Top 10 Stocks to Watch: April 2025

Top 10 Stocks to Watch: April 2025

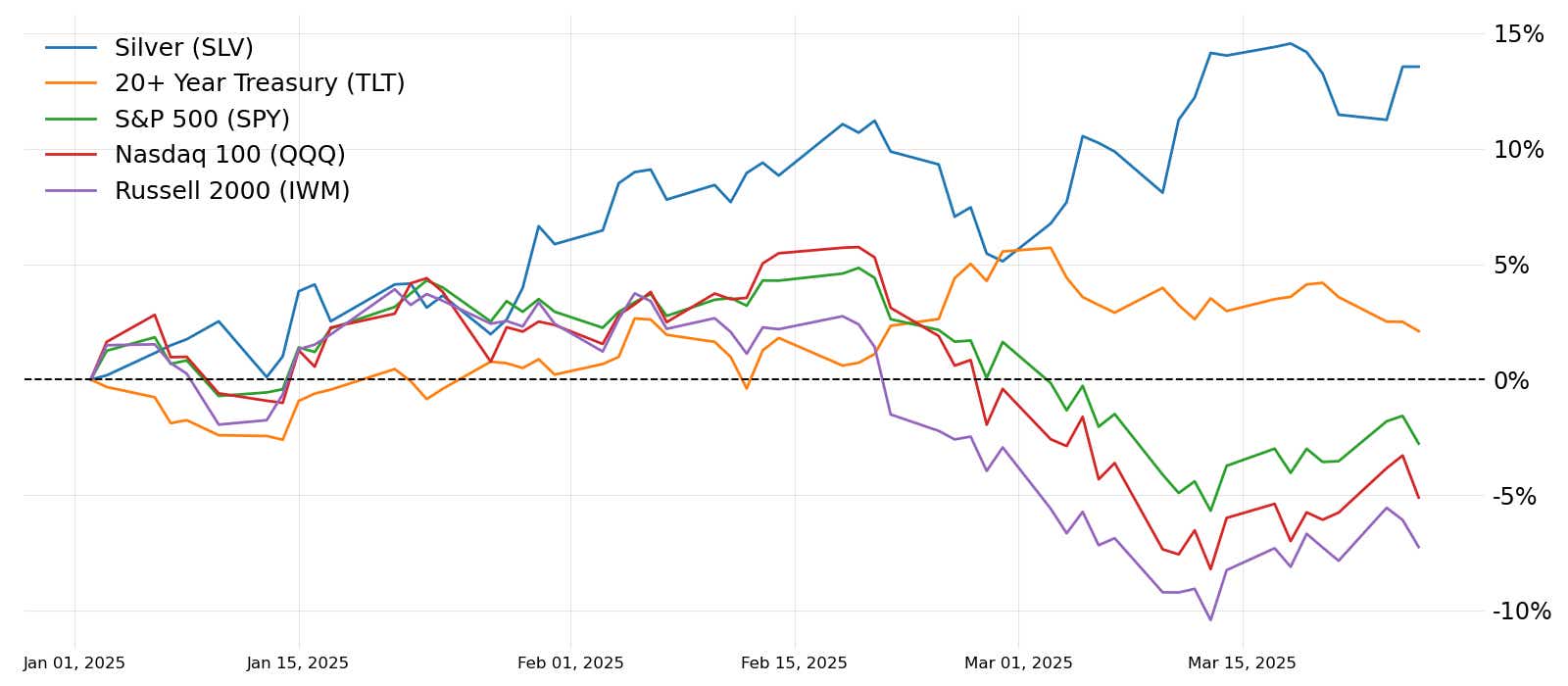

Market Update: S&P 500 E-Mini Futures down 3.29% year-to-date

Since our last update, the market moved from a horizontal stance to a sharp bearish sentiment, dropping down to a new yearly low on March 13 at $5,509.25. Since then, we rallied back to $5,836.50 and currently sit just below that at $5,758.00.

The price action below $5,629.00 appears to indicate an oversold market. This has some validity because of the jump in price following this price action. However, I would not be surprised if we once again test the $5,600 level.

That said, the S&P 500 does have a recent tendency to show price action that resembles a V-bottom, following a sharp sell-off. Expect more choppiness over the next couple of weeks.

