When You Test Different Duration Volatilities, You Get Some Surprising Results

When You Test Different Duration Volatilities, You Get Some Surprising Results

By:Kai Zeng

A look at volatility, duration and management

While many traders concentrate on profitability or return on capital, they often overlook a crucial factor—profit and loss (P/L) volatility. The latter refers to the fluctuation in a P/L series over time, acting as a measure of the dispersion of returns for a given security, strategy or position. Understanding the volatility of an option strategy can guide traders in making informed decisions about when to enter or exit a position and can shape our risk management approach.

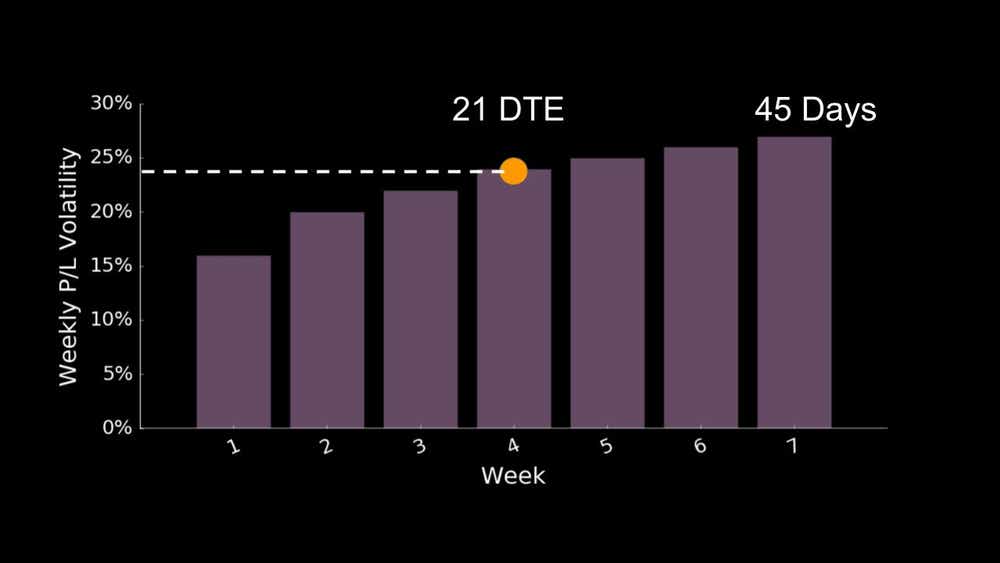

To comprehend this concept, let's examine how days to expiration (DTE) and management strategy might influence a position's volatility. For instance, consider our standard 45 DTE options. We tested 16 delta SPY strangles, represented by the SPDR S&P 500 ETF Trust (SPY), and charted the average weekly volatility.

Analyzing the patterns of a decade

An analysis of the average weekly volatility of 16 delta SPY strangles over a decade revealed that volatility escalates as we near expiration. This pattern should not surprise anyone familiar with basic options Greeks. Gamma, one of the Greeks in options, is the primary reason for the surge in volatility toward expiration. This insight suggests traders should consider closing their positions early to mitigate gamma risk and reduce volatility.

We also observed that exiting our positions 21 DTE before expiration can reduce our volatility. Although this strategy slightly decreases the daily return, it offers better protection to traders seeking improved risk control. This approach has proven a great choice for overall performance.

