The US Dollar Wrecking Ball May Be Back

The US Dollar Wrecking Ball May Be Back

Our forex and macro maven has been calling "King Dollar" right. Is havoc ahead?

- U.S. Treasury yields remain elevated, underpinning the U.S. dollar's strength.

- While the U.S. dollar has its own bona fides at the moment, the story is increasingly becoming about other currencies’ problems.

- Technical turns in the major components of the DXY Index suggest that the U.S. dollar wrecking ball may be back soon.

Market update: dollar index (DXY) up 1.24% month-to-date

The U.S. dollar continues to benefit from the sustained rise in U.S. Treasury yields, plain and simple. The bottoming effort that started to come together in mid-July has gained steam over the past week.

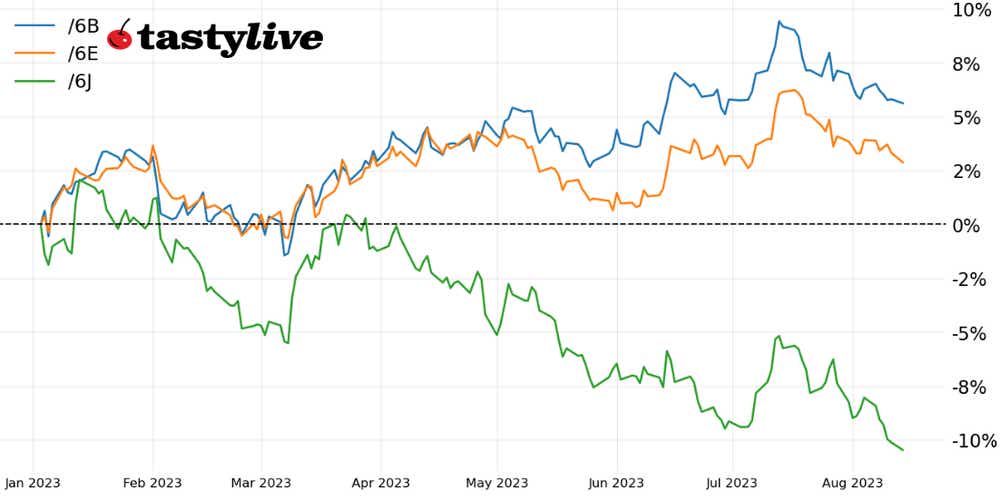

But much of the focus of why the dollar is succeeding is shifting: it’s becoming less about the dollar itself, and more about the problems of other major currencies. The Japanese yen has already hit fresh yearly lows, and both the British pound and the euro have started to break multi-month uptrends.

Outside of the U.S. Dollar Index (DXY) components, it’s not looking good either. The Russian ruble is melting down again thanks to deteriorating current account balance figures. The Chinese yuan is struggling in the face of a sluggish economy and renewed concerns around property developers. The Indian rupee touched an all-time low earlier as the country increasingly faces an accelerating inflation backdrop, undercutting real yields. So much for the BRICS—the grouping of the world economies of Brazil, Russia, India, China and South Africa.

As noted last week, it remains the case that “King Dollar is sitting on the precipice of a more meaningful technical turnaround that could signal additional gains over the coming weeks and months.”

/6B British pound technical analysis: daily chart (August 2022 to August 2023)

A more meaningful technical breakdown may be starting in the British pound (/6B) as the uptrend from the October 2022 and March 2023 swing lows has started to break. As such, it may be appropriate to say that a top has been forming in recent weeks. Momentum has turned increasingly negative, with /6B treating its daily-EMA envelope (5-, 13-, and 21-EMAs) as resistance. The moving average convergence/divergence (MACD) is trending lower through its signal line, and slow stochastics are back in oversold territory. It remains the case that a drop below 1.2600 by the end of August would be a strong confirmation signal that /6B has topped, potentially for the remainder for the year.

/6E euro technical analysis: daily chart (August 2022 to August 2023)

The technical prognosis for Euro FX futures (/6E) is shaping up to be worse than in /6B, as the uptrend from the September 2022 and May 2023 swing lows is breaking today. MACD is trending lower through its signal line, and slow stochastics are holding in oversold territory (as they have for the entirety of August). Like in /6B, the daily EMA envelope has been resistant for the past few weeks. Last week, it was noted that “a move below 1.0900 by the end of the month would offer increased confidence that the Euro has topped, and the U.S. dollar (via DXY, whose largest component is the Euro) has bottomed,” and this remains to be the case.

/6J Japanese yen technical analysis: daily chart (November 2022 to August 2023)

A descending triangle may have been initiated in recent days, suggesting that the Japanese Yen (/6J) is on a path towards more weakness in the near-term. Fresh yearly lows have appeared in three consecutive trading sessions as momentum has become increasingly negative: no moves above the one week moving average; MACD trending lower below its signal line; and slow stochastics in oversold territory. An important caveat: we’re nearing the territory whereby the Japanese Ministry of Finance could very well signal intervention to halt the rapidly falling /6J.

Christopher Vecchio, CFA, tastylive’s head of futures and forex, has been trading for nearly 20 years. He has consulted with multinational firms on FX hedging and lectured at Duke Law School on FX derivatives. Vecchio searches for high-convexity opportunities at the crossroads of macroeconomics and global politics. He hosts Futures Power Hour Monday-Friday and Let Me Explain on Tuesdays, and co-hosts Overtime, Monday-Thursday. @cvecchiofx

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.