Top 3 Defense Stocks to Watch

Top 3 Defense Stocks to Watch

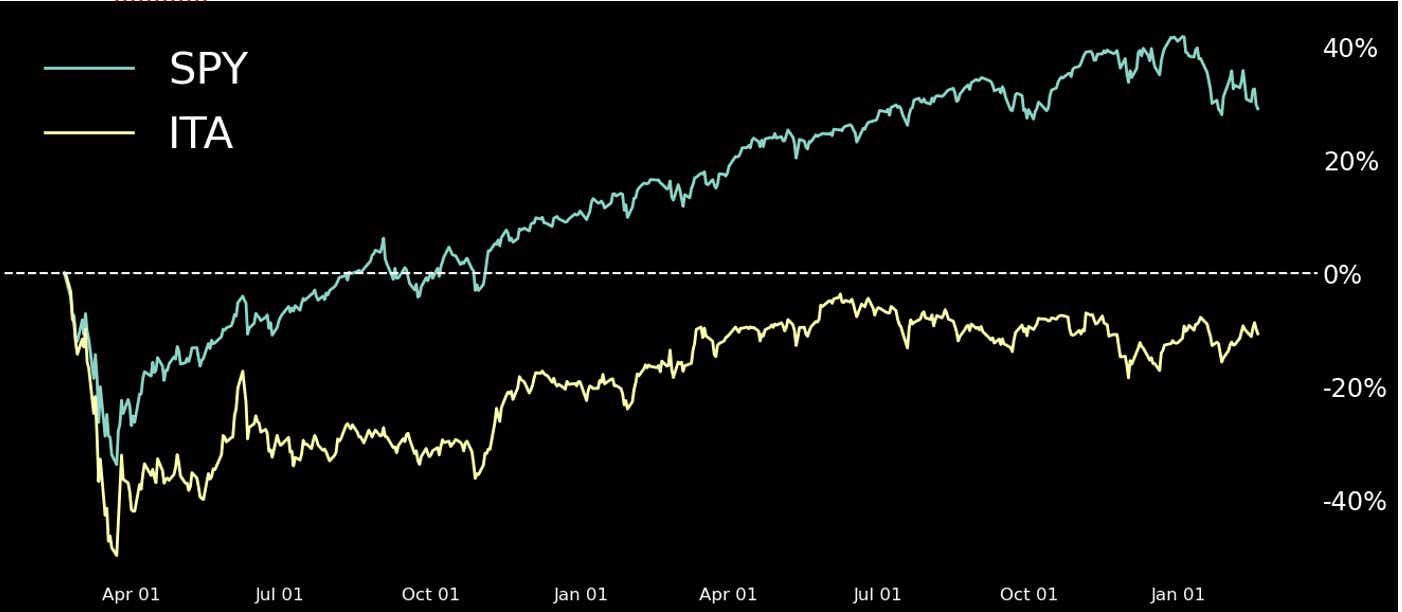

Despite the market turmoil we’ve experienced over the last 24 months, the Aerospace – Defense industry has not rebounded with the same velocity as the rest of the S&P 500. The US Aerospace & Defense Ishares ETF (ITA) tracks US equities in the aerospace and defense sector.

Lockheed

Martin Corp (LMT) and Raytheon Technologies Corp (RTX) are components of the

S&P 100 index, and Northrup Grumman Corp (NOC) is a component of the

S&P 500 index. Over a one-year period, LMT has

experienced growth returns of 15.36%, RTX, 29.15%, and NOC 33.96%, respectively.

It is appropriate to recognize that the bullish drift in the overall market

during the same period has contributed to the performance of these three

Aerospace - Defense stocks.

