This or That?: Taiwan Semiconductor Earnings Preview

This or That?: Taiwan Semiconductor Earnings Preview

Is TSMC just another reddit meme stock? Or a value-priced alternative to Nvidia?

- TSMC is set to report earnings on Thursday.

- Revenue is expected to drop, but guidance is key to investors.

- Is TSMC undervalued relatives to Nvidia?

Taiwan Semiconductor Manufacturing, or TSMC, (TSM) will report quarterly fiscal results for April to June before the opening bell on Thursday, July 20. Retail investors may join a rally if TSMC delivers impressive results.

Analysts—according to a Reuters poll—expect a 27% decline in quarterly profits from a year ago and a 13% decline in net revenue over the same period. Company executives will hold an earnings call Thursday at 2 a.m. EDT. The biggest drag on growth is a broader slowing in economic activity among central bank rate hikes.

Lowered Expectations

TSMC’s revenue is forecasted to drop to $5.6 billion in the quarter from $7.6 billion a year ago. A normalization in supply chains in the post-COVID period have dragged down chip pricing. The chip sector is typically slower in the second quarter because of seasonal factors.

In the TSMC June revenue report released last week, the company said revenue declined 11.4% from May and 11.1% from June 2022. While that is concerning, the company expects AI applications to boost growth in the second half of this year. If executives sound optimistic, it could incite a rally.

TSMC versus NVDA – A better-valued play on AI?

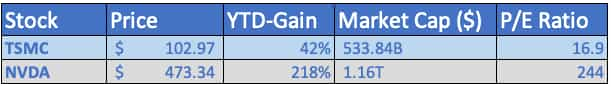

TSMC, as Nvidia's (NVDA) primary contract supplier, capitalizes on the artificial intelligence wave currently taking place. However, Nvidia outclasses TSMC significantly in year-to-date performance (see chart below).

Much of this performance gap could be caused by retail investors' preference for NVDA, catapulting the chip maker into the world of meme stocks. Nvidia often ranks within the top five most-mentioned stocks on Reddit's popular WallStreetBets forum.

The fundamentals spotlight TSMC as a potential value play. A comparison of Nvidia and TSMC's forward earnings shows TSMC offers better value.

In terms of the price-to-earnings (PE) ratio—an investor-favored metric for assessing a company's stock price relative to its earnings—TSMC's PE ratio stands at 16.9. This is significantly lower, and thus notably more appealing, than NVDA’s PE ratio of 244. Based on this analysis, TSMC appears a more attractive investment. Will TSM recognize Nvidia’s stock price momentum after earnings? The upcoming earnings report will reveal the answer soon.

Thomas Westwater, a tastylive financial writer and analyst, has eight years of markets and trading experience. @fxwestwater

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.