The U.S. Dollar Faces No Real Challenge from a BRICS Rival

The U.S. Dollar Faces No Real Challenge from a BRICS Rival

By:Ilya Spivak

Russia and China say the BRICS can displace the U.S. dollar in global trade. They are not even remotely close.

- Russia wants the BRICS to build a rival to the U.S. dollar-based financial system.

- In practice, the liquidity and network effects of the existing order are unrivaled.

- So central is the dollar, that strong U.S. growth can hurt global stock markets.

Russian President Vladimir Putin has sought to frame a summit for the “BRICS+” group of countries taking place in the Russian city of Kazan this week as a challenge to the U.S.-led global financial system. The founding members of “BRICS”—Brazil, Russia, India, China and South Africa—were recently joined by Egypt, Ethiopia, Iran and the United Arab Emirates.

Russia has been largely cut off from the U.S. dollar-based financial system by Western sanctions following its invasion of Ukraine. It is understandably keen to gather allies to create a rival for processing cross-border capital flows that exists beyond Washington’s influence. In this, it has an ally in China, which also wants a non-U.S. alternative.

Both countries have sought to incubate a counter to the dollar-dominated SWIFT (Society for Worldwide Interbank Financial Telecommunication) global payments system. China launched the Cross-Border Interbank Payment System (CIPS) in 2018. Russia has proposed “BRICS Bridge,” a crypto-like digital payments system run by national central banks.

The BRICS do not offer a viable competitor for the U.S. dollar

The BRICS grouping was first coined by former Goldman Sachs analyst Jim O’Neill, who intended nothing more than to describe a group of attractive investment destinations in 2001. It is the countries themselves that have taken the initiative to create a joint forum, despite significant policy divergences and sometimes directly clashing interests.

Writing for Project Syndicate this month, Mr. O’Neill did not mince words about the significance of this week’s summit. Under the headline “The BRICS Still Don’t Matter”, he argued that “each year [the summit] brings further confirmation that the grouping serves no real purpose beyond generating symbolic gestures and lofty rhetoric.”

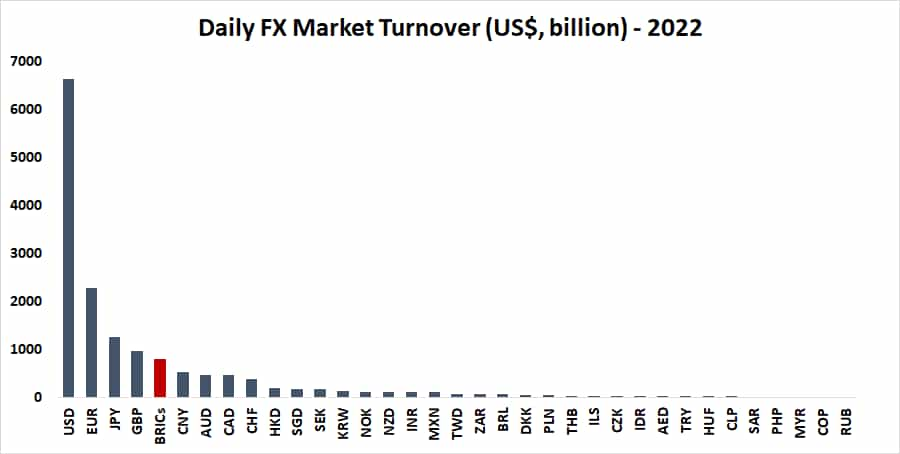

Indeed, it is not difficult to see why it is hard to imagine a significant challenge to the U.S. dollar as the preeminent vehicle for global commerce. The greenback had daily turnover of $6.6 trillion on average in 2022, according to the Bank of International Settlements (BIS). Taken together, the BRICS currencies accounted for just $801 billion.

The U.S. also accounts for a commanding 32% of external global debt compared to the BRICS’ 6.4% and boasts by far the largest capital markets. The combined value of U.S. stock and bond markets is a gargantuan $103.6 trillion. The BRICS add up to $42.1 trillion, of which China alone is $30.5 trillion.

Hot U.S. economy may scorch global growth and stock markets

On balance, this means that the heft of the U.S. dollar system makes for unrivaled liquidity and network effects, so much so that settling a trade between two non-USD currencies can be cheaper to do with the greenback as intermediary versus doing the deal bilaterally. That the U.S. is a top trading partner for many of the BRICS themselves cements the point.

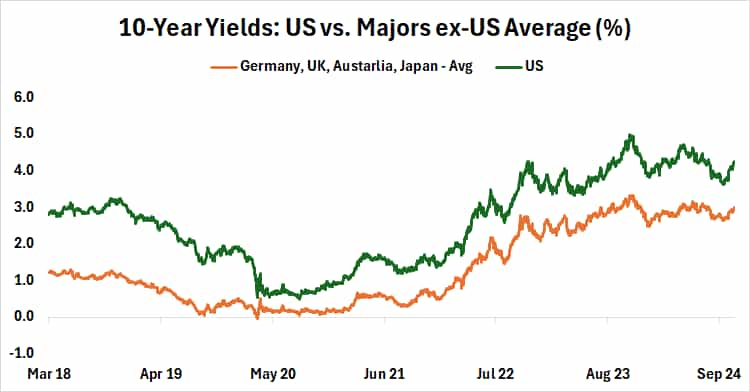

In the near term, this makes for a precarious state of play as the U.S. economy powers forward while the other major engines of global demand—the Eurozone and China —are struggling. Since U.S. demand is mainly pointed at the domestic service sector, this has translated into slowing global performance overall.

The dollar’s centrality has meant that – as this outperformance cuts into Federal Reserve rate cut expectations and boosts U.S. Treasury yields – global borrowing costs have followed suit even as most major central banks try to bring them lower. That is unwelcome at a time when growth is struggling. Stocks might feel the pinch before long.

Ilya Spivak, tastylive head of global macro, has 15 years of experience in trading strategy, and he specializes in identifying thematic moves in currencies, commodities, interest rates and equities. He hosts Macro Money and co-hosts Overtime, Monday-Thursday. @Ilyaspivak

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.