation is looking less probable, which could pave the way for a further reduction in risk around the euro.

However, markets are already showing their hand: volatility metrics are subsiding off their highs, signaling an end to the weakness predicated around fear in /6BU4 and /6EU4.

FX FUTURES CONTRACT | IVR HIGH & DATE | IVR HIGH THIS WEEK | IVR AS OF 7/5/24 |

/6BU4 | 134.32 on 5/1/24 | 70 | 48.2 |

/6EU4 | 154.63 on 4/7/24 | 107.52 | 84.2 |

/6JU4 | 147.54 on 5/14/24 | 85.87 | 46.8 |

The Japanese yen (/6JU4) remains the lonely third that is not seeing its risk improve. If anything, the high volatilities in FX futures in recent months may be a function of a compounding effect: the accumulation of yen intervention, French election and British election risk raised volatility for the entire asset class. The perceived “end” to this chapter of British and French election risk may likewise see FX futures volatility drop across all currencies, even the Yen.

/6B British Pound Technical Analysis: Daily Chart (August 2023 to July 2024)

The British pound (/6BU4) has maintained a sideways consolidation that has been in place since mid-December 2023, but it is testing the topside of that range in the neighborhood near 1.2900 in the wake of the U.K. elections. Short-term momentum is pointedly higher: slow stochastics nearing overbought territory: MACD (moving average convergence/divergence) issuing a bullish crossover above its signal line; and the one-week moving average (daily 5-EMA) rising above its one-month moving average (daily 21-EMA). Directionally, short at-the-money (ATM) put spreads may be the best way to take advantage of a directional move higher in a deteriorating volatility environment. A break above 1.2900, coupled with a further drop in volatility might warrant a shift in strategy to long ATM call spreads.

/6E Euro Technical Analysis: Daily Chart (August 2023 to July 2024)

The euro (/6EU4) is benefiting handsomely from the perceived reduction in political risk across the English Channel, with market participants projecting their own expectations onto round two of the French parliamentary elections this weekend. As noted in the table above, volatility has come down markedly as well over the past few weeks, with /6EU4 erasing roughly two-thirds of the decline since the French parliament was dissolved. As momentum gathers pace toward the middle of a trading range in place since August 2023, the elevated volatility environment makes both short ATM put spreads and iron condors appealing ways to capitalize on a reduction of fear.

/6J Japanese Yen Technical Analysis: Daily Chart (January to July 2024)

The Japanese yen (/6JU4) is a different beast altogether. A widow-maker in 2024, /6JU4 has been unable to stage any sort of significant recovery – even with Japanese policy officials saber-rattling about intervention. Closing in on its highest level since October 1986, the USD/JPY spot rate would be ground zero for an intervention. If energy prices are pointed higher, any rally in /6JU4 may be presented as an opportunity to get short anew as it appears increasingly likely that markets may try to break the Bank of Japan.

Christopher Vecchio, CFA, tastylive’s head of futures and forex, has been trading for nearly 20 years. He has consulted with multinational firms on FX hedging and lectured at Duke Law School on FX derivatives. Vecchio searches for high-convexity opportunities at the crossroads of macroeconomics and global politics. He hosts Futures Power Hour Monday-Friday and Let Me Explain on Tuesdays, and co-hosts Overtime, Monday-Thursday. @cvecchiofx

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.