Top 10 S&P 500 Stocks Are Leading This Decline

Top 10 S&P 500 Stocks Are Leading This Decline

Top 10 S&P 500 Stocks Are Leading This Decline

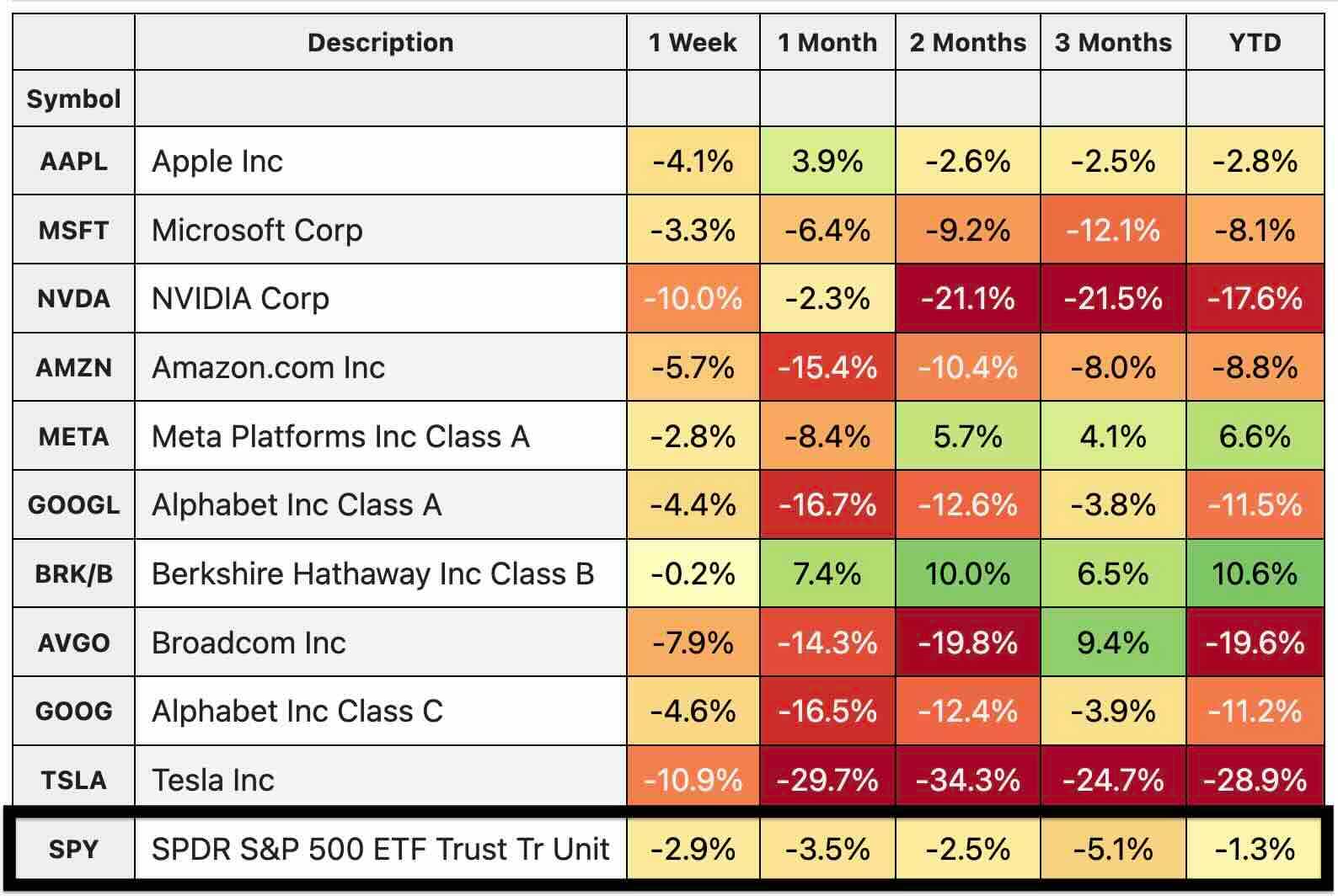

The top 10 weighted stocks in the S&P 500 make up 34% of the index because it’s capitalization-weighted. One $100 billion company makes up 10x as much weight as a $10 billion company.

