"The Zebra Set UP" // tastyBeats June 22-26

"The Zebra Set UP" // tastyBeats June 22-26

The great thing about options is the flexibility we can get in regards to leverage. Synthetically, we can build options positions that will act like long stock positions while using less buying power. The ZEBRA strategy is an option trade that will get you that near 100 delta position for a fraction of the buying power in comparison to stock, while also holding less max risk.

ZEBRA stands for “Zero Extrinsic Back-Ratio”. The set up consists of two ITM long options with one closer ATM short option, with the goal of selling enough extrinsic value in the short to offset the extrinsic value purchased in the long.

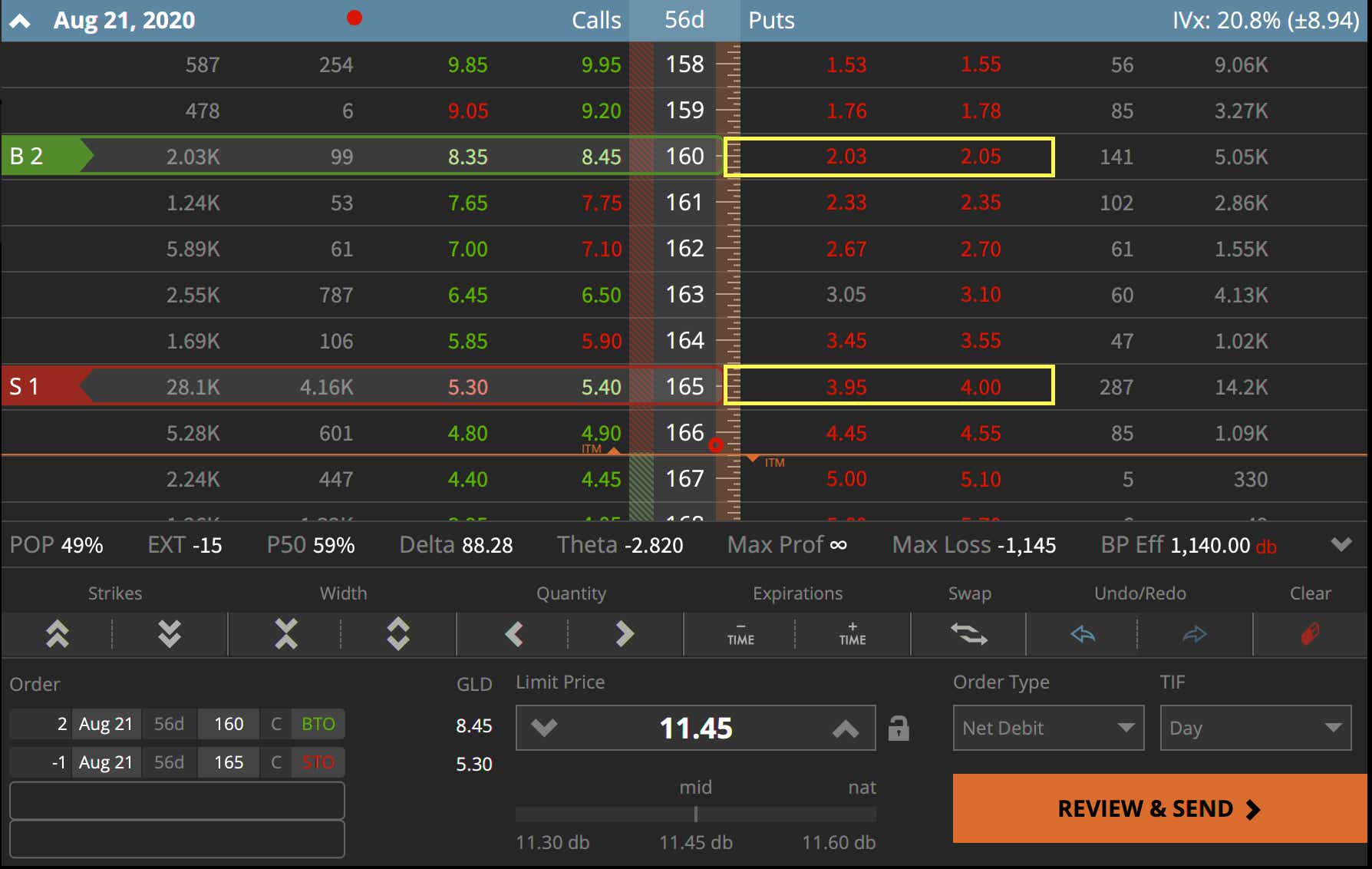

A quick way to gauge extrinsic value of an ITM option is to look at the same strike OTM option value.

