The Lifecycle of a Strangle

The Lifecycle of a Strangle

In the latest installment of The Lifecycle of a Trade, Nick Battista explains the birth, middle age and surmise of a strangle

Looking for an example of the entry, management and exit of a strangle? Then you came to the right place.

Check out the full video here!

For this example, I started with a strangle in Advanced Micro Devices (AMD)—short the 135 put and the 190 call with 51 days until expiration. The trade used about $1,500 in buying power, and I sold the strangle for a $5.09 credit.

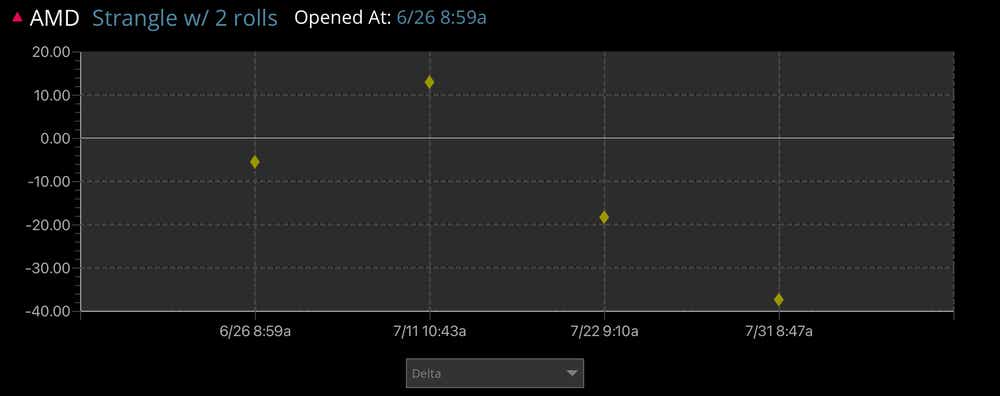

Let’s walk through price, delta and implied volatility (IV) of the underlying throughout the life cycle of the trade, using the Market Snapshots feature in the Order Chains in the tastytrade.com platform.

Opening Position

At the start, the position is relatively flat delta, leaning slightly short delta because of the call skew. The stock had been rangebound between 150-170 for the previous month, and the implied volatility was relatively high at about 40%. I sold roughly the 1 SD (standard deviation) strangle, short the 135/190 strangle.

Rolling up the put

Over the next two weeks, the stock rallied from around 160 to nearly 180, along with an expansion in volatility for 40% to nearly 60%. While the position wasn't yet in the money (ITM), it was significantly underwater with the combination of the price movement and expansion in volatility. The put at 135 had lost significant value, and was no longer "hedging" the upside move because the value had already decayed. At this point it's time to either lean short (via the short call) or reduce some delta exposure/add premium via rolling up the put. I rolled up the put from 135 to 155, picked up roughly 15 long delta and a net credit of $2.20

Rolling down the call

he iconic "whipsaw" is what everyone is so afraid of when rolling the untested side. AMD falls back to $150 from $180—but volatility stays high at roughly 55%. At this point, we've gone from short to long delta in the span of a couple weeks. Again, the decision becomes—do I lean long at $155 or reduce directional exposure/capture some volatility premium? Here we rolled down the call, added around -18 short delta and collected an additional $2.77 in credit.

Closing order

The stock continued lower for another week, at which point you again have to decide whether to lean into it directionally (stay long) or roll down the call further to reduce delta. The stock ended up rallying from the mid 130s back up to 155, which enabled me to exit the position with a profit of $156.

What we learned

This trade encompasses all of the most common fears a trader endures. “What happens if the stock explodes higher!?" "What if I get whipsawed after rolling!?" “How do I hedge the position, or do I just eat the loss!?"

The first key is to stay small—the position was at one point a fairly large marked loss, but by staying small, I was able to hold on and manage the position through time.

Duration is your friend. Time decay and volatility premium will help soften profit and loss (P/L) . It's easy to say "do nothing" when faced with losses.

Don't hindsight-trade. Mechanically manage positions. Roll up puts to reduce short delta, roll down calls to reduce long delta. All these adjustments are under-hedges. They enable us to lean long/short into price action but help reduce the overall need for a directional move.

Read #1 again ... STAY SMALL!

Check out more trades from this series here!

Nick Battista, tastylive director of market intelligence, has a decade of trading experience. He appears Monday-Friday on Options Trading Concepts Live. On Wednesdays, he co-hosts Johnny Trades. @tradernickybat

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.