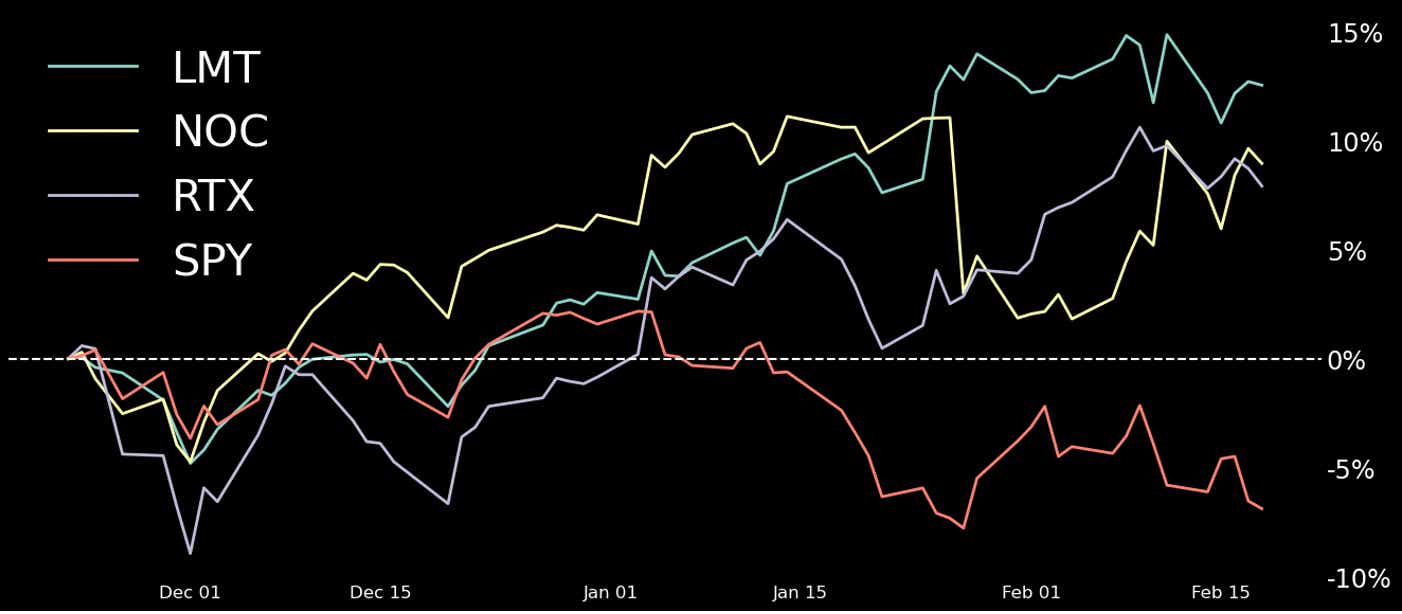

LMT, RTX, NOC Stock Performance

The last three months of daily price action for LMT, RTX and NOC, and, their outperformance of SPY equities, indicates that investors, which includes a large institutional investment base, believe these three stocks represent continued long-term value, which is often sought after during periods when investors are looking for a haven for their capital.

As market conditions respond to continued uncertainty in regional and global political challenges, the value maintained in these three Aerospace – Defense stocks has remained strong.

Currently, NOC posts an impressive profit margin of 19.64% with a return-on-assets of 9.79%, LMT has a profit margin of 9.42% with a return-on-assets of 14.84%, and RTX has a profit margin of 6% with a return-on-assets of 4.03%. In an industry where defense and security concerns are at the forefront of global tensions, it is understandable that many of the federal contracts granted to the Aerospace – Defense private sector accumulate at thelargest market cap corporations. The last three months of profitability measurements represent that current phenomenon.

Big Boy Contracts for Northrup, Lockheed and Raytheon

Within the last 12 months, LMT, NOC, and RTX have all been awarded several contracts worth hundreds of millions of dollars, with Raytheon awarded several contracts worth more than a billion dollars, from the United States government or United States military.

These contracts include systems development, aerospace development, and satellite development contracts. Investors pay a premium to own stock in these companies, which represents pricing for all three compared to the rest of the sector.

Is this increased performance of these stocks related to the mounting military tensions around the globe in the last three months? Possibly, but the answer is not straightforward.

Based on the timing and price movement, it is reasonable to assume escalating military conflicts around the world have added to the increase in company stock prices.

On the other hand, even though the ITA ETF is underperforming in the market, these three stocks have recovered and maintained their value relative to the rest of the stock market and will continue to do so regardless of any current political or military tensions that may arise.

The ability of LMT, NOC, and RTX to dominate competitors and win the lion's share of contracts awarded in this sector makes them valuable Defense Stocks. A retreat from broad market investments and into targeted companies like these could protect capital during inflationary periods performing better than most investments overall.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.