More days to expiration

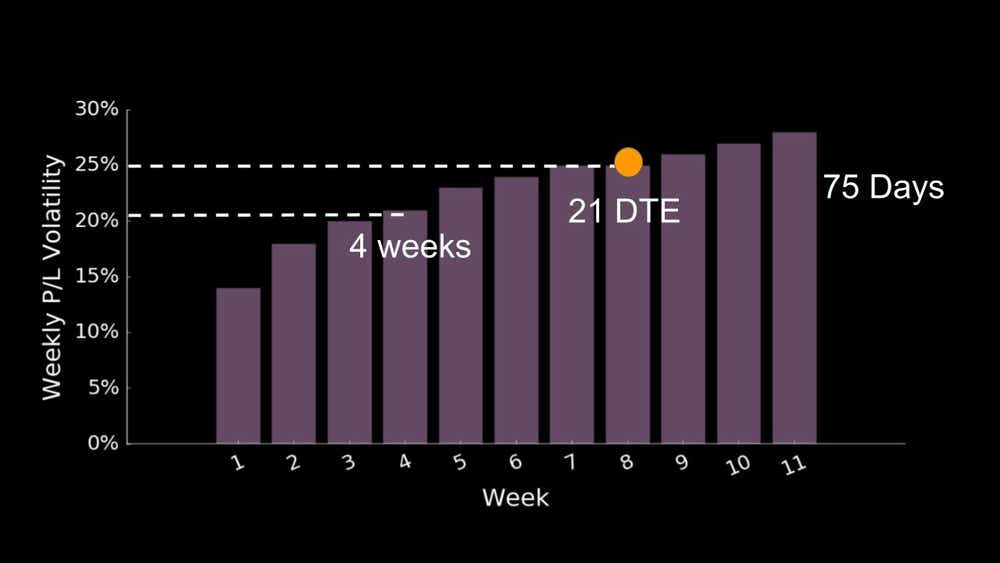

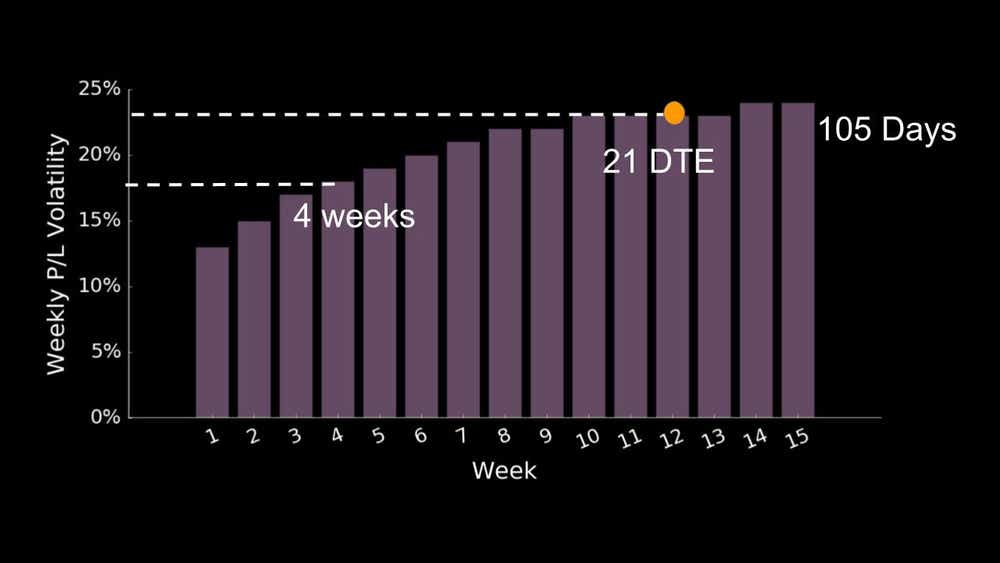

The study also evaluated longer duration trades, specifically 75 and 105 days until expiration.

For 75 DTE, we identified a similar pattern where volatility increases as expiration approaches. Exiting the position at the same point, 21 DTE, produces almost identical weekly volatility as the 45 DTE position.

In the case of even longer duration 105 DTE options, the same conclusions were drawn. Regardless of the expiration cycle, managing at 21 DTE yields nearly identical weekly volatility, which is lower than holding to expiration. This finding suggests traders need not hold options longer than necessary.

Lastly, comparing the daily return of these three strategies, we found 45 days was the optimal trading duration. The 45-day option yielded about 10% higher average daily returns compared to the longer options with the same volatility if managed at 21 DTE.

In conclusion, understanding and accurately predicting volatility is a critical aspect of successful trading. Regardless of the chosen duration, volatility increases as we approach expiration. Managing the trade at 21 days to expiration provides consistent volatility across different expiration cycles. The 45-day to expiration option, when managed at 21 days, has been found to improve performance and organization for traders. This strategy strikes a balance between risk and return, making it an attractive option for traders.

Kai Zeng, director of the research team and head of Chinese content at tastylive, has 20 years of experience in markets and derivatives trading. He cohosts several live shows, including From Theory to Practice and Building Blocks. @kai_zeng1

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.