Tesla Chargers Are Taking Over the EV Space

Tesla Chargers Are Taking Over the EV Space

By:Mike Butler

Tesla charging stations are set to become the ubiquitous industry standard.

- Drivers can soon use Tesla chargers to power up their GM and Ford electric vehicles.

- Strategic charging locations and the sheer quantity of stations may have led GM & Ford to jump on board.

- TSLA stock has more than doubled since the start of 2023.

In a shocking turn of events, General Motors (GM) and Ford (F) seem to have bent the knee to the charging capabilities and locations that Tesla (TSLA) has scattered across the United States. This now gives Tesla even more of a stranglehold on the EV market, and the stock market does not disagree. TSLA stock is up to $256 as of June 28, significantly higher than the 2023 open of $118.47.

TSLA call skew—more room for the bulls?

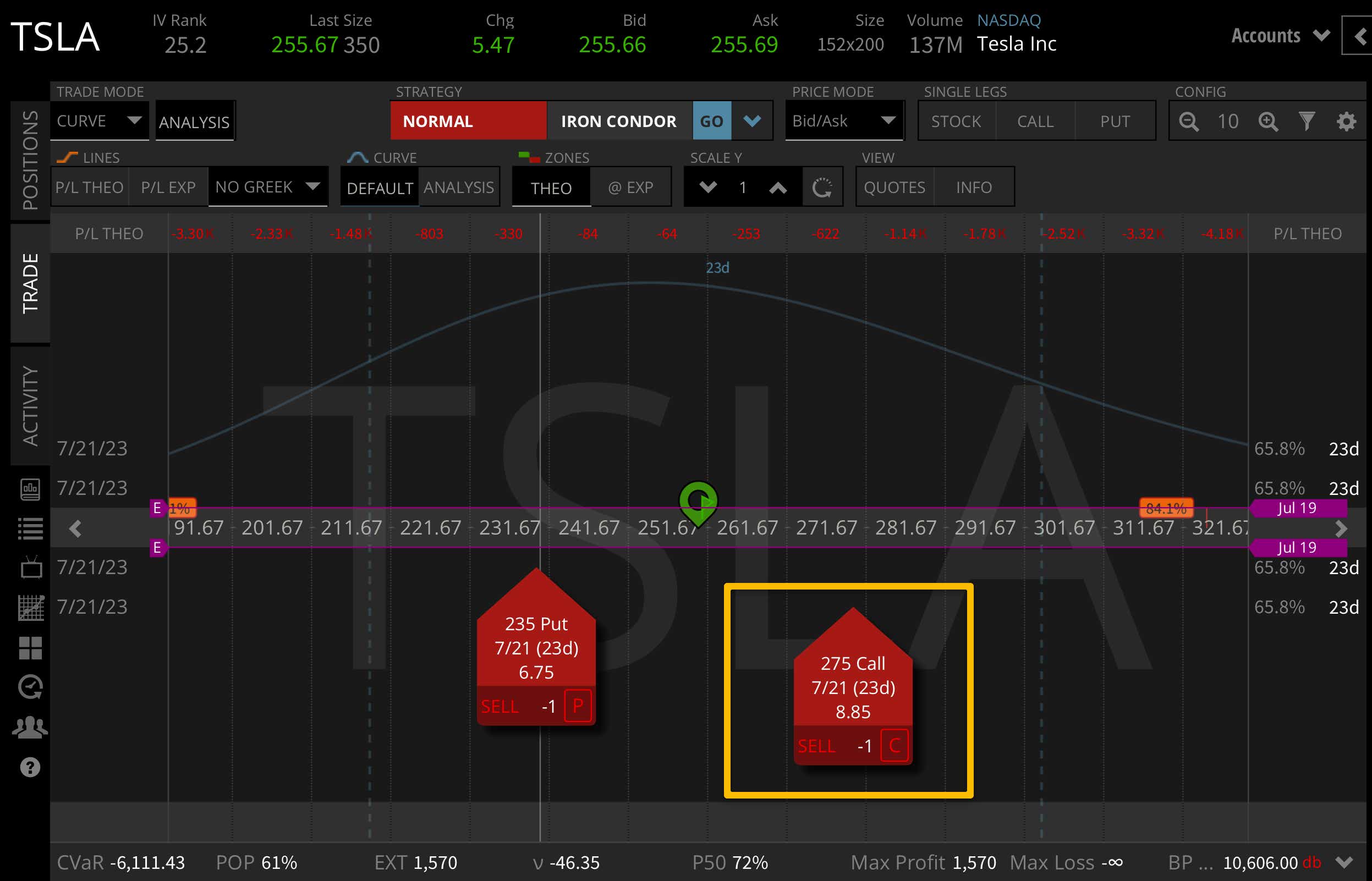

A lot of analysts are calling for the end of the recent TSLA rally, even after good news has come out around the stock. Many point to internal issues Tesla is battling, but there is still significant call skew in the TSLA options market. That means the market is pricing out-of-the-money (OTM) calls higher than equidistant OTM puts.

This translates to a bullish market perception of a high-velocity move, but it does not necessarily mean the stock is going to move to the upside. Either way, traders can use this pricing difference to strategize as they see fit.

In the image below, we can see that in the July options cycle, with TSLA trading at $255, the $275 call option 20-points OTM is trading for $8.85, significantly higher than the put price of $6.75 20-points OTM to the downside.

Tesla wins the charging battle, but GM & F stock prices are surging

Tesla certainly benefits from the charging deal, but it gives rise to an interesting point:

Now that Ford & GM electric vehicles will be able to charge at MANY more stations across the country, that are located in safe and convenient places, will this increase demand for non-Tesla EVs?

Since the beginning of June, GM has rallied $6, moving from $32 to $38 per share, almost a 20% increase:

Since the beginning of June, F has rallied $2.00, increasing from $12 to $14 per share, almost a 20% increase:

Any way you slice it, GM and Ford adopting the Tesla charging technology is positive news for the EV space in the United States—more accessibility means more demand, and 2024 could be huge for EV production.

Tesla stock has a current expected move of +- $56 from the current stock price of $256 through the December options expiration cycle. Tesla has the highest implied volatility of these three stocks discussed.

Ford stock has a current expected move of +- $2.20 from the current stock price of $14.75 through the December options expiration cycle.

General Motors stock has a current expected move of +- $6.35 from the current stock price of $38 through the December options expiration cycle.

Mike Butler, tastylive director of market intelligence, has been in the markets and trading for a decade. He appears on Options Trading Concepts Live, airing Monday-Friday. @tradermikeyb

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.