Sector View of Gold and Silver, Plus Two Trade Ideas

Sector View of Gold and Silver, Plus Two Trade Ideas

This week, we focus on a short strangle trade and an iron condor strategy

Sector View

These exchange-traded funds (ETFs) represent sectors with high implied volatility and historically elevated options prices.

XME: Metals & Mining ETF

GDX: Gold Miners ETF

XHB: Homebuilders ETF

SMH: Semiconductors ETF

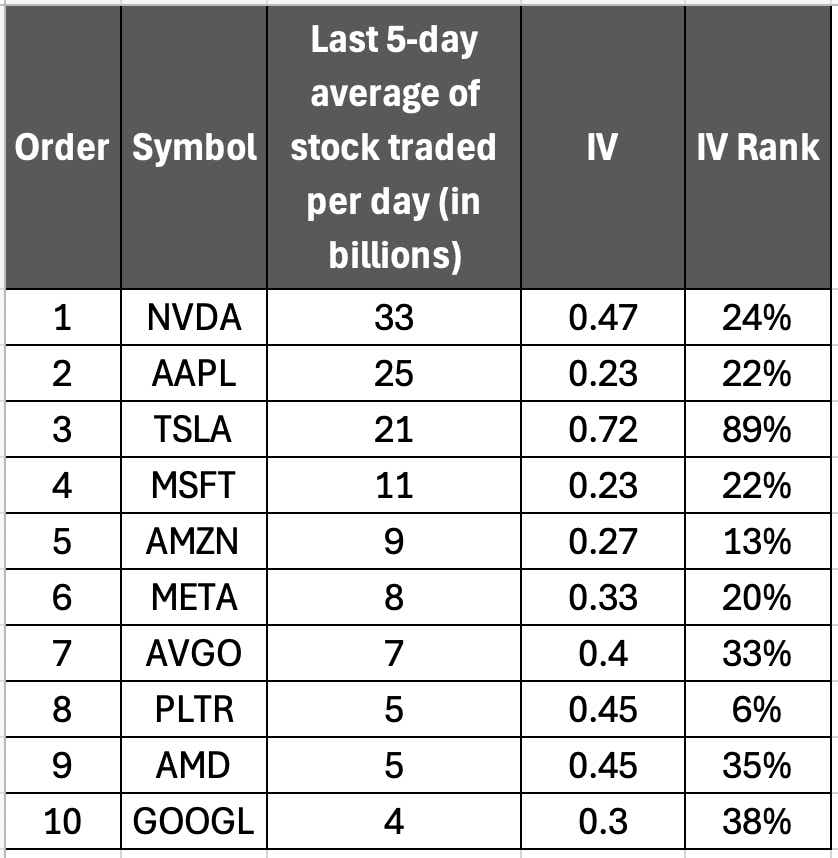

Top 10 Most-Traded Stocks

Gold and Silver

During the past few years, gold has slightly outperformed. Volatility in silver is usually greater, and this morning it was up $1.30.

