Tesla Earnings Preview: Will the Automaker Snap its Losing Streak?

Tesla Earnings Preview: Will the Automaker Snap its Losing Streak?

By:Mike Butler

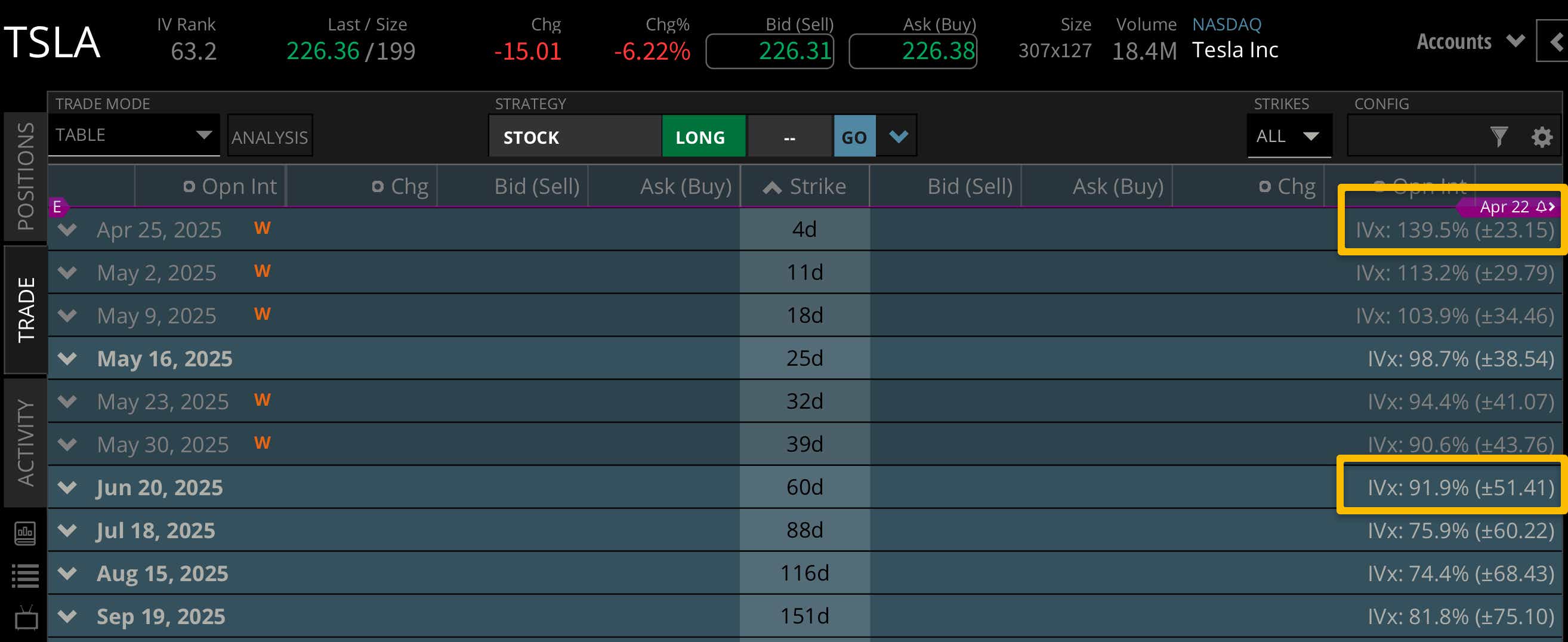

The week ahead accounts for almost 50% of the stock’s implied range through the next 60 days—a big chunk

- Tesla is set to report quarterly earnings after the market closes tomorrow.

- The company is expected to report earnings per share of $0.45 on $21.85 billion in revenue.

- It has missed at least one of the earnings metrics in three of the last four earnings calls.

- Elon Musk's departure from DOGE, and tariff implications for Tesla will be focal points of this earnings call.

Tesla (TSLA), one of the nation’s most volatile companies, is set to report earnings after the market closes closes tomorrow. It’s one of the first big-name stocks to kick off the earnings season, and it has an implied stock price move of more than 10% for the week. There’s plenty of implied volatility around its earnings on a regular basis, but this time feels different with so many polarizing topics at the forefront of the announcement.

Investors want to know when Elon Musk will leave his government role and return to a focus on Tesla. The impact of tariffs is a big question for the automaker, but its leadership shouldn’t feel alone—that's likely going to be the topic for all of the earnings conference calls over the next few weeks.

All said, Tesla has had a very rocky earnings history over the past four quarters, missing earnings-per-share (EPS) or revenue estimates three times. It’s expected to report EPS of $0.45 on $21.85 billion in revenue tomorrow.

TSLA stock has had a volatile 2025, opening the year at $390.10 after a roaring bull rally following the election of Donald Trump. Many investors saw the outcome as a bullish sign for the stock. After reaching a high of $488.54, the stock tumbled to the current price of $225 per share.

In the last earnings call press release, Tesla executives offered commentary on 2024 and an outlook for 2025:

"Q4 was a record quarter for both vehicle deliveries and energy storage deployments. We expect Model Y to once again be the best-selling vehicle, of any kind, globally for the full year 2024, and we have made it even better, with the New Model Y now launched in all markets. In 2024, we made significant investments in infrastructure that will spur the next wave of growth for the company, including vehicle manufacturing capabilities for new models, AI training compute and energy storage manufacturing capacity."

The optimism didn’t end there. The release went on to say that “2025 will be a seminal year in Tesla’s history as FSD (supervised) continues to rapidly improve with the aim of ultimately exceeding human levels of safety. This will eventually unlock an unsupervised FSD option for our customers and the Robotaxi business, which we expect to begin launching later this year in parts of the U.S. We also continue to work on launching FSD (supervised) in Europe and China in 2025."

But times have changed since these releases were issued. I expect nothing short of volatility in the stock price this week for Tesla's earnings call, and I hope to hear more clarity on the talking points outlined above.

For this week, TSLA stock is projected to have a +/- $23.15 expected stock price range. This is just over 10% of the notional value of the stock price that hovers around $225, which puts its earnings on the map for one of the highest expected moves so far this earnings season.

Looking further, we can see a +/- $51.41 expected stock price range for the June options expiration. This means the week ahead accounts for almost 50% of the implied range for the stock projected through the next 60 days. This is a big chunk, and highlights the true implied volatility of the week ahead for Tesla after the earnings call.

Bullish on Tesla stock for earnings

If you're bullish on TSLA stock for earnings, you want to see some strong numbers from the company with an EPS and revenue beat—something it has not achieved over the past four earnings calls. If traders can hear positive sentiment and a more concrete plan for Musk to return to focus on Tesla, we could see the stock price rise after the earnings call if there are no tariff implications that are too alarming.

Bearish on Tesla stock for earnings

If you're bearish on TSLA stock for earnings, you're looking for continued weakness in sales performance for the company. If that's paired with a questionable conference call and cloudy tariff implications, we could see investors continue to exit TSLA stock and the share price could tumble after the market closes Tuesday.

Join us tomorrow on Options Trading Concepts Live at 11 a.m. CDT for an in-depth look at options strategies ahead of the earnings call for Tesla.

Mike Butler, tastylive director of market intelligence, has been in the markets and trading for a decade. He appears on Options Trading Concepts Live, airing Monday-Friday. @tradermikeyb

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.