Trading China's Pending PMI Data Release

Trading China's Pending PMI Data Release

By:Ilya Spivak

China's share of global supply chain trade has been steadily declining since early 2021. Their economic slowdown may help drag the global economy into recession.

- PMI data may show post-COVID recovery in China is coming undone.

- Globalization-driven economy struggling as external demand wanes.

- Soft outcomes may spook stocks, boost U.S. dollar on recession fears.

China is struggling to find its footing after scrapping “zero-COVID” lockdowns in December 2022. That’s bad news for the global economy at a time when it can ill-afford any more complications.

Most global central banks remain fiercely hawkish and filled with resolve to lift interest rates until inflation is chased back toward 2%, even at the cost of recession. A robust rebound in the world’s second-largest economy might have helped smooth things over.

Chinese PMI data to show the economic recovery unraveling

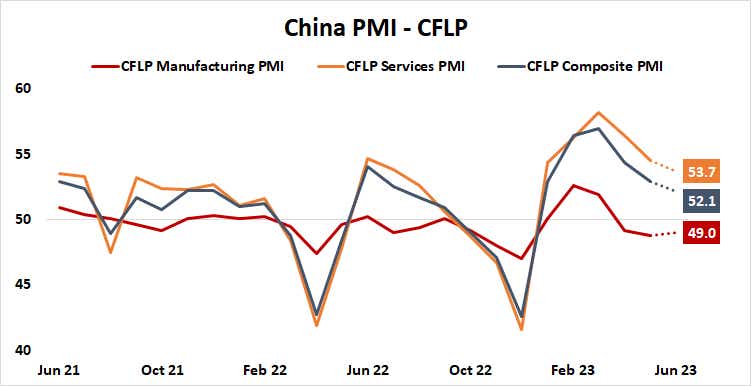

Data due out this week is expected to paint a gloomier picture. Surveys of purchasing managers (PMI) by the China Federation of Logistics and Purchasing (CFLP) are set to show the manufacturing sector contracted for the third consecutive month while the services side grew at the slowest pace in six months.

The outcomes are presented as indices with a “neutral” center line at 50. Values above that represent expansion, while those below it signal contraction. Distance away from 50 in either direction represents speed: The higher above 50, the faster the expansion; the lower below it, the faster the contraction.

Such sobering results speak to the lingering hangover from China’s pandemic containment strategy. Sharp bursts of catch-up growth in the U.S. and Eurozone—the East Asian giant’s most important export markets—had long since crested by the time Beijing decided to end mass quarantines.

A burst of pent-up domestic demand juiced up growth in the first quarter as the service sector bloomed, but that fillip already seems to be spent. Meanwhile, central bank tightening has pushed global trade turnover to a two-year low, sapping the lifeblood of the globalization-dependent economy.

China’s prolonged absence also encouraged supply chain diversification. Its share of global trade volumes has been steadily declining since early 2021, hitting the lowest point in over three years at 11.2% as of February 2023. That’s down from a peak of 15% in April 2020.

Markets may shudder if Chinese data stokes global recession fears

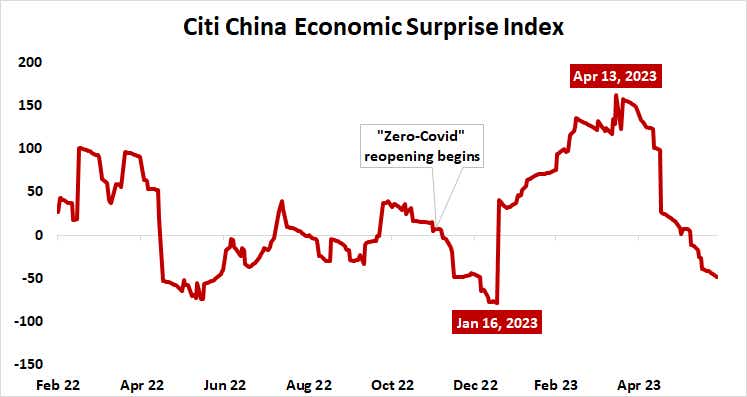

Data from Citigroup suggests Chinese economic news-flow has been deteriorating relative to baseline forecasts since April. Financial markets may shudder if this extends to the PMI data set. Disappointments would follow similarly downbeat results from the U.S. and Europe, stoking recession fears.

Price action in the wake of those outcomes seemed to offer a preview of what this may look like across major asset classes: Stocks and cyclical commodities like crude oil and copper fell, the inversion in the U.S. 10- to two-year Treasury yield curve spread deepened, and the U.S. dollar rose.

Ilya Spivak, tastylive head of global macro, has 15 years of experience in trading strategy. Spivak specializes in identifying thematic moves in currencies, commodities, interest rates and equities. He hosts Macro Money and co-hosts Overtime, Monday-Thursday. @ilyaspivak

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.