These large stocks are what are really driving the decline in the index.

Notice the S&P 500 is down only 1.3% year-to-date, and the largest weighted stocks are really skewing the decline. Only two stocks are up this year: Berkshire Hathaway (BRK-B) and Meta (META), the owner of Facebook.

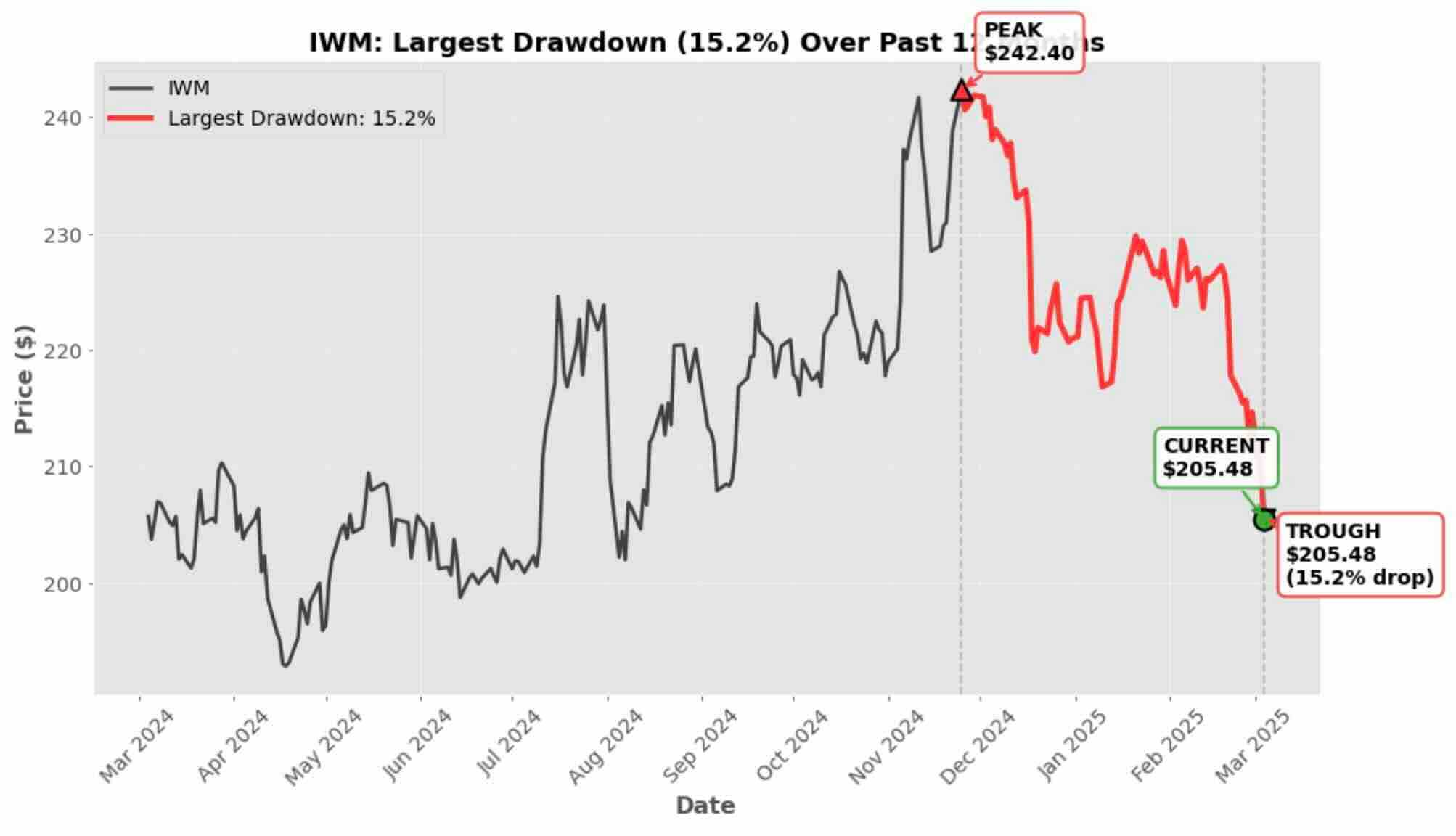

Of the major indices, The Russell 2000 is hit hardest because the small capitalization stocks are down the most.

Russell 2000 (IWM): Down 8.27%

S&P 500 (SPY): Up 0.57%

Dow Jones (DIA): Up 1.40%

Nasdaq 100 (QQQ): Up 0.76%

The Russell 2000 is down 15% from its peak, but that’s still not as bad as the decline of 33% from 2021 to 2023.

Why are these stocks getting hit?

At tastylive, we’ve generally given two main reasons why Small Caps tend to get hit during market turmoil:

- Liquidity. During times of economic stress, investors tend to prefer the liquidity of large caps.

- The Russell 2000 has more financials, which are extremely sensitive to economics.

But what Happens when the S&P 500 VIX has gone over 20?

The VIX is currently at 25, which could be considered “heightened market fear.”

The S&P 500 has an average one-month return of 0.48% and a median return of 1.37%.

The market tends to be positive following the VIX spikes:

- Positive returns 60% of the time (128 instances)

- Negative returns 40% of the time (85 instances)

Range of outcomes:

- Maximum one-month return is 10.7%

- Minimum one-month returns is -24%, which occurred during the COVID-19 pandemic.

In a nutshell, this supports the contrarian view that fear often presents opportunities in the market.

Two Trade Ideas

IWM ($204) Calendarized Ratio CRAB Trade (MAY/APR) $3.79 debit

