How Theta and Premium Decay Work in Options Trading

How Theta and Premium Decay Work in Options Trading

By:Kai Zeng

Traders can collect daily premium depreciation only when theta is positive

- Selling options with a credit doesn’t guarantee profitable time decay.

- Traders can collect daily premium depreciation only when theta is positive.

- For risk-defined strategies, negative theta is observed when strikes are breached.

- The wider the wings of a risk-defined strategy, the higher the likelihood of receiving daily premium decay.

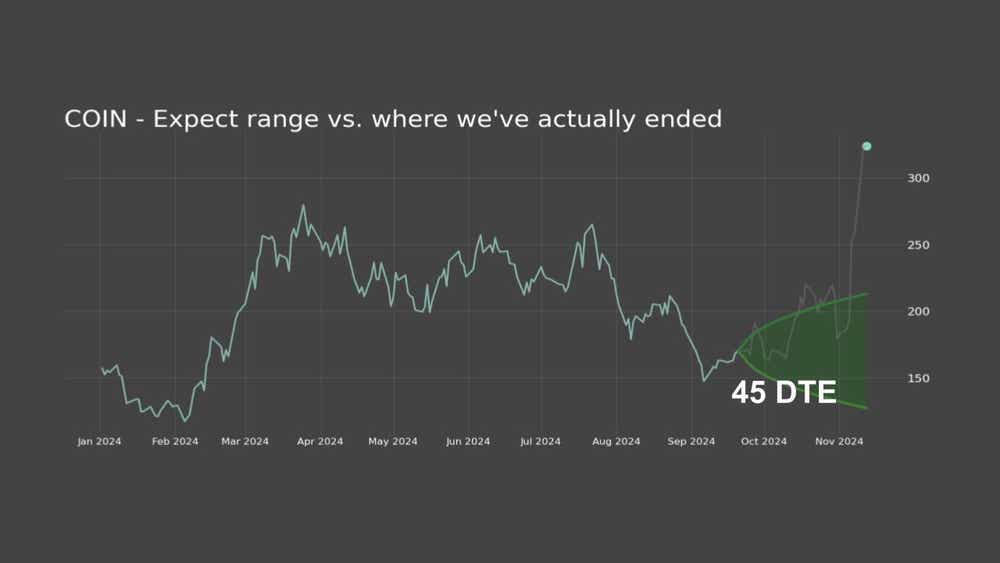

Market volatility has increased since the election, leading to unexpected and significant stock price movements. These fluctuations are challenging for premium sellers because they often test or breach options strikes.

One of the advantages of selling premium is the ability to benefit from daily premium decay—the reduction in an option's time value. If all other factors remain constant, short premium positions can potentially generate income over time because theta, a measure of time decay, is positive when the position is initiated.

But what happens when positions are breached, meaning the stock price touches one of the short strikes?

When selling naked positions, such as puts, calls, or combinations like strangles and straddles, positive theta is maintained throughout their life cycle, regardless of the stock price. This means that even if the put or call strike is breached, options sellers can still receive daily premium decay.

.jpg?format=pjpg&auto=webp&quality=50&width=1000&disable=upscale)

However, for risk-defined strategies, like spreads or Iron Condors, premium decay behaves differently. In those cases, the position's theta can be either positive or negative.

.jpg?format=pjpg&auto=webp&quality=50&width=1280&disable=upscale)

For instance, selling a December out-of-the-money (OTM) put spread in Tesla (TSLA) might generate a +4 theta, indicating an expected collection of $4 over a 24-hour period. Conversely, if options are breached and become in-the-money (ITM), the position might have a -2 theta, meaning traders expect to pay $2 over the same period.

.jpg?format=pjpg&auto=webp&quality=50&width=1000&disable=upscale)

This applies to all risk-defined strategies, including Iiron condors and ironflies. Once the position is breached, time value no longer favors the seller.

Understanding this is crucial because, if it occurs, traders can roll the untested side (still OTM) closer to the breached side to generate higher positive theta.

Alternatively, rebalancing the entire position could reset the theta completely.

For risk-defined strategies, the width of the wings affects the probability of a position being breached. Tighter wings significantly increase this probability. A straightforward solution to reduce this risk is to widen the wings.

.jpg?format=pjpg&auto=webp&quality=50&width=1280&disable=upscale)

Kai Zeng, director of the research team and head of Chinese content at tastylive, has 20 years of experience in markets and derivatives trading. He cohosts several live shows, including From Theory to Practice and Building Blocks. @kai_zeng1

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.