Here in GLD, the ITM long options have around $2 in extrinsic value (buying two of them for a total of $4 in extrinsic value). To offset the extrinsic value, we can sell the near ATM option that holds around $4 in extrinsic value. This means the position is all intrinsic value, just like long stock while using 1/8th of the BP!

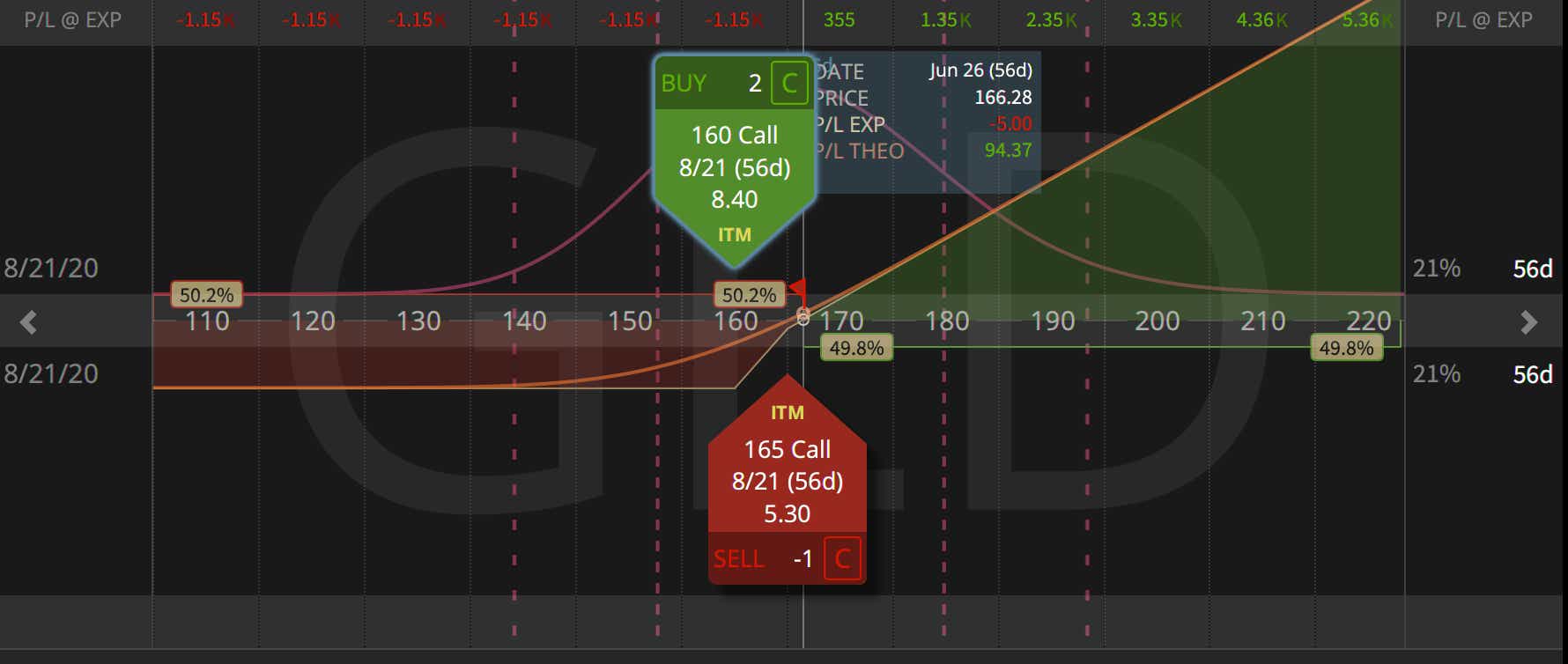

The other plus side to the zerbra strategy is the limited risk in comparison to long stock. The zebra strategy will actually lose delta if the stock goes against your position (here, to the downside). This means that if it continues to drop, the loss will be less and less compared to the long stock position. Here the position has around 88 long delta, which means it will lose $88 in value if the stock goes down $1. With that move the two long options will lose more delta compared to the single short option, which means the net delta will decrease, lets say down to 82. That means your loss actually lessens on the next $1 move down ($82), until it is eventually capped (the amount paid for the spread). This means that in the short term if the position goes against you the loss would be lesser than long stock, while you would have around the same upside exposure as stock (with the delta of the position INCREASING up to 100 as the stock goes up!)

The zebra strategy is a great alternative to long/short stock with nearly all the upside and less of the downside!

Want to talk Zebra’s? Shoot me and email to support@tastylive.com or tweet me @TraderNickyBAT !

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.