A Short Yet In-depth Analysis of VIX Trading Above 38%

A Short Yet In-depth Analysis of VIX Trading Above 38%

By:Kai Zeng

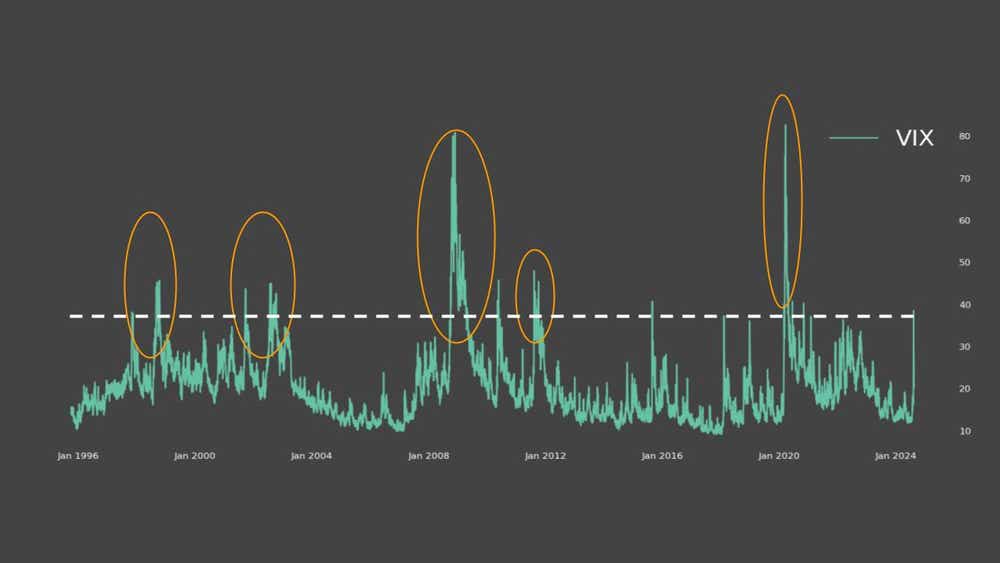

The VIX has traded above that elevated only five times since 1995

On Aug. 5, the S&P 500 (SPX) experienced a surprising decline of 3% in a single day. However, even more notable was the Cboe Volatility Index, or VIX, also known as the "fear index," closing at a high of 38%. That situation raises the question of how often such occurrences happen and their historical significance, particularly when compared to the market correction in 2022.

How rare Is VIX at 38%?

Since 1995, the VIX has traded above 38% only five times. For context, even during the market challenges of 2022—when the S&P 500 declined by 18%—the VIX never reached that level.

.jpg?format=pjpg&auto=webp&quality=50&width=1000&disable=upscale)

Essentially, the VIX above 38% is very rare, happening for only 3.4% of the time since 1995. This unusual rise presents a unique opportunity for selling premiums, assuming this high level of volatility remains.

.jpg?format=pjpg&auto=webp&quality=50&width=1000&disable=upscale)

For example, in 2020, the market experienced a significant crash, driving the VIX to elevated levels, but these peaks were not sustained for long periods. Understanding this pattern is crucial for investors and analysts.

Duration of high VIX

One important aspect to consider is how long the market stays at these elevated levels of volatility. By focusing on when the VIX hits 35%, it becomes apparent that the duration of high volatility has generally shortened over the past 15 years, excluding 2020. Once the VIX hits the 35% mark, the median level during subsequent periods tends to be around 32%, much higher than the long-term average of about 16%.

.jpg?format=pjpg&auto=webp&quality=50&width=1000&disable=upscale)

This suggests high volatility, once triggered, can be persistent, though the durations might be getting shorter over time. For investors, that means being cautious and employing strong risk management strategies.

Takeaways:

- The VIX at 38% is a rare event, occurring only 3.4% of the time since 1995.

- The market can sustain high VIX for extended periods, although these durations have been decreasing in recent years, excluding 2020.

- Investors should approach with caution, using sound risk management strategies to navigate these turbulent times.

Kai Zeng, director of the research team and head of Chinese content at tastylive, has 20 years of experience in markets and derivatives trading. He cohosts several live shows, including From Theory to Practice and Building Blocks. @kai_zeng1

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.