GLD is the Gold ETF

SLV is the Silver ETF

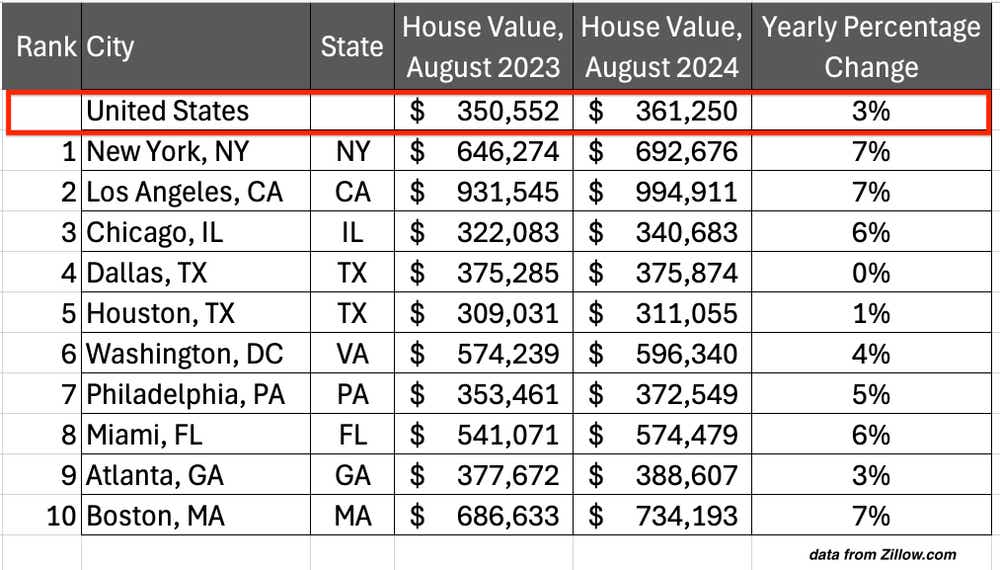

Growth in Housing Prices

Have you been pondering the burning question of how much housing prices have grown in the top 10 cities?"

Well, surprise, surprise! We happen to have those stats for you!

Here are the top 10 largest cities in the United States with their housing prices as of last month and as of a year before that. We also include their percentage changes.

The data is from Zillow.com (Z).

Two Trade Ideas

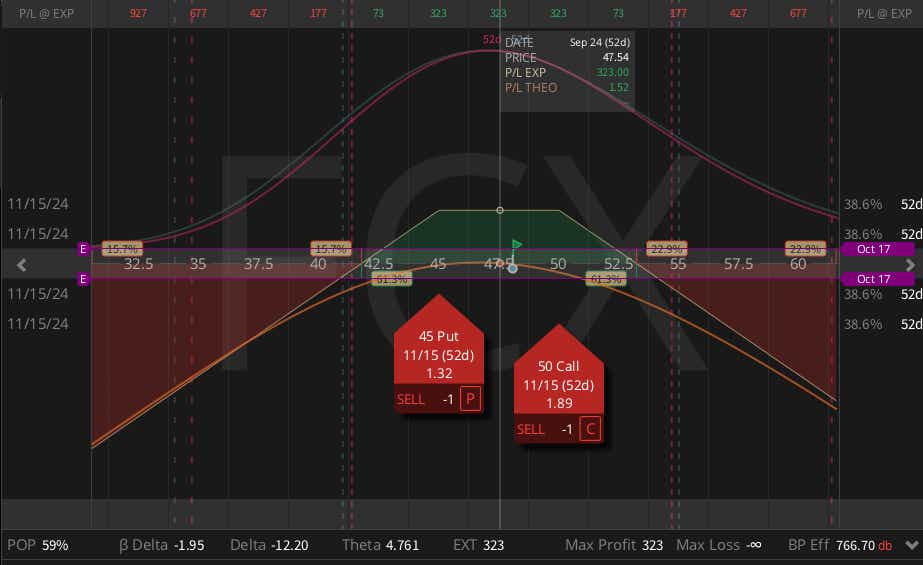

FCX ($48) short strangle (NOV) $3.23

Metals have been on a run recently, with copper futures (/HG) up nearly 3% today. Freepor-MdMoRan (FCX) has been a beneficiary—up nearly 20% over the last couple of weeks. If you think the good news might be baked in, a slightly short skewed strangle 45p/50c trades at around $3.23 credit, uses around $750 in buying power and has roughly a 60% probability of profit.

V ($277) Iron Condor (NOV) $3.02 Credit

Visa (V) has been a news-driven trade recently with antitrust lawsuits raised by the Justice Department. It has traded between 260 and 290 for the better part of 2024 and currently sits right in the middle around $277. If you think it might bounce around that range, an iron condor (where you short the 260/250 put spread and the 295/305 call spread) trades at around $3.02 with a roughly 60% probability of profit.

Sharing is caring. Forward this email to your friends so they can subscribe to our newsletters, too! Get weekly data-driven trade ideas with Cherry Picks and daily pre-market insights and trade ideas with Cherry Bomb.

Michael Rechenthin, Ph.D., (aka “Dr. Data”), managing director of research and development, has 25 years of trading and markets experience. He is best known for his weekly Cherry Picks newsletter. On Thursdays, he appears on Trades from the Research Team LIVE.

Nick Battista, tastylive director of market intelligence, has a decade of trading experience. He appears Monday-Friday on Options Trading Concepts Live. On Wednesdays, he co-hosts Johnny Trades. @tradernickybat

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.