The Bond Market, DOGE and Deflation: What Will Trump Accomplish and When?

The Bond Market, DOGE and Deflation: What Will Trump Accomplish and When?

Cutting the federal budget may prove difficult for a commission with no statutory authority

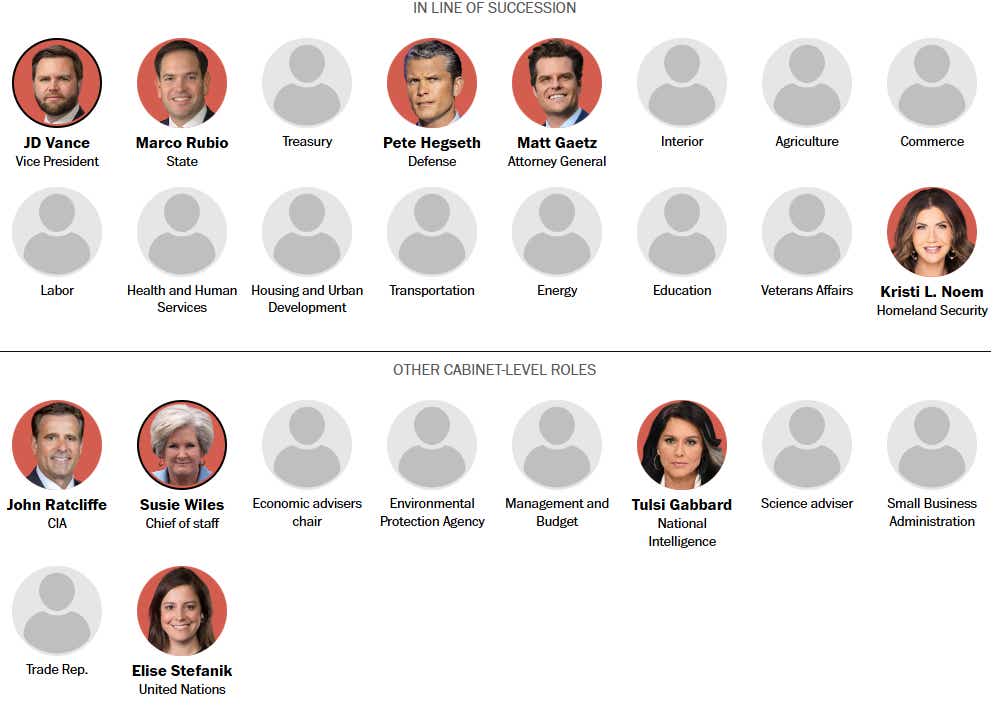

The news from Washington has been intense over the past 48 hours with cabinet appointments and plans for executive orders by President-elect Donald Trump. This is a fluid situation, but let’s consider some implications for the bond market given what we know as of today—Thursday, Nov. 14, 2024.

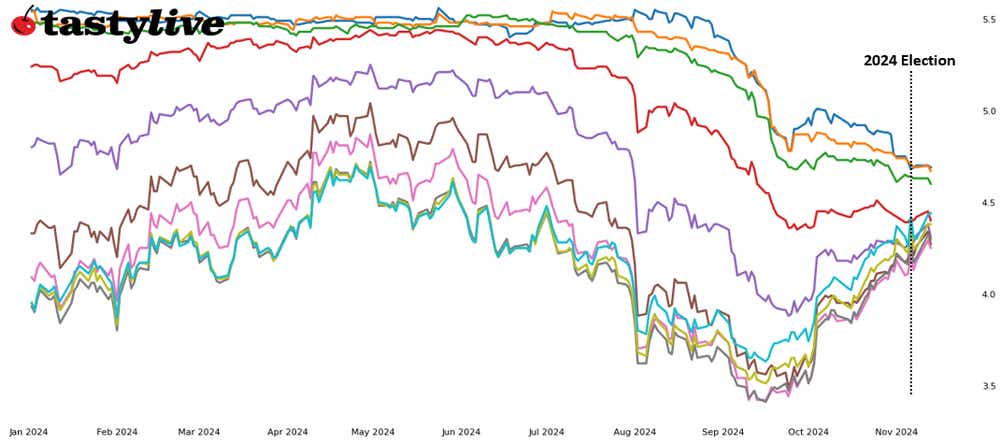

Bonds tell the story

U.S. Treasuries, particularly at the long end of the curve, have been quite the rollercoaster since it became clear Trump would win the 2024 presidential election. With a GOP trifecta, markets started to look past the possibility of sweeping tariffs and instead focus on the prospect of significant spending cuts that might spark a wave of deflation. After all, a Department of Government Efficiency (DOGE), led by Elon Musk and focused on cutting government waste, was promised on the campaign trail.

But President-elect Trump’s announcement that the department would be a deficit reduction commission in the fashion of a blue-ribbon committee (or blue-ribbon commission) may be a signal those deflationary spending cuts aren't coming anytime soon.