A note on earnings trades

To capture the bulk of the volatility of earnings announcements, earnings trades are often executed either the day before or on the day of the earnings announcement. However, earnings trades can also be placed days or weeks before an earnings event, which could lead to early profit-taking.

Alternatively, placing a trade shortly after an earnings announcement can be a strategic choice to circumvent the binary nature of the event. Evaluate each trade in a way that enables you to execute the position that matches your strategy.

If you're considering a trade going into an earnings event, one approach is to initiate the position in the monthly options contract that follows the report. This strategy offers flexibility. Should you need to defend your position—perhaps because of unexpected market movements—you have the choice to “roll” it out to the subsequent monthly options. Rolling out the position enables you to extend its duration and potentially collect more premium, providing a buffer against market volatility.

Top 10 stocks to watch in April 2024

- Constellation Brands (STZ) – April 11, Before the open

- CarMax (KMX) – April 10, Before the open

- Wells Fargo (WFC) – April 11, Before the open

- Citigroup (C) – April 15

- United Airlines (UAL) – April 15

- Alcoa (AA) – April 16, After the close

- Taiwan Semiconductor Manufacturing (TSM) – April 17

- Netflix (NFLX) – April 17, After the close

- Boeing (BA) – April 23

- Royal Caribbean Cruises (RCL) – April 24

1. Constellation Brands (STZ) - This company produces and markets beer, wine and spirits. It is down 18.39% year-to-date. Its IVR is 83.8, with April IVx at 45.2, May IVx at 35.8, and its liquidity is rated two out of four on the tastytrade platform.

2. CarMax (KMX) - CarMax retails used vehicles and provides auto financing. It is down 7.95% year-to-date. Its current IVR is 65.4, with April IVx at 39.1, and its liquidity is rated three out of four on the tastytrade platform.

3. Wells Fargo & Company (WFC) - Wells Fargo provides banking, insurance, investments, mortgage, and consumer and commercial financial services. It is currently up 5.29% year-to-date. Its current IVR is 51.1, with April IVx at 37.2, May IVx at 33, and its liquidity is rated four out of four on the tastytrade platform.

4. Citigroup (C) - As a global bank, Citigroup offers a range of financial products and services. C is currently up 4.6% year-to-date. Its current IVR is 55.1, with April IVx at 37.6, May IVx at 34.3, and its liquidity is rated four out of four on the tastytrade platform.

5. United Airlines Holdings (UAL) - This company provides air transportation for passengers and cargo. UAL is currently down 20.18% year-to-date. Its IVR is 71.8, with April IVx at 68.9, May IVx at 58.3, and its liquidity is rated three out of four on the tastytrade platform.

6. Alcoa (AA) - Alcoa is involved in the production of bauxite, alumina and aluminum products. AA is down 12.39% year-to-date. Its IVR is 59.6, with April IVx at 54.7, May IVx at 54, and its liquidity is rated three out of four on the tastytrade platform.

7. Taiwan Semiconductor Manufacturing (TSM) - It manufactures semiconductor products for various applications. TSM is down 12.26% year-to-date. Its current IVR is 46.4, with April IVx at 48.1, May IVx at 42.2, and its liquidity is rated four out of four on the tastytrade platform.

8. Netflix (NFLX) - Netflix is an internet entertainment service offering streaming movies and television shows. NFLX is up 8.7% year-to-date. Its IVR is 82, with April IVx at 46.6, May IVx at 43.3, and its liquidity is rated two out of four on the tastytrade platform.

9. Boeing (BA) - Boeing designs, develops and sells airplanes, rotorcraft, rockets, satellites and missiles worldwide. BA is up 0.13% year-to-date. Its IVR is 39.4, with April IVx at 35.9, May IVx at 36.2, and its liquidity is rated four out of four on the tastytrade platform.

10. Royal Caribbean Cruises (RCL) - Royal Caribbean operates a global cruise vacation company. RCL is down 4.67% year-to-date. Its current IVR is 52.7, with April IVx at 42.5, May IVx at 45.7, and its liquidity is rated two out of four on the tastytrade platform.

Ryan Sullivan is an active options and forex trader and programming producer for the tastylive network.

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.