The small caps have been killed during the last couple of months, and they’ve reversed almost an entire year of gains. Lower rates are usually a tailwind for small cap stocks, but that hasn't been the case recently. If you are looking to buy the dogs with flees, a CRAB trade is interesting with volatility this high. Going Long the MAY 210 call and short 2x the APR 220 call with a 230 long call wing set s up with around 10 delta and some positive gamma, with a bit of short term positive theta decay.

NVDA ($111) Short Put Spread (APR) $2.28 Credit

If you missed the move in May of 2024 ... we are right back to that point! Nvidia (NVDA) has come down almost 30% from highs, and volatility has continued to expand. Maybe it'll go lower, but if you are bullish and want to take advantage of a down move and a pop in volatility, put spreads have been juicy. Selling the 100/90 short put spread; it trades at $2.28 with a breakeven right around the May 2024 breakout.

Subscribe to Cherry Picks. We are okay with grifters, but to be on our good side subscribe to our newsletter. Please share with your friends - and if you don't have friends - our condolences.

We love new subscribers! We’re OK with grifters, but to be on our good side by subscribing to our newsletter.

Sharing is caring. Forward this email to your friends so they can subscribe to our newsletters, too! Get weekly data-driven trade ideas with Cherry Picks and daily pre-market insights and trade ideas with Cherry Bomb.

Michael Rechenthin, Ph.D., (aka “Dr. Data”), managing director of research and development, has 25 years of trading and markets experience. He’s known best for his weekly Cherry Picks newsletter. On Thursdays, he appears on Trades from the Research Team LIVE.

Nick Battista, tastylive director of market intelligence, has a decade of trading experience. He appears Monday-Friday on Options Trading Concepts Live. On Wednesdays, he co-hosts Johnny Trades. @tradernickybat

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex and macro.

Trade with a better broker. Open a tastytrade account today. tastylive Inc. and tastytrade Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.