A blue-ribbon commission is like hiring a consulting group. As Dylan Ratigan put it on a recent episode of Overtime on the tastylive network, it’s no different than throwing money at McKinsey or a K Street think tank. It's an outside group making recommendations with no statutory authority.

Musk says they're going to finish this more quickly than Trump has proposed. And the timeline the president-elect has mentioned ends July 4, 2026, just in time for America's 250th birthday. So, let's say realistically some of these recommendations come down the pipeline beginning in early 2025 and continue through the middle of 2026. There aren’t many things to cut because this is not a statutory committee—its recommendations need Congressional approval.

Trump and DOGE would be dropping a list of spending cuts in Congress's lap the summer before midterm elections. The incumbent party typically loses about 20 or so seats in the midterms, so do you think Republicans will want to gut spending? Unlikely.

Why this timeline matters

If the spending cuts do come, it probably won’t be in the first budget of Trump’s term. Sifting through the DOGE recommendations will take time, and the changes will require Congressional approval. Meanwhile, Trump is chipping away at the GOP majority in the House by appointing members to his cabinet. The net gain from the 2024 election is shaping up to be just one seat. Speaker of the House Mike Johnson said on camera yesterday he’s “pleaded” with the Trump transition team to stop whittling down the ever-slimmer majority.

Trimming the cost of legislation like the Tax Cuts and Jobs Act (TCJA) will probably be a slam dunk. Republicans will get behind that. But other substantive spending cuts will prove difficult for a commission with no statutory authority. It can make proposals a year and a half out, but the deflation argument predicated on a spending cliff doesn’t have teeth.

This is but one theory that may explain the recent divergence between the short end and the long end of the curve, when viewed in the context of the odds rising for a December 2024 Federal Reserve interest rate cut. Traders are downgrading the likelihood of spending cuts, while the probability of tariffs (inflationary) and mass deportations (inflationary) remain elevated, given their centrality to Trump’s campaign messaging.

The balance of risk shifts from spending cuts

Those last points deserve consideration. If we accept the constraints as the modal outcome given all the information we have thus far, a House of Representatives with a thin majority may have difficulty agreeing on any significant spending cuts up front.

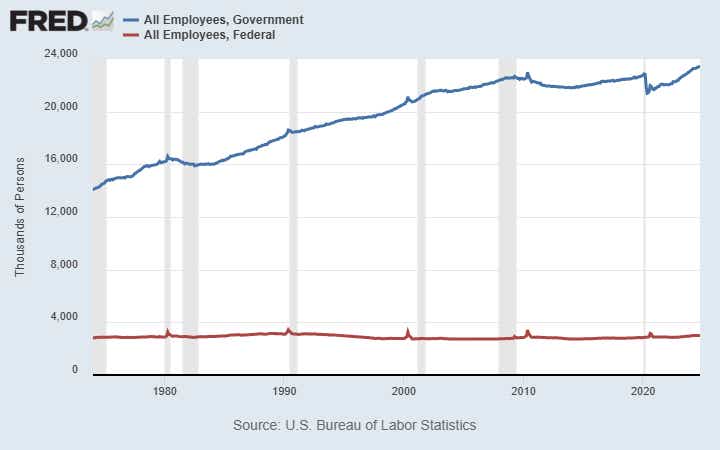

It would likewise mean spending cuts or headcount reductions in the federal budget will initially be accomplished through hiring freezes or by letting people roll off through attrition for retirement and then not hiring replacements. The reality is the majority of federal employees work for the Department of Defense (which neither party touches in terms of spending cuts), and that the number of federal employees is but a small portion of all the government employees nationwide.

If so, that leaves executive authority and tariffs as the primary levers of economic policy. It's a way to circumvent the gridlock and compensate for whatever slim majority there could be in the House. This would occur in the context of tax cuts and the possibility of mass deportations.

If Trump delivers on his campaign promises, it could cause inflation in the short term because a lot of undocumented workers are in lower-wage industries doing jobs many Americans don't want. It's probably going to mean higher wages for the people who fill those gaps in the short term.

So, we arrive at the conclusion that the balance of risks to the bond market suddenly looks inflationary, at least as we wind down 2024 and peer into 2025.

Then again, this is all a fluid situation. Many more cabinet appointments are yet to be made, and we’re all re-learning Trumpspeak and how it affects s markets. So, the likely path forward for the bond market, teetering between deflationary and inflationary impulses, could change quickly enough to render all of this null and void!).

Christopher Vecchio, CFA, tastylive’s head of futures and forex, has been trading for nearly 20 years. He has consulted with multinational firms on FX hedging and lectured at Duke Law School on FX derivatives. Vecchio searches for high-convexity opportunities at the crossroads of macroeconomics and global politics. He hosts Futures Power Hour Monday-Friday and Let Me Explain on Tuesdays, and co-hosts Overtime, Monday-Thursday. @cvecchiofx

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.